What happens if COVID-19, unrest and hyped valuations collide?

Yesterday’s earnings deluge made plain that tech shares are not rocketing higher as 2020 comes to a close. Indeed, in pre-market trading this morning, Microsoft, Apple, Facebook and Amazon are all down.

Alphabet is the only member of the Big Five that is worth more today than yesterday. Strong advertising and cloud results helped the search giant post a return-to-form quarter. But in most other reports there were signs of weakness or underperformance compared to expectations that could undermine the relentlessly bullish attitude tech shares have enjoyed for several months.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

The tailwinds that lifted much of tech this year remain. Every CEO I speak to still thinks that the COVID-19 bump to digital services demand has room to run, and that the digital transformation’s acceleration that has been a regular point of optimism for VCs, founders and public company leaders, will continue.

But that doesn’t mean all tech companies will benefit or post outsize results. Those facts don’t imply that pandemic-induced friction won’t add up.

But that doesn’t mean all tech companies will benefit or post outsize results. Those facts don’t imply that pandemic-induced friction won’t add up.

It’s not only the biggest companies that are treading water. We’re seeing valuations pause in tech’s hottest category — SaaS and cloud — despite continued growth in its constituent companies. The combined sentiment-and-share change could dampen enthusiasm for startup shares, perhaps undercutting some of the hype and FOMO that we keep hearing is driving private valuations higher.

Are we seeing a change in tech’s temperature while the weather changes? Let’s take a look.

Good news, bad news

Starting with the biggest tech companies, Alphabet’s results were pretty good. The company’s YouTube and cloud segments outperformed expectations, helping the company best expectations.

From there, things get choppier. Apple beat expectations, but its shares fell after investors were less than impressed with its aggregate results. Microsoft posted good calendar Q3 earnings including strong Azure performance, but its guidance left investors underwhelmed and its shares also fell. Facebook beat expectations in the quarter, but rising costs seemed to dampen investor sentiment. It lost a little ground after earnings. Amazon’s Q3 was hot, but its Q4 should reduce operating income due to COVID-19 costs. It also lost ground after reporting.

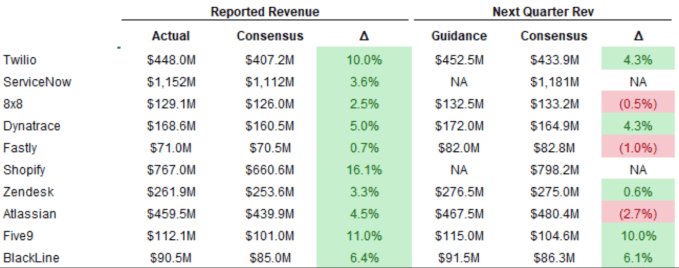

From that malaise we turn to the SaaS and cloud world. Redpoint’s Jamin Ball is doing his usual roundups, one of which we’re borrowing this morning. Here’s his digest of SaaS and cloud earnings thus far:

Takeaways? Every SaaS and cloud company crushed Q3, but Q4 is looking a bit more dicey. Beats look slim, some companies are declining to project, and aside from an outlier or twom the numbers look slimmer overall.