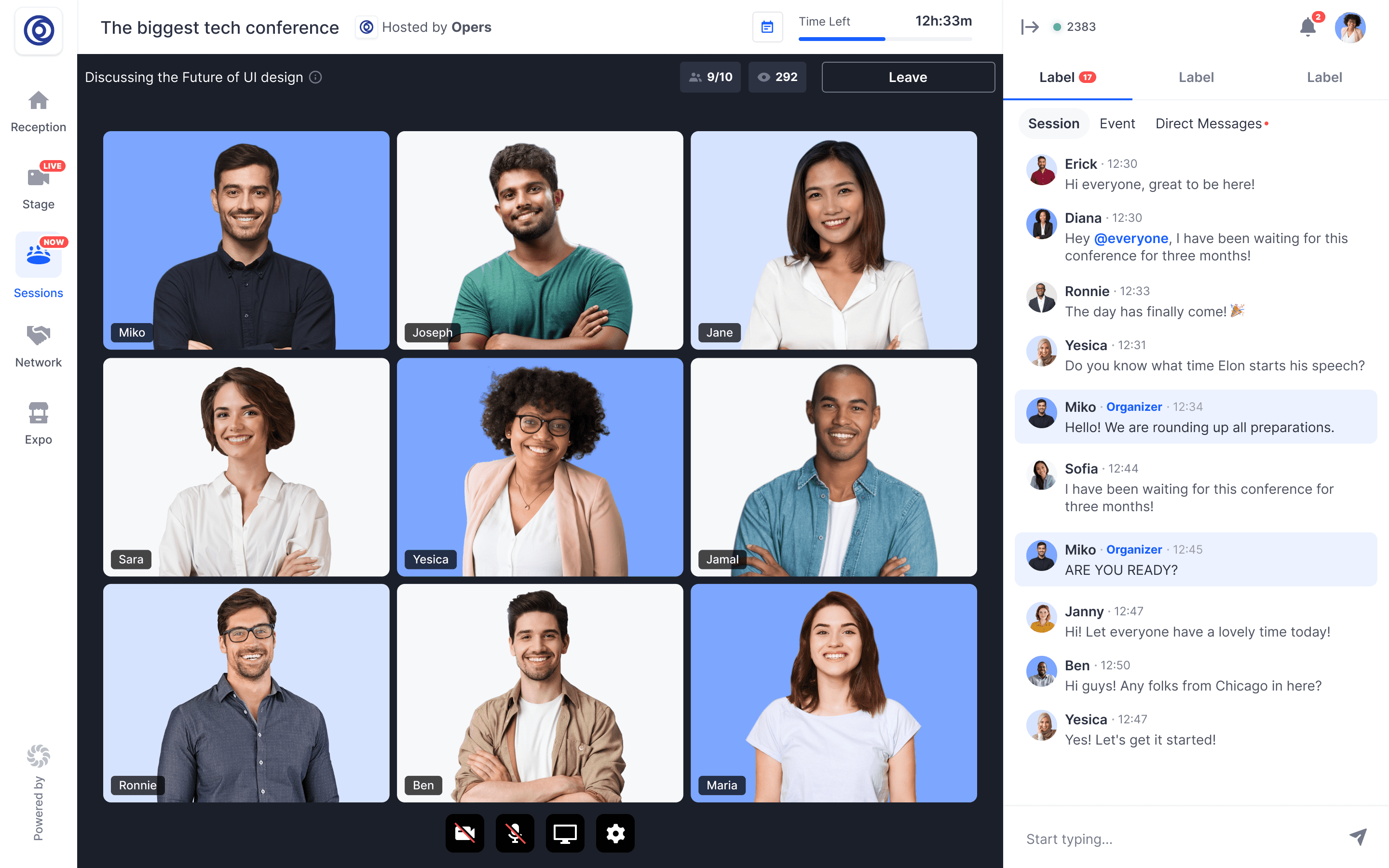

Hopin is a platform for running events online.

Hopin

LONDON — Online events platform Hopin said Thursday that it’s raised $400 million at a $5.65 billion valuation, more than double what it was worth in an investment round just four months ago.

The London-based start-up was founded less than two years ago but has seen demand for its software soar in the coronavirus pandemic. Hopin rushed to onboard users to its service last year as events started getting canceled due to the health crisis.

Hopin’s platform lets conference hosts run their gatherings digitally, aiming to emulate the experience of a physical event with tools for virtual talks and networking. It’s now looking to expand its range of products, having recently acquired video streaming service StreamYard and mobile app development firm Topi. Hopin launched its own mobile app last month.

“We’re now trying to expand into a multi-product company, with the greater mission of being the company that drives accessibility around the workplace,” Johnny Boufarhat, founder and CEO of Hopin, told CNBC in an interview.

Competition

Hopin’s latest financing round was led by Andreessen Horowitz, General Catalyst and IVP, some of Silicon Valley’s most prominent venture capital firms. As is the norm in start-up dealmaking today, the funding talks were held entirely remotely. Boufarhat said there was “aggressive” competition among tech investors to back his firm.

News of the fresh investment arrives only a few months after Hopin said it had raised $125 million at a $2.1 billion valuation, up sharply from a previous market value of $350 million. It signals continued appetite among venture capitalists for fast-growing tech firms whose businesses have been accelerated by Covid-19. The company competes with Zoom and start-ups like Run The World, another Andreessen Horowitz portfolio company, and Teooh.

Clubhouse, an invite-only audio chat app which is also backed by Andreessen Horowitz, has exploded in popularity over the past few months. It’s grown to more than 10 million users — which include celebrities like Tesla CEO Elon Musk and MC Hammer — and a $1 billion valuation, despite still being in beta mode and exclusively available through Apple’s App Store. An Android version of the app is currently in the works.

Hopin has experienced similar growth to Clubhouse, with the total number of organizations running events on its platform climbing to 80,000 this year from 50,000 in November. The firm’s clients range from American Express to NATO. Hopin’s employee headcount has also spiked to 400 from just six early last year. The company has a different business model to Clubhouse, though, focusing on enterprise clients rather than consumers.

“It’s a completely different space,” Boufarhat said when asked whether he considered Clubhouse to be a competitor. “Clubhouse overlaps a lot with consumer events. Hopin today doesn’t run many of the consumer-type events. We run much more on the B2B (business-to-business) events.”

As well as investing in Hopin, Andreessen Horowitz’s Sriram Krishnan has also joined the firm’s board. Krishnan, a former Twitter executive, was hired by Andreessen Horowitz as a partner shortly after hosting a Clubhouse discussion with Musk and Robinhood boss Vlad Tenev. Hopin also appointed a new marketing chief, Anthony Kennada.

Stay-at-home trends

The pandemic-driven boom in online services hasn’t been limited to Hopin, with the likes of Zoom, Amazon and Netflix all getting a lift from Covid. But there are worries that some of these stay-at-home trends could unwind as vaccines roll out to more people, and governments start lifting restrictions on public life.

Hopin is “just as excited as everyone else about the vaccine,” Boufarhat said. The firm is anticipating a “hybrid” events future which marries technology with big in-person events.

“From a personal standpoint, I’m tired of being at home,” Boufarhat said. “From a business standpoint, we were a hybrid business before Covid.”

“Most people will agree that you don’t need to travel two hours just to attend a meeting nowadays, and it’s the same thing with events,” he added. “It’s an industry that will continue growing. We’ve just accelerated it.”

IPO?

With a $5.65 billion valuation, Hopin is one of the largest unicorns — privately-held start-ups valued at $1 billion or more — in Europe. The firm says it now has annual recurring revenue of $70 million, up from $20 million last year, and is profitable. Boufarhat said he’s already thinking about an eventual stock market listing.

“Although we could be ready for an IPO later this year or early next year, it’s more likely we would hold off on it and continue being agile,” he told CNBC.

But Boufarhat ruled out going public via merger with a special purpose acquisition company, or SPAC. A review commissioned by the government has recommended London relax rules around such blank-check firms, which have boomed on Wall Street. Under the current framework, London-listed SPACs are forced to suspend trading after a merger gets announced.