Intel reported fiscal fourth-quarter earnings, for the period ended Dec. 26, after the bell on Wednesday. Shares slipped about 1% in after-hours trading.

Here’s how Intel did versus Refinitiv consensus estimates:

- EPS: $1.09, adjusted, versus $0.91 expected

- Revenue: $19.5 billion, adjusted, versus $18.31 billion expected

Intel said it expected $18.3 billion in adjusted sales in the first quarter of 2022, beating consensus analyst expectations of $17.62 billion.

Intel’s largest business, its Client Computing Group, was down 7% year-over-year to $10.1 billion, though it still beat analysts’ average estimate of $9.6 billion, according to FactSet.

Intel CEO Pat Gelsinger said in an interview that the annual drop in the group, which includes Intel’s PC chip business, was a function of customers and PC makers shifting sales from quarter to quarter. PC sales have been elevated since the start of the pandemic in 2020, including during last year’s December quarter.

“I wouldn’t read anything into the quarter-on-quarter,” Gelsinger said, adding that supply constraints were also a factor.

Gelsinger said that he expects PC sales to remain strong. Microsoft on Tuesday reported that revenue in its personal computing group climbed almost 16% from a year earlier, topping estimates, and CEO Satya Nadella said that demand is strong across the business.

Intel’s Data Center Group unit also topped expectations, with revenue rising 20% to $7.3 billion, compared to the average estimate of $6.7 billion.

“The Q4 was really marked by the on-premise, enterprise, and government sector strength,” Gelsinger said. He added that some clients were having trouble getting parts like ethernet power controllers that are required in order to build new Intel-powered servers.

Gelsinger said the company’s next-generation server chip, Sapphire Rapids, is on schedule to start shipping this quarter and that production will ramp in the second quarter. Analysts had worried about delays for the chip, which is manufactured on a new process.

Mobileye, the subsidiary that focuses on self-driving car technology, reported $356 million in sales during the quarter, a 7% annual increase. Intel said in December that it plans to take the unit public in an IPO.

Gelsinger took over as Intel just under a year ago and set off on a period of massive capital expenditure. Under Gelsinger, Intel announced it will continue to manufacture its own PC and server chips and, in a strategy shift, would also begin to manufacture designs from other companies.

This strategy requires new facilities and investment. “First, we have to invest to catch up. We’re behind on capacity, you know, we would lust after having some free capacity today,” Gelsinger said.

Intel announced last week it plans to build a chip-making complex in Ohio which could house as many as eight fabs, or chip factories, with production set to begin in 2025. Intel said it would invest at least $20 billion to get the first two factories up and running.

Intel warned last quarter that its margin would shrink over the next two to three years as it invests in additional manufacturing capacity. Even with the lowered expectations, the company’s gross margin forecast for 52% in the first quarter still narrowly missed estimates of almost 53%.

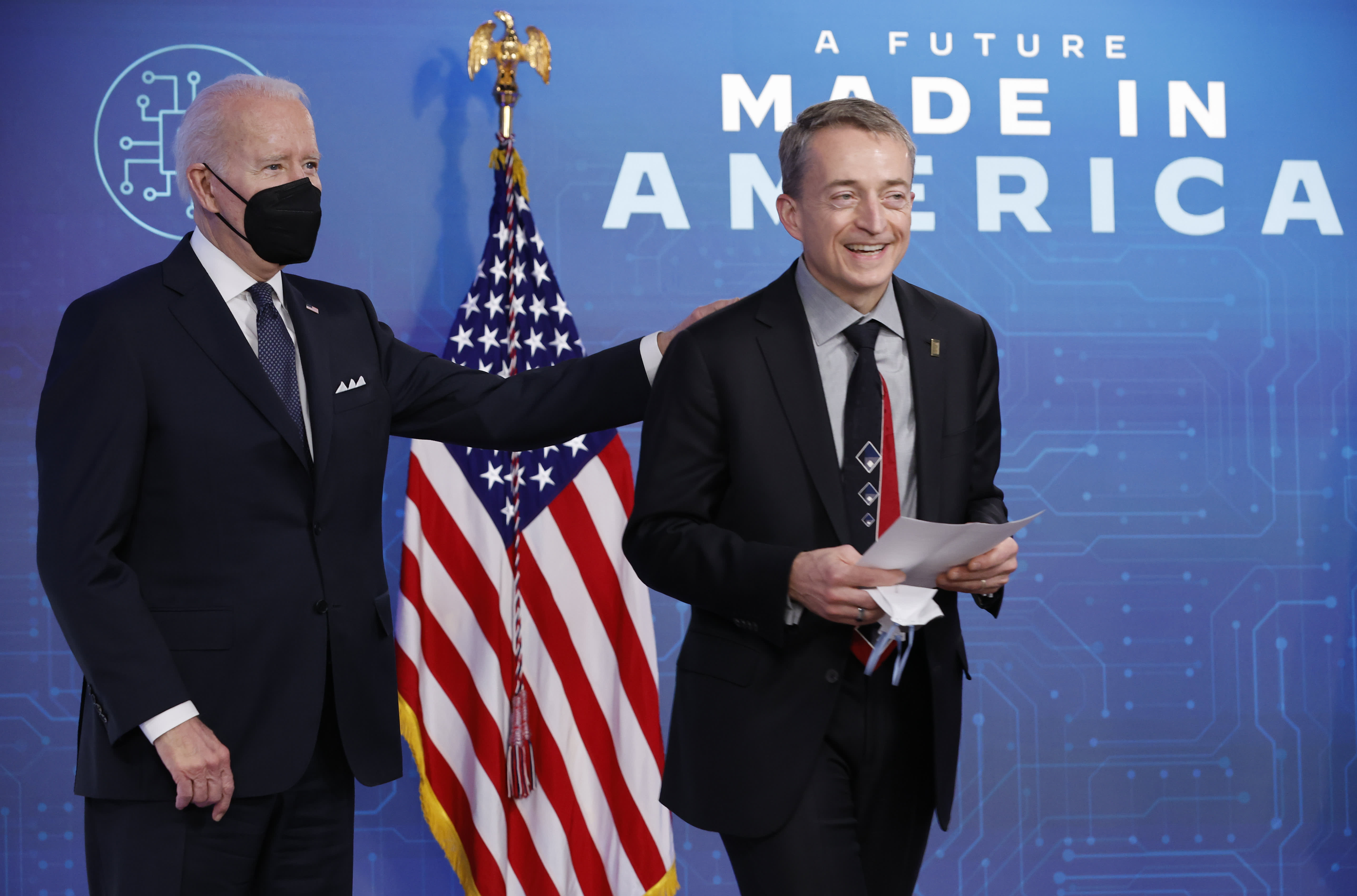

The ultimate size of the Ohio complex is linked to legislation that would result in $52 billion in subsidy funding for semiconductor companies. Intel could spend as much as $100 billion if subsidies are approved. Gelsinger appeared at an event with President Biden last week to encourage Congress to pass legislation to authorize the bill’s full funding.

The Ohio investment follows plans announced last year to spend $20 billion expanding an existing facility in Arizona.

In February, Intel will present a broader overview of its strategy and technology roadmap to investors, who are closely watching Intel’s operating margins as it invests in additional production capacity. Gelsinger said Intel will also present technical roadmaps for its consumer and data center chips.

Intel raised its quarterly cash dividend 5% to $0.365 per share.