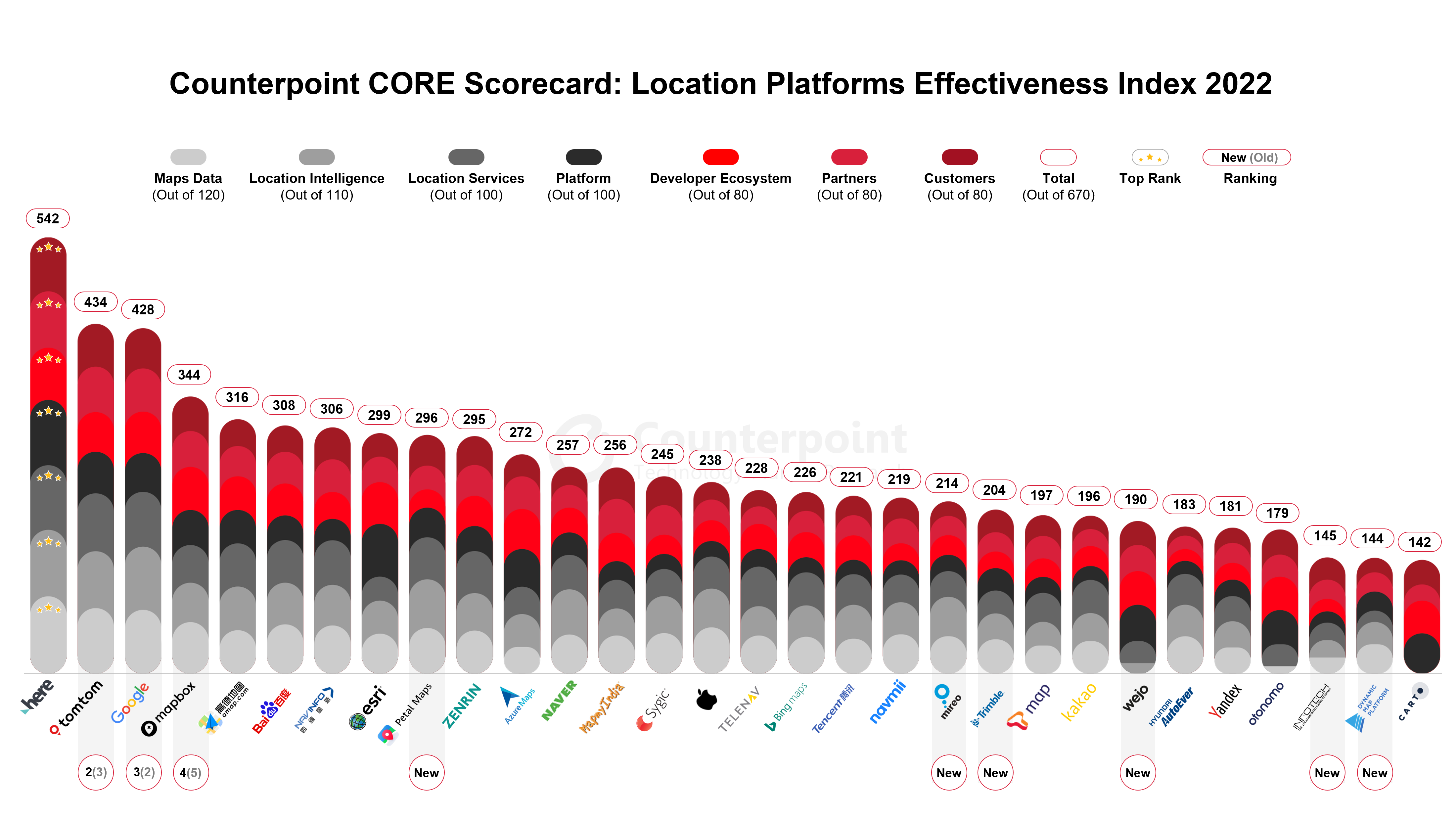

- HERE took an unassailable lead across major criteria such as Location Intelligence, Location Services and Platform by a wide margin.

- TomTom and Mapbox moved up the rankings with a more holistic platform play across consumer, enterprise and auto verticals when compared to Google.

- 2022 saw the entry and expansion of newer players such as Huawei Petal Maps, MIREO, Carto and Otonomo.

- Regional champions such as Navinfo, Naver, Zenrin, Yandex and MapmyIndia continued to do well in their home markets, besides striking partnerships to expand abroad.

2022 was a pivotal year for the “mobility” ecosystem, especially location platforms. These platforms continued to build robust, meaningful capabilities while striking key partnerships within the ecosystem to digitally transform different applications, from smart automotive and data-driven IoT/enterprise to consumer-centric location experiences.

The power of location as a context blended with the continuous stream of telemetry data and visualized to derive insights or autonomous capabilities has become the new battleground transforming mapping and location platforms into “data platforms”.

As a result, these location platforms are becoming modular, offering rich data, services via APIs, co-creation services, analytics, and visualization tools to empower the developers to build powerful location-centric experiences. However, choosing the right platform is challenging for enterprises and developers. It warrants a thorough evaluation and understanding of the vendor’s capabilities as well as success of these platforms.

To help better understand the key location platforms’ capabilities and market trends, Counterpoint has released its latest edition of the Location Platform Effectiveness Scorecard report, which analyzes 30+ leading mapping and location platform vendors using our proprietary CORE (COmpetitive Ranking Evaluation) framework. This comprehensive and detailed evaluation is based on 65+ key capabilities spanning seven categories – maps data, location intelligence, location services, data platform, developer ecosystem, partners, and customer rolodex growth since our last update.

2022 location and mapping platform CORE scorecard analysis

HERE, the “Switzerland of Location Platforms” continues to lead the location platform rankings for the sixth year in a row. In the last 12 months, HERE continued to enhance its industry-leading platform with newer differentiated capabilities, partnerships (like aws) and customer wins (Vinfast, Volta Trucks, Smart) targeting advanced applications. Some examples of Here’s products and services include ADAS/ISA Maps, EV, Truck Routing, Asset Tracking, Last Mile and Workspace low-code map creation tool.

Counterpoint Research Vice President Neil Shah added, “HERE leads the global location platform rankings in terms of comprehensiveness, completeness, capabilities and customer success. HERE has leapfrogged competition in multiple aspects, from providing accurate location data and services content via its platform to helping the companies transform themselves digitally with its consulting, implementation and support services.”

“HERE continued to widen the gap with rivals, leading across most of our evaluation categories. During the year, we saw broader diversification of HERE’s portfolio across geographies, verticals and applications. With its advanced mapping, navigation content and highly scalable and automated location platform, HERE remains the number one choice when it comes to automotive, logistics and enterprise verticals. HERE’s location platform is nearing an inflection point looking at its strong pipeline of licensing, monetization, and co-creation of IP opportunities across the ecosystem.”

TomTom surpassed Google to take the second rank for the first time in Counterpoint’s Location Platform CORE evaluation rankings. 2022 was quite an eventful year for the Dutch map maker. The company rebranded itself with a new logo and announced the “TomTom maps platform”, which includes new maps, and mapping platform and ecosystem.

Commenting on TomTom’s growth this year, Research Analyst Mohit Sharma said, “The new transformed TomTom maps platform, developer experience and newer capabilities have helped the vendor gain some mind share and market share. TomTom has taken a modular approach for its new platform, focusing on data and services across the automotive, enterprise and consumer applications while striking new partnerships and customer wins in 2022. This has helped TomTom lift its overall evaluation and surpass Google.”

For example, TomTom’s entry into the digital cockpit segment with IndiGo has seen traction in striking partnerships with developers such as Spotify, Access, Cinemo, Amazon Alexa and Tier-1 suppliers like HARMAN and Bosch. Another important win is TomTom joining MIH Consortium with Foxconn to strengthen its presence in next-generation smart mobility vehicles. In terms of platform capabilities, TomTom expanded its automated driving portfolio and coverage with some customer wins, such as Hyundai Motor Group, Fisker and other automakers for its L2+ driving maps. In the enterprise segment, it has managed a few significant customer wins across fleet, logistics, last-mile and ride-hailing companies. TomTom has also moved to strengthen its partnership with top tech companies such as Amazon, Meta and Microsoft by co-founding “Overture maps”, which should help the vendor gain some mind share and scale.

Google was the third-ranked location and mapping platform provider globally, having been surpassed by TomTom this year for the first time. Google continues to benefit from strong coverage in the consumer space thanks to Android devices helping the vendor score well on data scale, depth, freshness, coverage and usage. Traction in the automotive space via Android Auto has also helped Google maintain some presence in the automotive vertical against bigger and more successful competitors such as HERE and TomTom.

Commenting on Google’s evaluation, Research Director Jeff Fieldhack said, “Google continues to focus on B2C (smart devices) and B2B2C applications (retail, logistics and O2O services) for the Google Maps platform from the perspective of capabilities and overall Google Cloud strategy. Location-based services from the search, discovery and visualization perspective for its Android users have been the sweet spot for the Google Maps platform. The adoption and scale across transport and logistics have been strong, especially for consumer-facing enterprises, delivering more than 10 billion geocodes monthly and 800 million routes daily.

However, the Google Maps platform slipped in our rankings due to its lack of vision, focus and portfolio capabilities, and alignment with other high-value automotive and enterprise–grade opportunities. Its advertising-centric business model is one of the reasons for its elusive position in these verticals to become an all-round location platform.”

Mr. Sharma, added” Mapbox jumped to the fourth position in our rankings due to its focus on the developer community, visualization capabilities like 3D Globe Maps and announcement of new features and capabilities like new core style maps and analytics tool “co-pilot”. Over the past years, Mapbox has pivoted itself to capture the automotive and logistics segment and strengthened its presence by introducing products and services like ISA Maps, EV routing and Mapbox fleet. In the process, it managed to get a few new customers like Toyota and FedEx.”

In terms of evaluation for the top four platforms:

- HERE led in more than 40 capabilities including maps data depth, freshness, ADAS (ISA) maps, HD maps, navigation, routing, EV services, tracking and positioning, developer support, platform privacy, security and more.

- TomTom led in navigation, offline maps coverage, traffic, infotainment and other areas.

- Google led in overall maps data reach, coverage, depth, POIs, AR, indoor maps and other areas.

- Mapbox led in developer support, visualization capabilities and other areas.

With the increase in EV penetration and high demand for automated driving features in many markets, like China, Japan, South Korea and India, local map players like Amap, Navinfo, Naver, Zenrin and MapmyIndia are doubling down on capabilities, partnerships and customer wins. Other opportunities include transport and logistics, fleet optimization, on-demand services and enterprise verticals. New entrants such as Huawei Petal Maps are looking to make a mark in the consumer space as an alternative to Google Maps.

Data platforms such as Wejo, Carto and Otonomo are continuing their run-up, getting traction from some good customers and partners, and intensifying the competition. However, the absence of a full stack of first-party data – maps and location services like the top three – makes them not so unique and easily replicable. Where they score is in their ability to act as a competitive marketplace to exchange, integrate and analyze the location data.