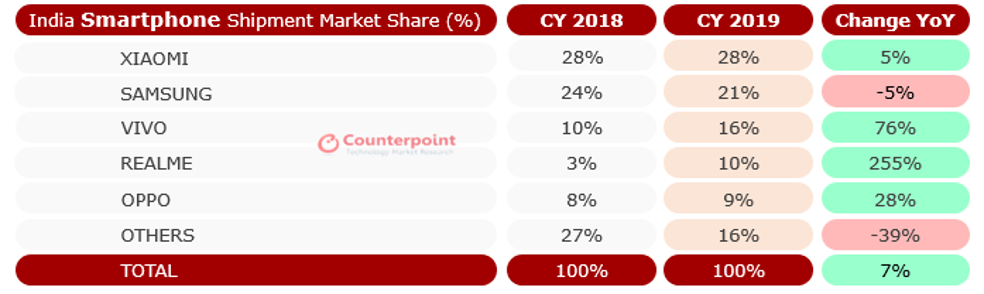

• Xiaomi continues to capture the number one position for the second successive year.

• realme (255%), Vivo (76%), Asus (67%) and OnePlus (29%) were the fastest-growing smartphone brands on an annual basis.

• The combined share of the top five smartphone brands (~84%) reached the highest ever level.

The India smartphone market surpassed the USA for the first time on an annual level, becoming the second-largest smartphone market globally, reaching 158 million shipments in 2019 with 7% YoY growth, according to the latest research from Counterpoint’s Market Monitor service.

This is due to the growth of the mid-tier segment where Chinese brands aggressively introduced many flagship-grade features and capabilities to capture demand coming from users looking to upgrade from their first or second smartphone. Additionally, the online channels became the preferred selling platforms to introduce these products faster into the market.

Commenting on the market dynamics, Tarun Pathak, Associate Director, said, Although the rate of growth for the smartphone market was only single digit for the first time on an annual basis, India is underpenetrated relative to many other markets; 4G penetration among subscribers being around 55%. Going forward, we expect this demand to grow further due to the ongoing transition from feature phones to smartphones and progressive diffusion of key smartphone features to the entry-level price tier as a result of hyper-competition among multiple players.

We further expect brands to have multi-tier strategies involving partnerships in the mobile ecosystem from hardware, software and services, thus creating opportunities within different segments like entertainment, gaming, financial services and more, he added.

Commenting on the competitive landscape, Anshika Jain, Research Analyst at Counterpoint Research said, “Chinese brands’ share hit a record 72% for 2019 compared to 60% a year ago. During 2019 we have seen all major Chinese players expanding their footprint in offline and online channels to gain market share. For example, Xiaomi, realme, and OnePlus have increased their offline points of sale, while brands like Vivo have expanded their online reach with Z and U series. 2019 also marked the fifth anniversary in India for some OEMs. Several have seen significant growth from their first full year of operation. For example, over the past four years, Xiaomi, Vivo, and OnePlus have grown 15x, 24x, and 18x respectively. This highlights that OEMs are mature enough to capture the next wave of growth and further expand their operations in India.

Exhibit 1: India Smartphone Market Share 2019

Source: Counterpoint Research Market Monitor 2019

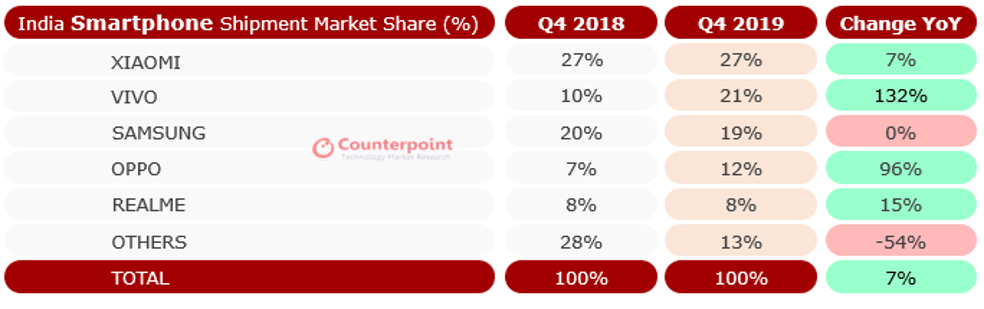

Exhibit 2: India Smartphone Market Share Q4 2019

Source: Counterpoint Research Market Monitor Q4 2019

While the smartphone market registered YoY growth, the feature phone market saw a steep decline of around 42% YoY in 2019 and 38% YoY in Q4 2019. This is due to a slowdown in new shipments from Reliance Jio. However, the players such as itel, Lava, Nokia and Micromax registered positive annual growth despite the overall segment decline. In fact, itel emerged as the number one feature phone brand in Q4 2019 followed by Samsung and Lava.

Market Summary:

The India smartphone market grew 7% YoY in both Q4 2019 and in 2019 due to the expansion of Chinese brands with their aggressive pricing and promotional strategy.

Xiaomi grew 7% YoY in Q4 2019 and 5% YoY in 2019 driven by expansion in offline channels and the strong performance of its Redmi Note series. India is now the biggest market for Xiaomi, surpassing its home market, China, in 2019. However, the growth rate has declined to single-digit as Xiaomi is now serving a much larger installed base in India. Hence, 2020 will require specific strategies related to user retention and acquisition respectively.

Vivo grew 76% YoY in 2019 and 134% YoY in Q4 2019 driven good performance of its budget segment series. Also, by successfully pivoting to online and aggressively positioning the S series in the offline segment with new features, it managed to make a dent in the INR 15,000 -INR 20,000 ($250-$300) segment. Due to this, Vivo captured the second spot for the first time in India’s smartphone market.

Samsung shipments remained almost flat YoY in 4Q19, while it has shown a 5% YoY decline in 2019 as a whole. Samsung shipments were driven by its upgraded A and M series (A50s, A30s, M30s and A20s). This is the first time Samsung transitioned to a completely new portfolio targeting different channels (offline with A series and online with M series). However, it needs to double-down to keep any momentum going.

OPPO shipments almost doubled YoY in Q4 2019, due to demand for its budget segment device A5s and the good performance of its recently launched devices A9 2020 and A5 2020 in the offline segment. OPPO is now aggressively moving towards higher price points with the introduction of the Reno series.

realme grew 255% in India in 2019. The growth of realme was driven by an aggressive go-to-market strategy that involved launching several industry-first features with a strong design language. This is resonating well among young consumers seeking value-for-money devices. In the fourth quarter of 2019 realme also made an entry into the premium segment for the first time with its X2 Pro device, which started sales strongly.

All major brands are now aiming to expand in the mid to high price tier, which is likely to be the fastest-growing segment in 2020.

Transsion Group (Itel, Infinix, and Tecno) reached its highest ever market share in Q4 2019. Transsion remained strong in tier 3, tier 4 cities and rural India. Itel was the number one smartphone brand in the entry-level sub-INR 4,000 (US$ 60) price segment, while Tecno and Infinix showcased YoY growth in INR 6000-INR 10000 (US$ 86-US$ 142) segment by bringing aggressive features at lower price-points like 6.6-inch displays, 20:9 aspect ratio, 5000 mAH battery, etc.

Apple was one of the fastest-growing brands in Q4 2019 driven by multiple price cuts on its XR device, thanks to local manufacturing in India. Additionally, 2019 saw the fastest rollout of Apple’s new iPhones (11 series) in India, with aggressive pricing and a good channel strategy. In fact, the new series especially iPhone 11 was introduced at a lower price point than the last year’s iPhone XR This has helped to gain share during the festive season and in its launch quarter in India.