RyanJLane

One of the most common sayings that I have heard is, ‘may we be cursed to live in interesting times’. And these most certainly are interesting times. This is true on a macro scale. But it’s also true when talking about individual investment opportunities. As an example, we need only look at International Game Technology (NYSE:IGT), a company that operates as a global leader in gaming that focuses on lotteries, gaming machines, sports betting, and even digital gaming. In June of 2023, I wrote an article about the company wherein I took a very bullish stance. In a rare move, I even rated it a ‘strong buy’ to reflect my belief that it represented one of the best investment opportunities currently on the market. As you might recall from an article that I published earlier this year, the ‘strong buy’ prospects that I tend to pick out typically outperform the market rather meaningfully.

Unfortunately, International Game Technology has so far been the exception. With some weakness on the bottom line for its latest fiscal year, combined with a move lower following an announcement toward the end of last month that the company would be spinning off some of its operations and merging them with Everi Holdings (EVRI), a firm that itself offers gaming machines, various gaming services, and a variety of financial tech products and services, shares are now down 30.7% at a time when the S&P 500 is up 21.6%.

As painful as this movement has been, the data provided by management suggests that the long-term outlook for the business is still positive. If we assume that the company is correct regarding what the picture will look like following this major transaction, then shares still look to be trading on the cheap. Given these factors, I do believe that the ‘strong buy’ rating I assigned the stock previously is still logical.

A look at International Game Technology today

Before I get into the details of the transaction between International Game Technology and Everi, I think it would be helpful to look at the most recent data provided by management regarding the firm’s health. The best way to do this is to look at the 2023 fiscal year in its entirety relative to 2022. After all, when I last wrote about the firm, we only had data covering through the first quarter of the 2023 fiscal year.

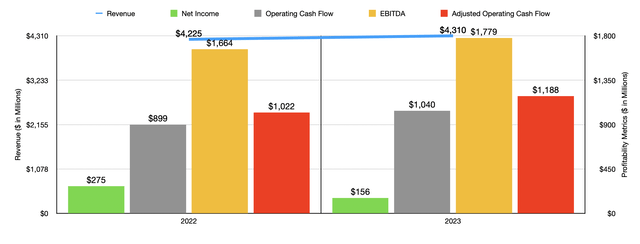

Author – SEC EDGAR Data

For 2023 and its entirety, the picture was not bad. But it wasn’t exactly great. Take revenue as an example. Overall sales came in at $4.31 billion. That represents an increase of only 2% compared to the $4.23 billion generated one year earlier. This growth was driven by a couple of different factors. For starters, under the Global Gaming segment, service revenue expanded by 6.7% from $714 million to $762 million. Product sales, meanwhile, grew by 11.6% from $709 million to $791 million. These two items go hand in hand. The more products, or machines, that the company sells, the more service revenue that can ultimately be generated in the form of terminal services, systems, software, and more. Thanks to selling 35,090 machines, up from 32,820 one year earlier, the product sales increased. A 5% higher global average selling price also contributed to some of that upside. And as the total installed base for the company expanded from 49,586 to 53,906, the amount of revenue generated by services dedicated to those machines also grew.

Management also reported service revenue growth associated with the PlayDigital operations of the business. Revenue increased by 8.6% from $209 million to $227 million. $15 million of this came from the company’s acquisition of iSoftBet, while the rest was driven by expansion of legacy operations into new jurisdictions and growth in markets in which the firm already operates. There was, of course, some weakness. While product sales under the Global Lottery segment grew from $157 million to $171 million because of higher terminal deliveries throughout North America and the extension of a multiyear central system software license in Switzerland, on top of some other operations in Poland and the UK, service revenue actually fell by 3.2% from $2.44 billion to $2.36 billion. This was because of a plunge in systems, software, and other revenue from $255 million to $53 million. And according to management, this was the result of the firm’s decision to sell its Italian Commercial Services business back in September of 2022. If we exclude this from the equation, overall revenue for the business would have expanded by $287 million from 2022 to 2023 instead of the $85 million ultimately experienced.

Although we did get to see an increase in revenue, profits for the business took a hit. Net income fell from $275 million in 2022 to $156 million last year. There were multiple differences from one year to the next that this can be blamed on. For instance, the firm’s foreign exchange loss grew from $36 million to $75 million. It also experienced $24 million in separation and divestiture costs, on top of $7 million of additional restructuring expenses. But the biggest problem was an 84% increase in income taxes from $175 million to $322 million. Without this, profits would have risen year over year. Other profitability metrics were actually quite positive. Operating cash flow went from $899 million to $1.04 billion. If we adjust for changes in working capital, the rise was from $1.02 billion to $1.19 billion. And lastly, EBITDA for the firm grew from $1.66 billion to $1.78 billion.

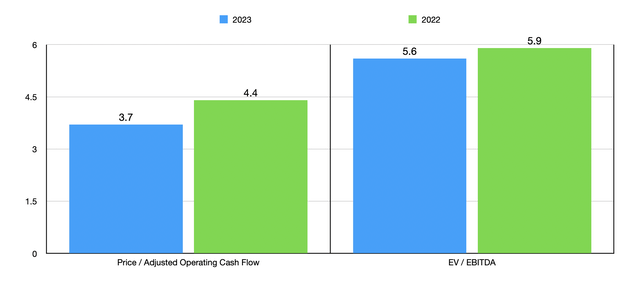

Author – SEC EDGAR Data

When it comes to the 2024 fiscal year in its entirety, management anticipates revenue of between $4.3 billion and $4.4 billion. Even though the company is forecasting about 300 basis points of pain associated with separation and divestiture costs leading up to the aforementioned merger of some of its assets with Everi, overall operating cash flow is still expected to be north of $1 billion. Given the complications associated with this transaction, it probably is best to just value the company using data from 2023. As you can see in the chart above, the company is trading at a price to adjusted operating cash flow multiple of 3.7. That’s an improvement over the 4.4 reading that we get using data from 2022. The EV to EBITDA multiple, meanwhile, should improve from 5.9 using data from 2022 to 5.6 using data from last year. No matter how you stack it, these are very attractive numbers.

An interesting transaction

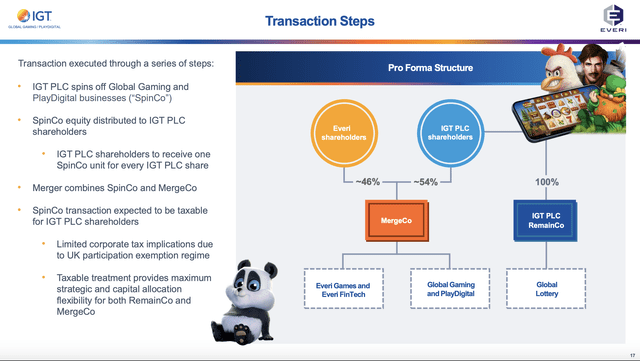

While management seems confident in their guidance for 2024, the picture for the business looks destined to change in the long run. This is because of an announcement made on February 29th of this year. The management team at International Game Technology struck a deal with Everi whereby International Game Technology will spin off its Global Gaming and PlayDigital operations into a separate company that will then merge with Everi in an all-stock transaction. Shareholders of International Game Technology will end up with a 54% ownership stake in the combined firm, while also retaining their current ownership in International Game Technology.

International Game Technology

It appears as though investors in both Everi and International Game Technology are unhappy with this maneuver. I say this because shares of the former are down 21.7% since the announcement was made, while shares of the latter are down 20.7%. There are probably 2 reasons behind this. First and foremost, the new combined firm is expected to take on about $2.7 billion of additional debt. Around $100 million of this will cover financing fees, while the rest will be used as a payment that is made to International Game Technology. Total financing will actually be larger than this at $3.7 billion, plus a $500 million revolver. But the revolver will likely remain untouched for a time, while the other $1 billion being financed will be used to refinance existing debt that Everi has outstanding. So on a net basis, that cancels out. The second likely reason, in addition to the additional debt being brought on, involves the fact that this is a taxable spin-off for shareholders of International Game Technology. My goal here is not to get into the tax side of the equation because each person has a different tax situation. But generally speaking, those who have seen the greatest upside in International Game Technology over the years will face the largest tax bill.

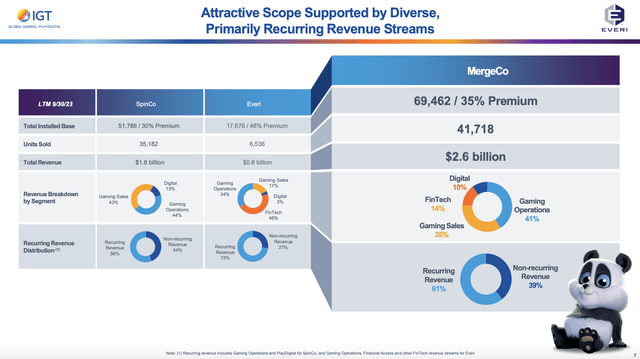

International Game Technology

The new, combined company will have an enterprise value, using data from the day that the transaction was announced, of about $6.2 billion. $4 billion of that involves the assets being spun off by International Game Technology. Management expects the combined business to generate around $2.6 billion in revenue and at least $1 billion annually in EBITDA. Roughly 41% of all sales generated by that business will come from gaming operations, while another 35% will involve gaming sales. The remaining 24% will be split between the financial technology operations currently owned by Everi and by the digital operations under the PlayDigital name. About 61% of all revenue for the combined business will be recurring in nature. This is great to see since recurring revenue adds stability to any business.

International Game Technology

There are plenty of opportunities to capture value from this transaction. For starters, both International Game Technology and Everi own different gaming brands. As you can see in the image above, this maneuver will allow them to bring these together. This is likely going to result in some cost savings. Speaking of which, management believes that annualized synergies of $85 million can be captured by this transaction. $10 million of it will fall under the capital expenditure category, while the remainder will come from traditional operational costs. This includes, but it is not limited to, improvements in the supply chain, the divestiture of certain real estate, and more. They do think that it will take about 3 years to capture the $75 million in profit and loss improvements.

If all goes according to plan, the expectation is that the firm can get some rather attractive growth as time goes on. They are forecasting mid single digit revenue growth, on an annualized basis, from now through 2026. But they do think that on the bottom line, EBITDA growth will be in the high single digit range. If we define adjusted operating cash flow has EBITDA less capital expenditures, which is what management has done for the purpose of its investor presentation, we are looking at about $800 million or more in adjusted operating cash flow by 2026.

Naturally, this will leave International Game Technology as a standalone global lottery company. The benefit to this is that the company will be able to focus on what it does best. That should definitely be value accretive. I say this because, even using data from 2023, International Game Technology’s Global Lottery operations generated revenue of $2.53 billion and segment profits of $913 million. Its EBITDA for the same window of time was $1.32 billion. Between growth and the prospect of debt being paid down, some of these numbers should improve. As an example, let’s look at the current debt the business has. International Game Technology as a whole has $4.93 billion in net debt. After factoring in around $400 million in various expenses associated with this major transaction, the firm will receive $2.2 billion in cash following the spin-off. The fixed interest rate on the death that it has today ranges between 2.375% and 6.50% per annum. The enterprise has about $1.57 billion worth of variable rate debt in the form of term loans and credit facilities. That’s included in the aforementioned net debt figure. However, none of it is currently above 6.50%. If we assume that management pays down debt with a weighted average rate of about 6%, that will reduce annual interest costs by $132 million. Of course, the business does lose the tax shield associated with this. But that’s likely small price to pay in the grand scheme of things.

Author – SEC EDGAR Data

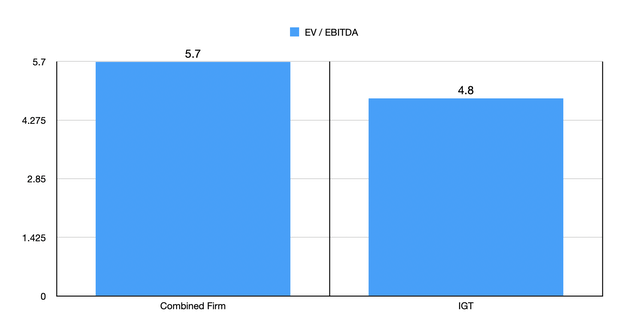

Because there is a lot of uncertainty regarding what exactly the debt profile of the firms will look like and because of the historical volatility associated with the tax rate the company pays, it’s really impractical to perform any sort of analysis valuing the two firms as standalone enterprises from a price to operating cash flow perspective. But it is fairly easy to value them using the EV to EBITDA approach. Based on my own calculations, and using current values for the companies, the new combined firm should be trading at an EV to EBITDA multiple of approximately 5.7, while International Game Technology on its own should be trading at an EV to EBITDA multiple of 4.6. This assumes that no synergies are captured. If they are, the picture will look even more appealing.

Takeaway

Based on the data provided, I have to say that International Game Technology still looks to be a very solid opportunity in my book. Shares are cheap, whether we assume the transaction will be completed as planned or not. The transaction does open up some interesting opportunities. But at the same time, there is some uncertainty involving the picture. Investors are not wrong to be frustrated about the taxable nature of the spinoff. And it’s possible that they are also on edge because of the increased debt that’s coming into the picture. But when you look at how cheap shares of both businesses are, and you consider that they should only grow from here, it’s difficult to be terribly pessimistic. Because of this, I have decided to reiterate the ‘strong buy’ rating I assigned the stock previously.