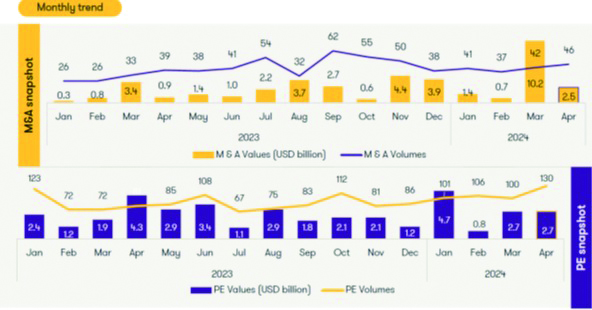

NEW DELHI: India’s deal volumes surged in April 2024, marking the highest monthly activity since May 2022. While no billion-dollar deals were recorded, 12 high-value transactions exceeding USD 100 million amounted to USD 3.8 billion, showcased a robust market. Despite a decline in M&A values compared to the previous month, April witnessed a notable increase in deal values, primarily fuelled by domestic consolidations led by the Adani Group. Interestingly, European companies exhibited a significant cross-border interest, signalling a shift from the dominance of US firms, the Grant Thornton Bharat’s Dealtracker reveals.

While M&A volumes remained steady, a significant decline in values was observed as March 2024 witnessed a USD 8.5 billion merger between the Reliance group and Disney. Barring this deal, April recorded 48 per cent increase in deal values driven by three significant domestic consolidations by the Adani Group, valued at USD 2 billion, accounting for 38 per cent of total deal values.

April 2024 saw close to 130 deals being struck in which PE funds participated. While retail, consumer, and IT sectors remained popular, they saw smaller deal values despite a high volume of transactions. Conversely, BFSI, healthcare and real estate sectors witnessed multiple deals with relatively higher values, notably involving Apollo, Avanse, Prestige Group & MMTP projects. Significant acquisitions such as Appasamyby Warburg Pincus and iBUSby NIIF and NSEIT by Investcorpunderscore a cautious yet confident investment approach, focusing on promising businesses at reasonable valuations.

The manufacturing sector is leading in deal values, with nine transactions totalling USD 1,919 million. This surge can be attributed to two high-value deals where the Adani group, acquired a total of 7.5 per cent stake in AmbujaCements amounting to USD 1.8 billion to increase the manufacturing capacity of cement makers. Retail dominated deal volumes accounting for a 19 per cent share in overall deal activity. Within the sector, e-commerce, textiles, apparel and accessories, and personal care segments contributed led the sector volumes with 64 per cent share totalling 21 deals, while the consumer services segment led the sector values contributing to a 38%,valuing USD 82 million.

The pharmaceutical sector experienced a notable surge in both values and volumes compared to the previous month with deal values increasing from USD 222 million to USD 993 million, marking the highest monthly since November 2023, while deal volumes surged by 31 per cent compared to March 2024. This increase in deal values is primarily attributed to three high-value private equity transactions, collectively valued at USD 842 million.

The IT & ITes sector’s volumes surged by 60 per cent while witnessing a significant increase in values by 76 per cent from the previous month. Tech start-ups accounted for the largest share of deal volumes at 41 perf cent followed by SaaS and tech services, each contributing 28 per cent while tech service providers led the values with 55 per cent share in the sector.

Transport and logisticssector witnessed significant increase in deal activity from March 2024, driven by cleantech packaging and logistics segment while Adani group’s acquisition of Gopalpur ports valuing at USD 163 million was a big boost to the sector contributing to nearly 80 per cent of the sector’s values. Professional/business services sector saw rebound after December 2023, recording five deals (including HR tech and ESG and accounting services) valued at USD 34 million regaining investor confidence within the sector.

Notably the aerospace sector (particularly in application-agnostic satellite platforms, advanced air defence aerial systems and aerospace component manufacturing segments) witnessed increased investment activity during the month. The deal outlook for 2024 continues to remain positive as India stands at the cusp of a new era of growth and investment supported by a growing consumer market, a flourishing tech start-up ecosystem, and supportive government policies. However, factors influencing domestic markets in the near term could include the outcome of Lok Sabha elections, global and domestic trend in interest rates driven by inflation and supply chain dynamics.