Google is launching a major redesign of its Google Pay app on both Android and iOS today. Like similar phone-based contactless payment services, Google Pay — or Android Pay as it was known then — started out as a basic replacement for your credit card. Over time, the company added a few more features on top of that but the overall focus never really changed. After about five years in the market, Google Pay now has about 150 million users in 30 countries. With today’s update and redesign, Google is keeping all the core features intact but also taking the service in a new direction with a strong emphasis on helping you manage your personal finances (and maybe get a deal here and there as well).

Google is also partnering with 11 banks to launch a new kind of bank account in 2021. Called Plex, these mobile-first bank accounts will have no monthly fees, overdraft charges or minimum balances. The banks will own the accounts but the Google Pay app will be the main conduit for managing these accounts. The launch partners for this are Citi and Stanford Federal Credit Union.

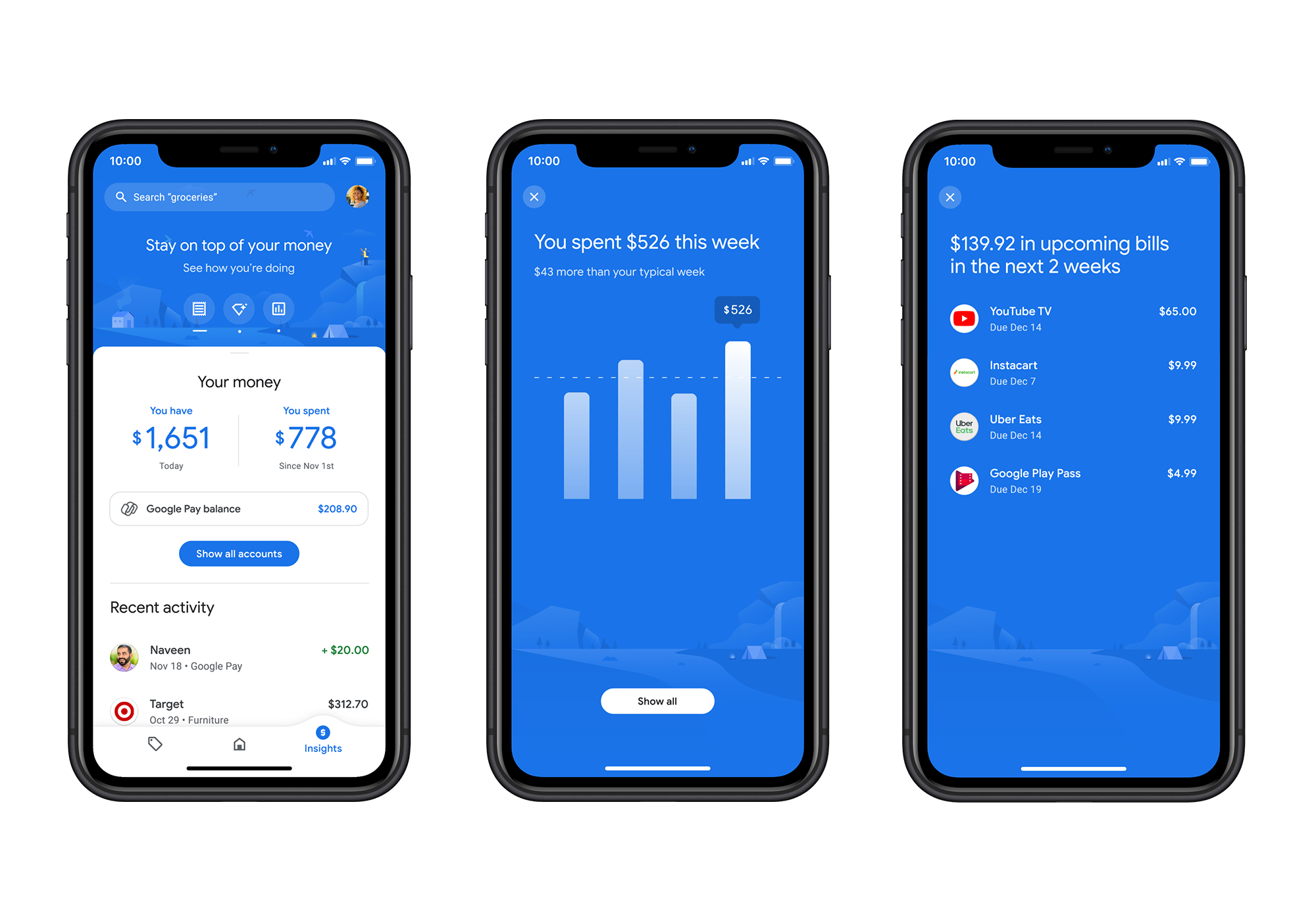

“What we’re doing in this new Google Pay app, think of it is combining three things into one,” Google director of product management Josh Woodward said as he walked me through a demo of the new app. “The three things are three tabs in the app. One is the ability to pay friends and businesses really fast. The second is to explore offers and rewards, so you can save money at shops. And the third is getting insights about your spending so you can stay on top of your money.”

Paying friends and businesses was obviously always at the core of Google Pay — but the emphasis here has shifted a bit. “You’ll notice that everything in the product is built around your relationships,” Caesar Sengupta, Google’s lead for Payments and Next Billion Users, told me. “It’s not about long lists of transactions or weird numbers. All your engagements pivot around people, groups, and businesses.”

It’s maybe no surprise then that the feature that’s now front and center in the app is P2P payments. You can also still pay and request money through the app as usual, but as part of this overhaul, Google is now making it easier to split restaurant bills with friends, for example, or your rent and utilities with your roommates — and to see who already paid and who is still delinquent. Woodward tells me that Google built this feature after its user research showed that splitting bills remains a major pain point for its users.

In this same view, you can also find a list of companies you have recently transacted with — either by using the Google Pay tap-and-pay feature or because you’ve linked your credit card or bank account with the service. From there, you can see all of your recent transactions with those companies.

Maybe the most important new feature Google is enabling with this update is indeed the ability to connect your bank accounts and credit cards to Google Pay so that it can pull in information about your spending. It’s basically Mint-light inside the Google Pay app. This is what enables the company to offer a lot of the other new features in the app. Google says it is working with “a few different aggregators” to enable this feature, though it didn’t go into details about who its partners are. It’s worth stressing that this, like all of the new features here, is off by default and opt-in.

The basic idea here is similar to that of other personal finance aggregators. At its most basic, it lets you see how much money you spent and how much you still have. But Google is also using its smarts to show you some interesting insights into your spending habits. On Monday, it’ll show you how much you spent on the weekend, for example.

“Think of these almost as like stories in a way,” Woodward said. “You can swipe through them so you can see your large transactions. You can see how much you spent this week compared to a typical week. You can look at how much money you’ve sent to friends and which friends and where you’ve spent money in the month of November, for example.”

This also then enables you to easily search for a given transaction using Google’s search capabilities. Since this is Google, that search should work pretty well and in a demo, the team showed me how a search for ‘Turkish’ brought up a transaction at a kebab restaurant, for example, even though it didn’t have ‘Turkish’ in its name. If you regularly take photos of your receipts, you can also now search through these from Google Pay and drill down to specific things you bought — as well as receipts and bills you receive in your Gmail inbox.

Also new inside of Google Pay is the ability to see and virtually clip coupons that are then linked to your credit card, so you don’t need to do anything else beyond using that linked credit card to get extra cashback on a given transaction, for example. If you opt in, these offers can also be personalized.

The team also worked with the Google Lens team to now let you scan products and QR codes to look for potential discounts.

As for the core payments function, Google is also enabling a new capability that will let you use contactless payments at 30,000 gas stations now (often with a discount). The partners for this are Shell, ExxonMobil, Phillips 66, 76 and Conoco.

In addition, you’ll also soon be able to pay for parking in over 400 cities inside the app. Not every city is Portland, after all, and has a Parking Kitty. The first cities to get this feature are Austin, Boston, Minneapolis, and Washington, D.C., with others to follow soon.

It’s one thing to let Google handle your credit card transaction but it’s another to give it all of this — often highly personal — data. As the team emphasized throughout my conversation with them, Google Pay will not sell your data to third parties or even the rest of Google for ad targeting, for example. All of the personalized features are also off by default and the team is doing something new here by letting you turn them on for a three-month trial period. After those three months, you can then decide to keep them on or off.

In the end, whether you want to use the optional features and have Google store all of this data is probably a personal choice and not everybody will be comfortable with it. The rest of the core Google Pay features aren’t changing, after all, so you can still make your NFC payments at the supermarket with your phone just like before.