- MEA Smartphone market grew 6% YoY in Q1 2019.

- Over 70% of the total smartphones sold in the region were in the sub-US$150 price segment.

- There is an increasing transition of users from feature phones to smartphones.

The smartphone market in the Middle East and Africa (MEA) grew 6% year-on-year (YoY) in Q1 2019, while the feature phone segment declined 6% (YoY), according to Counterpoint Market Pulse. Overall handset market grew 1% YoY.

Commenting on the smartphone market growth, Tarun Pathak, Associate Director at Counterpoint Research, said, “There is an increasing transition of users from feature phones to smartphones in the region. Availability of affordable devices, the growing ecosystem of refurbished devices, and increasing internet penetration are fuelling the switch to smartphones, especially in the African Region. In the larger African countries, like Nigeria and Kenya, smartphones remain the primary medium to access internet services. There is also increasing popularity of the mobile money ecosystem, which is driving further smartphone adoption. Price remains a key factor for smartphone adoption. Over 70% of the total smartphones sold in the region were in the sub- US$150 price segment. “

Transsion Group dominates the handset market in MEA, commanding a 19% market share in the smartphone segment and a 71% market share in the feature phone segment. Affordability and localized offerings underline the dominance of the Transsion’s brands. Features like longer battery life and optimized cameras for local needs make them a popular option. The brands also have a deep distribution network in Africa.

A large section of the population in MEA still uses 2G feature phones. Commenting on the feature phone segment, Varun Mishra, Research Analyst at Counterpoint Research said,” Although declining, feature phone remained relevant in the MEA and contributed to 34% of the total handsets sold during the quarter. In terms of shipments, MEA has surpassed India to become the largest feature phone market globally in 2019. Factors like the dearth of infrastructure, affordability, literacy, and ease of use continue to make feature phones a viable option in the region.”

MTN and Orange announced smart feature phones running on KaiOS in the African market for as low as US$20. Commenting on the smart feature phone segment, Varun Mishra added, “A smart feature phone would help users transition from 2G to 3G/4G in an affordable manner with minimal changes in the form-factor. The network transition and application ecosystem would open new monetization avenues for telecom players and increase the overall average revenue per user (ARPU) of operators in the competitive African market. Smart feature phone would serve as the middle ground between the feature phones and smartphones. Although feature phone shipments would decline in the future, the smart feature phone segment remains poised for growth. Many users are likely to access high-speed internet first time through a smart feature phone. Fostering a partnership model among ecosystem players, like KaiOS, would drive the initial access cost down, which would help increase internet penetration in the region and thus provide long-term profitability.”

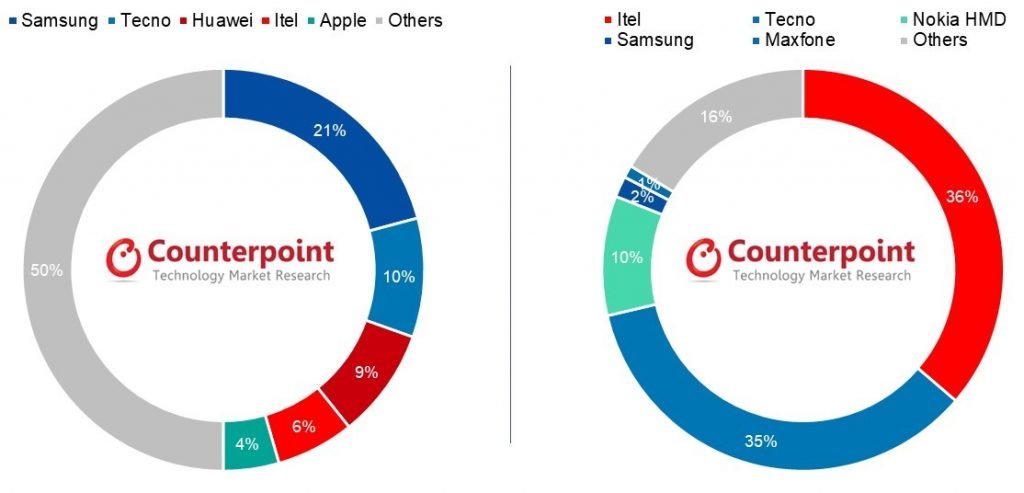

Exhibit 1: MEA Smartphone Market Share MEA Feature Phone Market Share

Source : Counterpoint Research Market Pulse Q1 2019

Market Summary:

- The top five smartphone brands captured 49% of the market.

- Samsung led the smartphone market by volume, capturing one-fifth of the total smartphone market in Q1 2019. However, the sell-through for the brand declined 23% YoY in MEA.

- Huawei was one of the fastest growing brand driven by the Y9 and P20 Lite. The brand grew 27% YoY. HONOR also grew 122% YoY, albeit small base. However, the future for both Huawei and HONOR remains uncertain amid the current US-China trade war.

- Sub-US$100 segment captured 55% of the total smartphone market. Premium segment (US$400 and above) captured single-digit market share in the price-sensitive MEA market.

- Close to one-fifth of the smartphones in the MEA region are still 3G. Although the transition is happening from 3G to 4G, as 4G capable handsets become more affordable and network availability increases.

- Feature Phones contributed to over one-third of the total sell-through in Q1 2019.

- iTel and Tecno lead the feature phone segment together, capturing over 70% of market share. Tecno defied the feature phone segment decline and grew 15% YoY.