- Independent Design House/Original Design Manufacturer (IDH/ODM) smartphone shipments remained flat annually in 2023 despite the overall smartphone shipments declining by 4%. But their contribution to the overall shipments reached record levels.

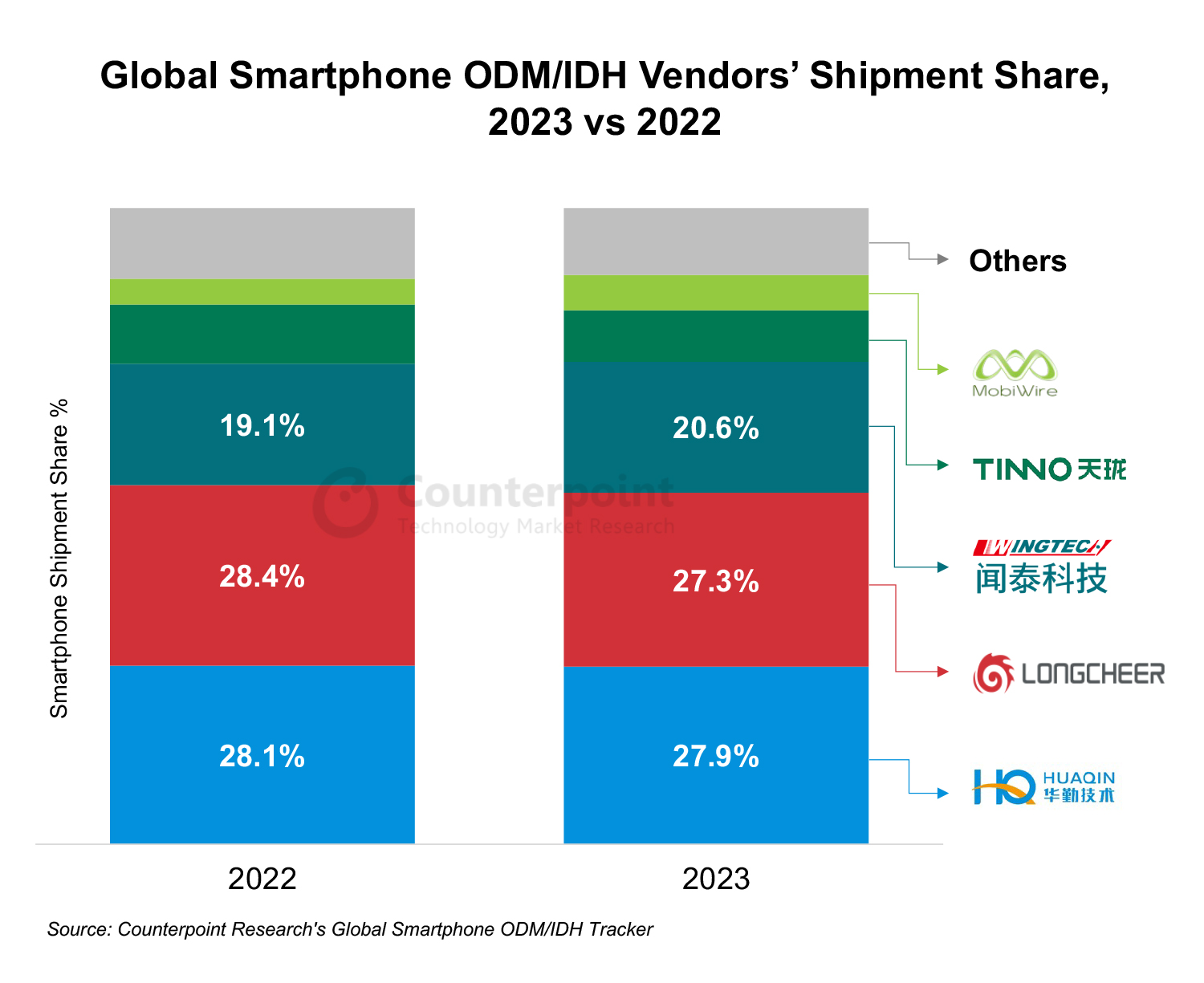

- The global smartphone IDH/ODM market is dominated by Huaqin, Longcheer and Wingtech, which contributed to more than three-fourths of the total IDH/ODM shipments in 2023.

- Emerging ODMs MobiWire and Innovatech saw a healthy uptick thanks to Transsion (TECNO, itel and Infinix), while TINNO and Chino-E saw an annual decline in orders.

The global smartphone market saw a 4% annual decline in overall shipments in 2023. However, many of the brands outsource their smartphone design and manufacturing to Independent Design Houses/Original Design Manufacturers (IDHs/ODMs) to remain competitive in the cut-throat market. In 2023, the contribution from IDHs/ODMs to the overall smartphone shipments increased marginally YoY to reach an all-time high, showing an increase in outsourcing. The brands outsourcing parts of their portfolios to these IDHs/ODMs include Samsung, Xiaomi, HONOR, OPPO, vivo and others.

Commenting on the ODM market dynamics, Senior Research Analyst Ivan Lam said, “After years of consolidation and exits, the highly competitive smartphone market now comprises eight Tier-1 and Tier-2 ODMs which control more than 95% of the outsourced smartphone volumes. In 2023, Huaqin managed to take the top spot, primarily driven by a stable share of the top three OEMs in its portfolio. Longcheer, which took the second spot, gained good orders from vivo, HONOR and Lenovo group. Wingtech captured the third spot, growing a healthy 7% annually with design wins from Xiaomi, Samsung and HONOR.”

Research Analyst Alicia Gong added, “Among the Tier-2 ODMs, Tinno managed to hold its position despite an 11% decline in shipments. Notably, MobiWire grew a healthy 30% annually, thanks to the Transsion group (TECNO, itel and Infinix brands) orders. Similar was the case with emerging ODM Innovatech. Chino-E saw a double-digit decline after losing orders from other Chinese brands. Shenzhen-based Coosea group was a rising star with orders almost doubling annually.”

Counterpoint estimates the IDH/ODM shipments to grow 4% annually in 2024, slightly ahead of the overall smartphone market’s expected growth. The Tier-1 ODM players have expanded their partnerships with major smartphone brands over the last five years to help them remain profitable. The battle now shifts beyond the mid-tier segment to the high-tier and premium-tier segments where these ODMs would like to gain design wins. Further, with 5G penetration poised to increase this year and next, the ODMs’ role in bringing down 5G smartphone prices to below $100 will be important.