By Naveen Joshi – Founder and CEO of Allerin

Works in Big Data, IoT , AI and Blockchain

• Due to its association with ledgering and transactions, Blockchain has been viewed as an obvious replacement for existing payment systems. However, immediate use of Blockchain in bulk payment system,s despite Blockchain’s current immaturity, may prove to be risky.

Blockchain, which is inherently a ledgering system, is being considered to form the basis of all future transactional systems. This is especially true for the bulk payment systems, such as the Automated Clearing House(ACH) system in the US and the inter-bank RTGS networks. However, using blockchain in bulk payment systems as a replacement for the existing technology may not be the best decision. This is because several issues remain to be resolved, which will happen only as the technology matures. But until then, blockchain applications should be limited to areas where long-term risks are minimal and short-term benefits are easily achievable.

Why is using Blockchain in bulk payment systems risky…?

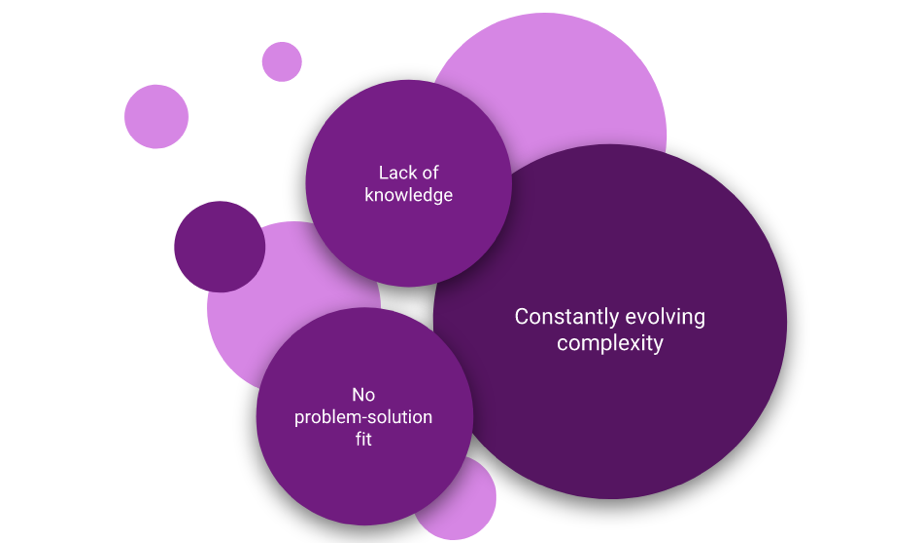

Blockchain has been around for only about a decade now, and hadn’t been considered for non-cryptocurrency applications until around 2014. This means that the technology has not achieved the level of maturity required for stable implementation. This immaturity implies that many of blockchain’s inherent issues, vulnerabilities, and capabilities are still obscure, and are continually evolving.

The current dynamic state of blockchain also means that there is a shortage of experts with the technical know-how on effective implementation, making the process of adopting this technology fraught with uncertainties. Given this, if blockchain is used as an immediate replacement for the existing regulated and widely connected bulk payment systems, then the potential damage caused by failure could be massive and could impact economies instead of individual businesses.

Investing in a blockchain-inspired overhaul of stable, fairly new transaction networks that are already very efficient would not justify the cost and the effort, especially if those existing systems have been recently installed. Due to lack of blockchain knowledge and the hype surrounding it, most organizations use the technology without due diligence.

What can be done?

Since the scope of impact for a failure in a blockchain network in bulk payment systems is huge, such applications should be avoided for at least the next couple of yeras, according to a Gartner research. Instead, the application of blockchain should focus on non-payment areas where the risks are not as significant, but the benefits are easily visible. In such cases, blockchain should mainly be used to record transactions, and not necessarily to carry out transactions, as in a bulk payment system For instace, blockchain can be used to maintain records of births and deaths, patents, and real estate ownership. Such an application is exemplified by Sony’s blockchain-based digital rights management(DRM) system. These applications should be looked upon as proofs-of-concept for eventual adoption of blockchain in bulk payment systems. Once cases of successful blockchain application become increasingly common, signifying the maturity of the technology, application in bulk payments should be seriously considered.

The potential impact of blockchain technology in making payments convenient, transparent, and faster is undeniable. However, the initial application of blockchain should focus on improving non-payment areas that involve a manageable amount of risk. With continuous innovation and experimentation, application of blockchain in bulk payment systems can be eased into practice.