- The global smartwatch market continued to contract in Q1 2023 following an 8% YoY decline in Q4 2022.

- Fire-Boltt surpassed Samsung for the first time in the global smartwatch market, capturing the second spot.

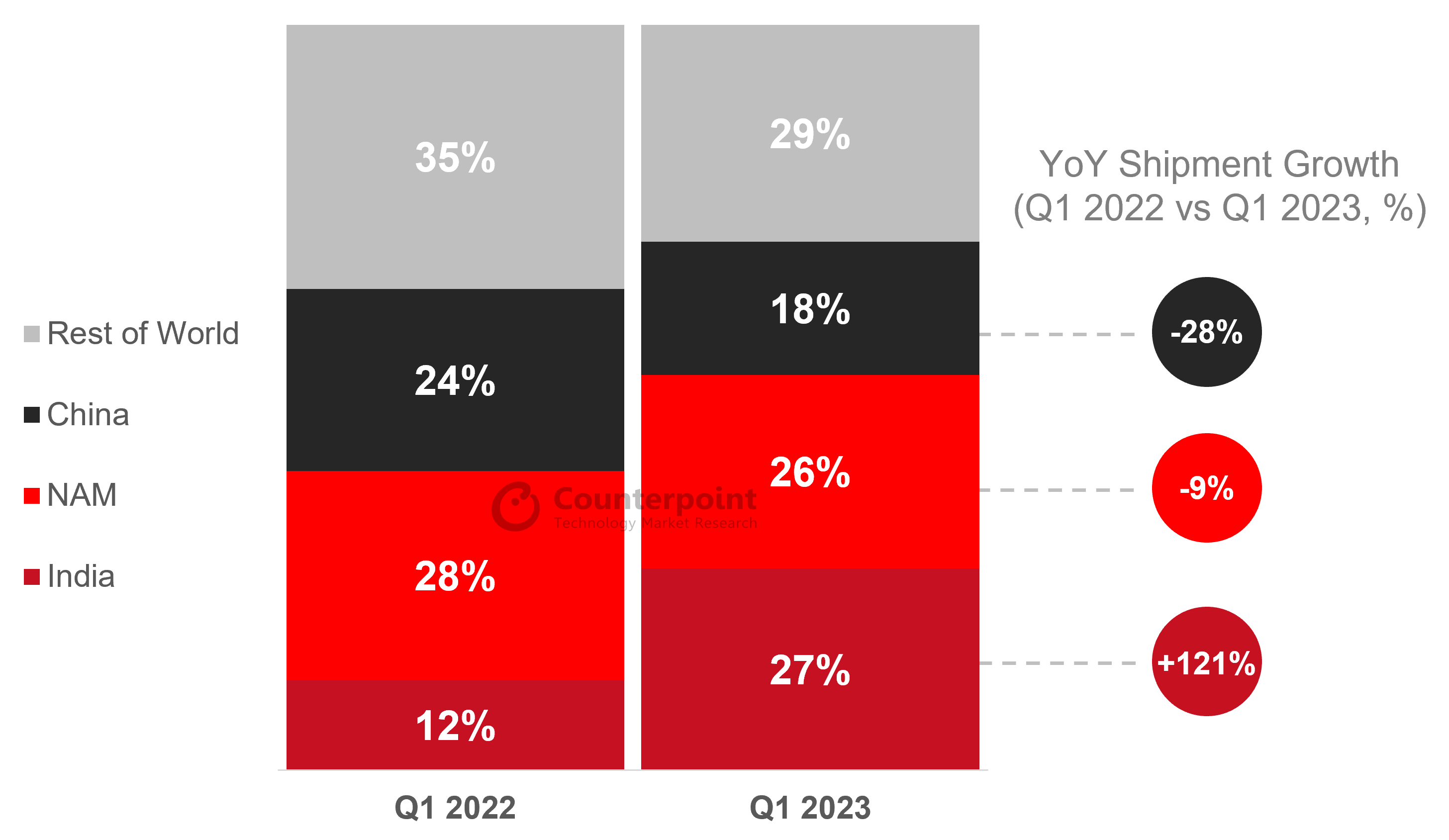

- All regions except India witnessed a YoY decline in shipments in Q1 2023.

Global smartwatch shipments contracted 1.5% YoY in Q1 2023, according to Counterpoint Research’s latest Global Smartwatch Model Tracker. The 121% growth in India’s shipments managed to restrict the decline. This was the second consecutive quarter of a YoY decrease in global shipments, which were hit by the seasonal decline in demand for products from major players like Apple and Samsung, along with consumer sentiment dampened by global financial pressures.

Research Analyst Woojin Son said, “The global smartwatch market, which had been experiencing steep growth for several years, has entered a period of stagnation since the end of last year when it declined 8% YoY in Q4 2022. Amid a global slowdown in demand for tech devices, the smartwatch consumption trend has also undergone a transformation. The market share of high-price and high-performance HLOS smartwatches*, primarily released by Apple and Samsung, decreased from 60% in Q1 2022 to 53% in Q1 2023. On the other hand, the market share of Basic smartwatches* significantly increased from 23% to 34% driven by rapid growth in the Indian market. Although the overall smartwatch shipment volume declined slightly compared to last year, affordable products that offer a certain level of performance generated substantial demand based on their price accessibility. These low-end smartwatches are also absorbing or replacing the existing smartband market.”

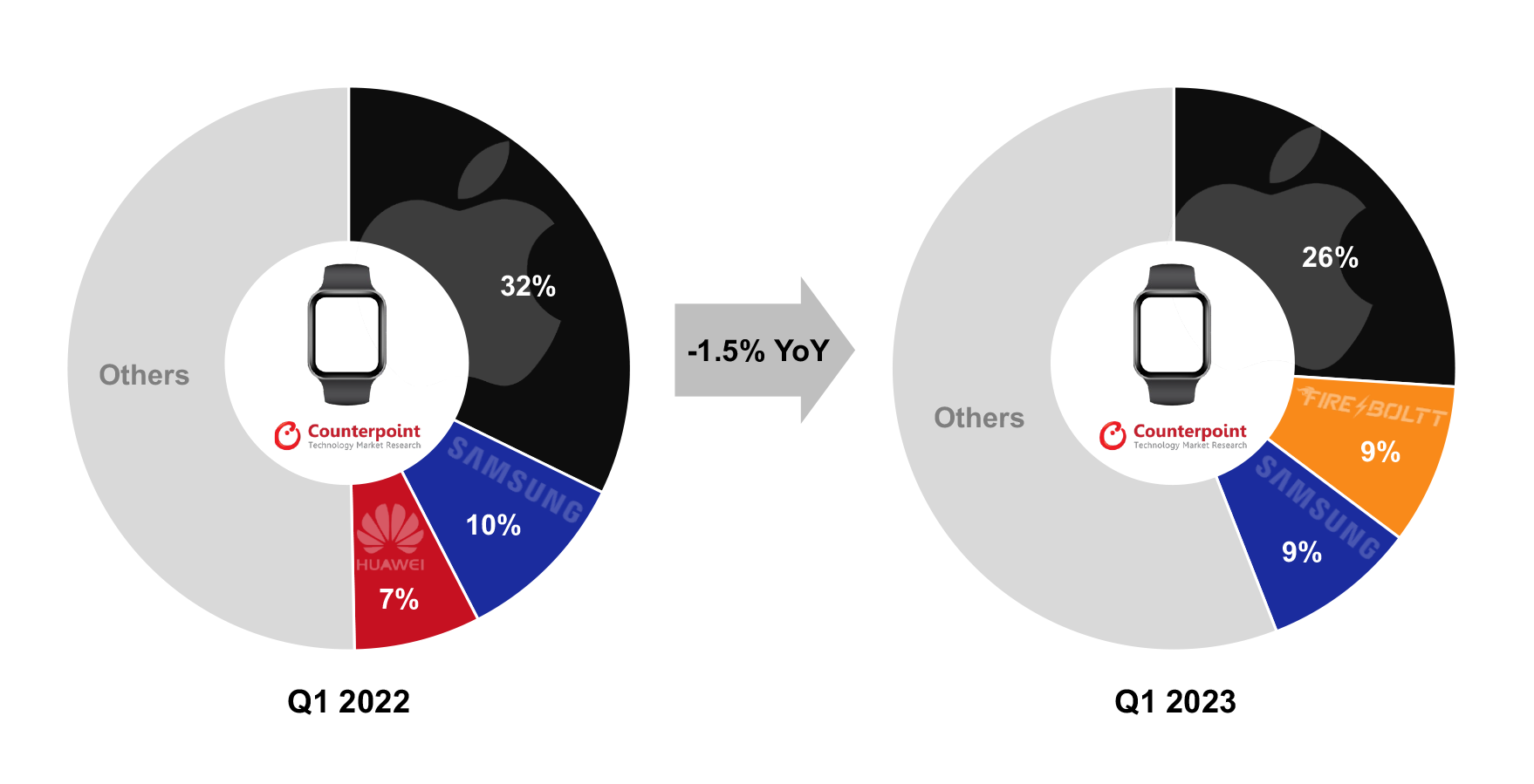

Global Top 3 Smartwatch Brands’ Shipment Share, Q1 2023 vs Q1 2022

Source: Counterpoint Global Smartwatch Model Shipment & Revenue Tracker, Q1 2023

Source: Counterpoint Global Smartwatch Model Shipment & Revenue Tracker, Q1 2023

Market summary

- Apple’s shipment volume fell 20% YoY in Q1 2023. This was the first time in three years that its Q1 shipments fell below 10 million units. As a result, Apple’s market share, which was 32% in Q1 2022, dropped to 26%. This can be attributed to the ongoing macroeconomic crisis, which has led to decreased accessibility to relatively higher-priced Apple Watches. Despite the Apple Watch Series 8’s release about a month ahead of its predecessor, it did not achieve the same level of success as the previous model.

- Indian brand Fire-Boltt surpassed Samsung for the first time and reached the second position in the global market. Its shipments increased by approximately three times compared to the previous year and saw a 57% growth compared to the previous quarter. This reflects the rapid growth of the Indian market, just like other local brands such as Noise and boAt.

- While Samsung experienced a 15% increase in shipments in its key market North America, it witnessed a decline in shipments in other major markets. As a result, its overall global shipments declined by 15% compared to the previous year and 21% compared to the previous quarter.

- Huawei, the most influential Chinese OEM, saw a 14% YoY decline in its shipments in the Chinese market, which is a key market for the company. However, Huawei saw increased shipments in India, LATAM and MEA, limiting its overall decline in global shipments to 9%. Huawei has been employing a strategy of relaunching models previously released for the Chinese market in the international market.

Smartwatch Shipment Share by Region, Q1 2023 vs Q1 2022

Note: Figures may not add up to 100% due to rounding

Source: Counterpoint Global Smartwatch Model Tracker, Q1 2023

In terms of the regional markets, India surpassed North America, reclaiming its position as the top region with a 27% share of global smartwatch shipments. Senior Analyst Anshika Jain said, “India’s smartwatch market grew 121% YoY in Q1 2023 driven by affordability, rising customer demand and availability of a wide variety of options in the budget segment. Around 40% of the total shipments were driven by the <INR 2,000 (<$25) price band, its highest proportion ever. The share of India-based players crossed 90% for the first time as they were quick in terms of upgrading their portfolios and adapting their products to customer needs at a reasonable price point.”