Indian food delivery startup Zomato on Wednesday filed for an initial public offering, becoming the first tech unicorn startup from the world’s second largest internet market to do so in recent years.

The 12-year-old Gurgaon-headquartered Indian startup, which counts Info Edge and Ant Group among its investors, has set $1.1 billion as its IPO size and will look to raise about $1 billion by issuing shares, it said in the filing.

Some key insights shared by Zomato in the filling:

-

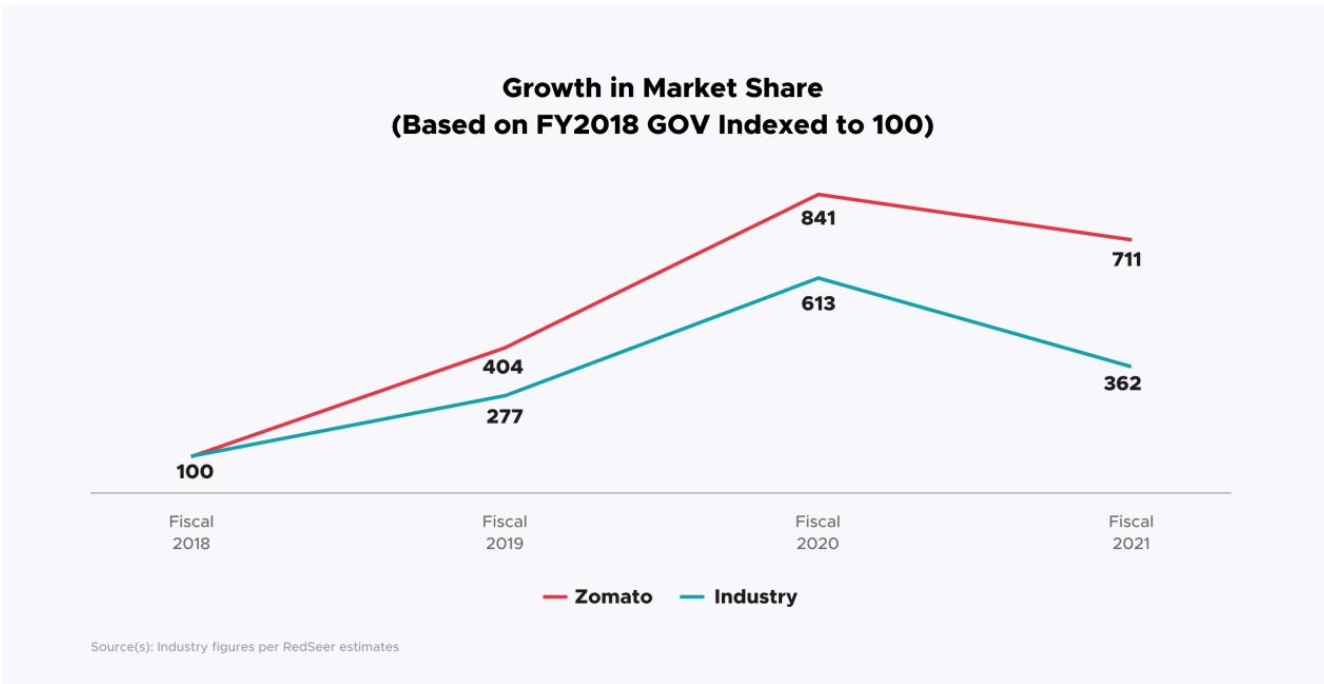

- Zomato has claimed market leading position in the food delivery market.

- The startup identified Prosus Ventures-backed Swiggy (which is in talks to raise capital from SoftBank Vision Fund 2), as well as restraunts such as Domino’s, McDonald’s and Pizza hut as its competitor. (But not Amazon, which entered the food delivery market last year.)

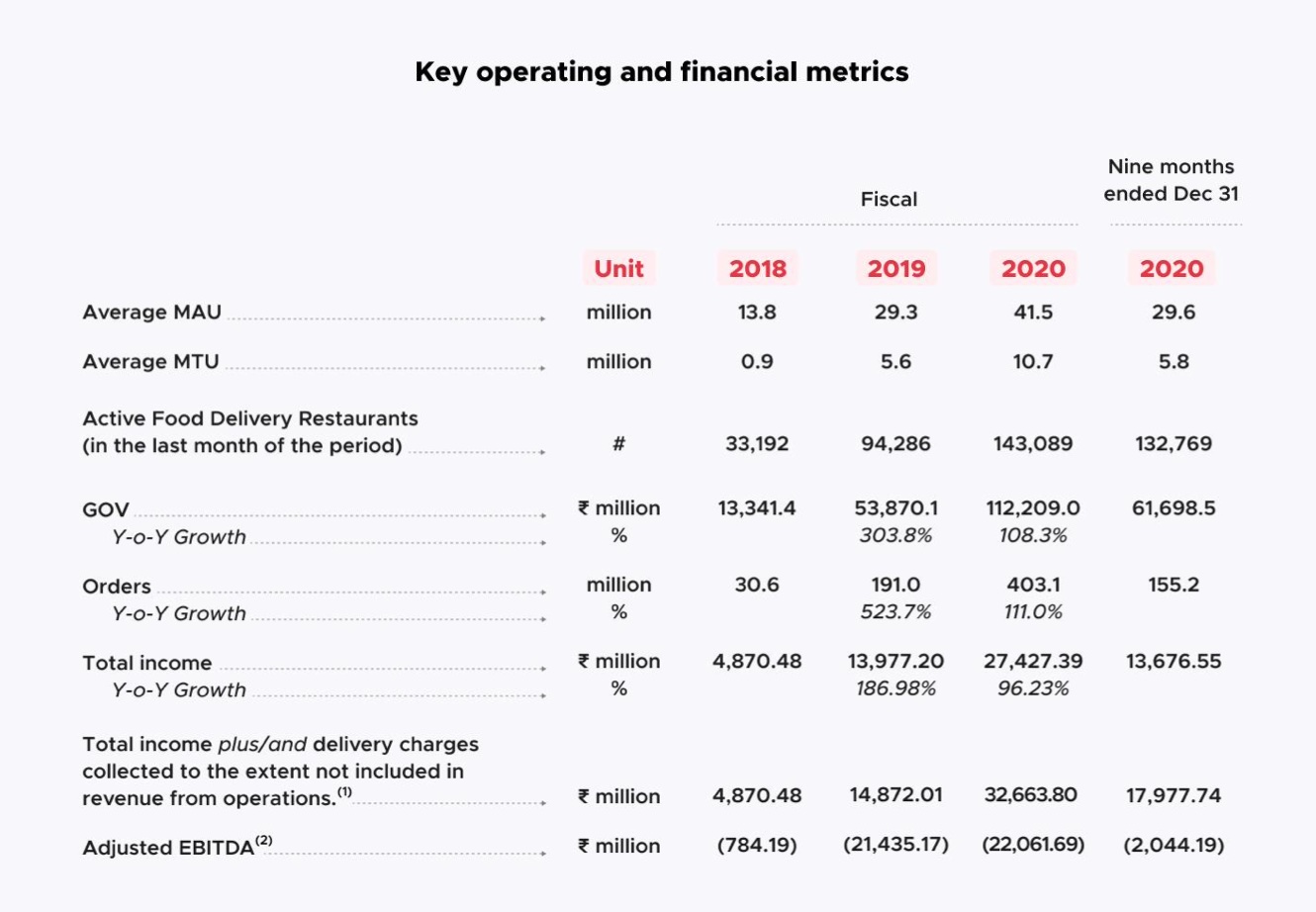

- The startup clocked $183.6 million in revenue between April 1 and December 31. Its losses during this period were $91.8 million.

- The startup said it has a history of net losses, and it anticipates increases expenses in the future.

- Info Edge, one of the biggest investor of Zomato, plans to sell stake worth $100 million, the investment firm said in a filing.

- Zomato has identified “changing regulation in India,” ability to raise foreign capital, and “political changes” among over a dozen risk factors.

- The startup, which employs 3,469 people across the globe as of December 31, plans to grow its Zomato Pro membership offering, which allows customers to avail additional benefits, deepen its relationship with restaurant partners in the foreseeable future.

- Zomato says by third quarter last year, going by the metric GOV (gross order value), the startup had recovered from the Covid crisis. But some of its business lines including dining-out business is “still recovering as customers continue to be reluctant to dine-out as a precautionary measure.”

- Zomato has claimed market leading position in the food delivery market.

This is a developing story. More to follow…