- boAt grew 128% YoY to mark its nine successive quarters of lead, while Noise stood second for the fourth consecutive quarter.

- OnePlus bounced back strongly in the top-five rankings with a 6% share in Q3 2022.

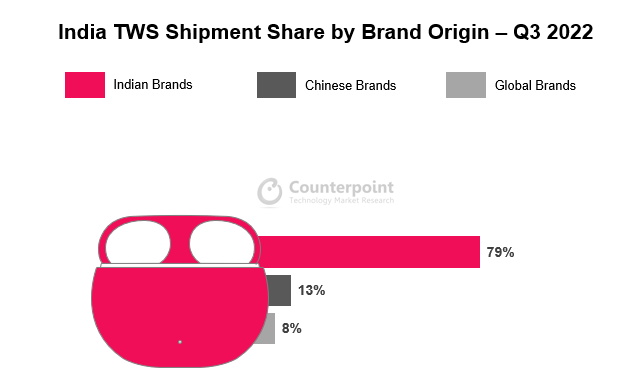

- Almost four in five TWS shipped in India were from an Indian brand.

- Domestic manufacturing saw a record 288% quarterly growth this year, contributing to 34% of the total shipments.

- Online channel maintained 79% of the volume with Flipkart in the lead.

India’s TWS (True Wireless Stereo earbuds) shipments doubled YoY in Q3 2022, according to the latest research from Counterpoint’s IoT Service. The growth was primarily driven by festive season inventory to meet the strong pent-up demand, multiple new launches, discount events and promotions.

Commenting on brand performance, Senior Research Analyst Anshika Jain said, “The top five TWS brands in India – boAt, Noise, Mivi, OnePlus and Boult Audio – accounted for almost 70% of the total shipments. OnePlus made a comeback in the top five driven by two recent launches – Nord Buds and Nord Buds CE – at an affordable price point. Indian brands showed the fastest YoY growth of 143% to reach their highest shipments ever in Q3 2022. Launching multiple devices according to customer needs, effective marketing tactics and aggressive participation in sales events have been their major growth drivers. Moreover, strong growth was observed in Q3 due to festive season sales and a focus on local manufacturing. People also use these devices for gifting purposes during festivals like Raksha Bandhan and for corporate gifts.”

On best-selling models, Jain said, “The top 10 TWS models captured 41% of the total TWS shipments. These models mostly catered to the low-mid price segment (INR 1,000-INR 3,000). Top player boAt captured seven spots in the top-10 best-selling model rankings. With a 9% share, the Airdopes 131 remained the top model for the sixth successive quarter. OnePlus took two spots with its recently launched models Nord Buds and Nord Buds CE grabbing a 2% share each. Noise took one spot with its best-performing buds VS102 model, which had a 3% share in Q3 2022.”

On distribution channels, Associate Research Director Liz Lee said, “It is still challenging for brands to strengthen their presence in offline channels, as a huge share of 79% still comes from the online market. In addition, the TWS online segment has a strong footprint on Flipkart, which has more than half of the total online shipment share. Key players Mivi and Boult Audio have recently stepped into the offline space and plan to go aggressive on their expansion offline. Online-centric brand Truke has also aimed to enter the offline market in the immediate quarter. We may witness brands existing in both online and offline marketplaces exploring and partnering with big retail chain companies to increase their offline presence.”

Source: India Hearables (TWS) Shipments, Model Tracker, Q3 2022

Dominant Indian brands lost a small share to Chinese and global brands in Q3 2022.

- Indian brands grew 143% YoY in Q3 2022 driven by boAt, Noise, Mivi, Boult Audio and Ptron. All the new entrants in Q3 2022 were local brands, namely Mobatree, 5 Elements, Duffer and Lyne (a U&I sub-brand). Besides, Indian brands had high penetration in the low-price segment (<INR 2,000 or <$50), with a cumulative share of 95%.

- Chinese brands saw an increased share of 13% in Q3 2022. OnePlus drove this growth by offering a feature-rich device, the Nord Buds CE, at the lowest price point in its entire TWS portfolio. The good performance of the Nord Buds model also contributed to its growth. realme and OPPO also offered multiple new advanced TWS devices that further supported the growth of Chinese brands.

- Global brands, which mostly cater to the premium segment (>INR 5,000), strengthened their growth with Apple launching its much-awaited new model, the Airpods Pro (2nd Gen). Global brands saw 91% QoQ and 9% YoY growth in Q3 2022, which was driven by Samsung, JBL and Apple.