JoomPay, a startup with a similar product to PayPayl-owned Venmo in the US, is set to launch in Europe shortly after being granted a Luxembourg Electronic Money Institution (EMI) license. The app allows people to send and receive money with anyone, instantly and for free. “Venmo me” has become a common phrase in the US, where people use it to split bills in restaurants or similar. Venmo is in common use in the US, but it’s not available in Europe, although dozens of other innovative mobile peer to peer transfer options exist, such as Revolut, N26, Monese and Monzo. The waitlist for the app’s beta is open now (iOS, Android).

Europe leads the world’s instant payments industry, with $18 trillion in worldwide volume predicted by 2025 up from $3 trillion in 2020 – a growth of over 500%. Western Europe – and COVID-19 – is now driving that innovation and will account for 38% of instant payment transaction value by 2025. While Europe lacks simple peer-to-peer payments solutions such as Venmo or Square Cash App in the US, challenger banks have stepped up to provide similar kinds of services. JoomPay’s opportunity lies in being able to be a middle-man between these various banking systems.

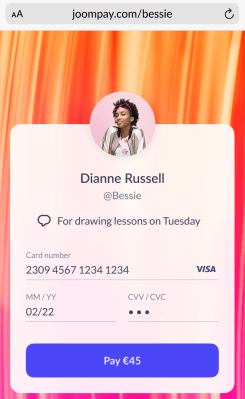

Shopping app Joom, which has been downloaded 150M times in Europe, has spun-off JoomPay to solve this problem. The app allows users to send and receive money from any person, regardless of whether they use JoomPay or not – and you only need to know their email or the phone number. JoomPay connects to any existing debit/credit card or a bank account. It also provides its users with a European IBAN and an optional free JoomPay card with cashback and bonuses.

Yuri Alekseev, CEO and co-founder of JoomPay, said: “Since COVID-19 started, we’ve seen a significant decline in cash usage. People can’t meet as easily as before but still need to send money, and we offer a viable alternative.”

JoomPay may have an uphill struggle. Its main competitors in Europe are the huge TransferWise, Paysend, and of course PayPal itself.