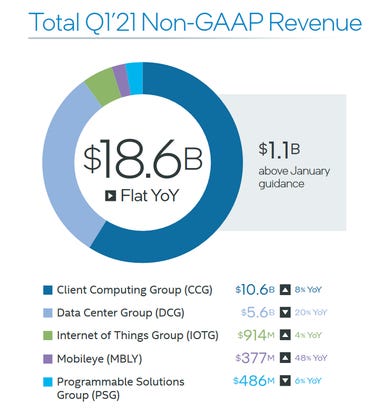

Intel published its first quarter financial results on Thursday, beating market expectations thanks to strong PC sales. PC unit volumes were up 38 percent YoY, and notebook volumes set a new Intel record, the company said. However, overall Q1 revenue was down year-over-year, with sales in the Data Center Group down 20 percent.

Intel’s non-GAAP earnings per share came to $1.39 on GAAP revenue of $19.7 billion, down 1 percent year-over-year.

Analysts were expecting earnings of $1.15 on revenue of $17.86 billion.

“Intel delivered strong first-quarter results driven by exceptional demand for our leadership products and outstanding execution by our team,” CEO Pat Gelsinger said in a statement. “The response to our new IDM 2.0 strategy has been extraordinary, our product roadmap is gaining momentum, and we’re rapidly progressing our plans with re-invigorated focus on innovation and execution.”

Gelsinger added, “This is a pivotal year for Intel. We are setting our strategic foundation and investing to accelerate our trajectory and capitalize on the explosive growth in semiconductors that power our increasingly digital world.”

Gelsinger took the helm as CEO of Intel in January. After the company experienced a number of delays in its product roadmap, the new chief executive committed Intel “to a steady cadence of leadership products” using both its own and external manufacturing.

Intel’s Client Computing Group (its PC business) brought in Q1 revenues of $10.6 billion, up 8 percent year-over-year. In addition to record notebook volumes, Intel’s PC business benefited from record wifi and Thunderbolt volumes. Those sales were partially offset by lower modem sales.

Revenue from the Data Center Group in Q1 came to $5.6 billion, down 20 percent. DCG revenue was down due to cloud digestion, Intel said, as well as the impacts of the Covid-19 pandemic on Enterprise and Government sales. Intel noted, however, that it’s already seeing an initial recovery of Enterprise and Government sales.

Intel’s memory business (NSG) brought in Q1 revenue of $1.1 billion, down 17 percent.

The Internet of Things Group achieved better-than-expected revenues of $914 million, up 4 percent over the year prior. Mobileye brought in $377 million, up 48 percent, setting a new record for the business.

Intel’s PSG (programmable solutions group) brought in $486 million, down 6 percent. The segment was down on cloud and enterprise inventory digestion, Intel said.

For the second quarter, Intel is giving an outlook of $18.9 billion in revenue. The company raised its full-year 2021 guidance and is now expecting GAAP revenue of $77 billion.