SUMMARY

Thirteen of the 19 new-age tech stocks under Inc42’s coverage gained in a range of 0.7% to 9% during the week, with Nykaa emerging as the biggest winner

Six tech stocks fell during the week in a range of 0.2% and 3.3% on the BSE, with Zaggle being the biggest loser.

Nifty50 gained 0.33% during the week to close at 22,096.75, while Sensex rose 0.26% to end at 72,831.94 on Friday (March 22)

After a few weeks of significant downfall, Indian new-age tech stocks staged a recovery this week, partially helped by stock-specific actions and the broader market recovery.

Thirteen of the 19 new-age tech stocks under Inc42’s coverage gained in a range of 0.7% to 9% during the week, with Nykaa emerging as the biggest winner.

Shares of Paytm, which have been seeing severe volatility since the beginning of February, also witnessed a strong uptrend this week and gained 8.5% on the BSE.

Zomato, Yatra, PB Fintech, Delhivery, Nazara, and DroneAcharya were among the other gainers this week.

Meanwhile, six tech stocks fell during the week in a range of 0.2% and 3.3% on the BSE, with Zaggle being the biggest loser.

In the broader market, the benchmark indices were volatile but rallied sharply in the last two trading sessions, as the US and UK central banks kept the interest rates unchanged. Nifty50 gained 0.33% during the week to close at 22,096.75, while Sensex rose 0.26% to end at 72,831.94 on Friday (March 22).

Siddhartha Khemka, head of retail research at Motilal Oswal, said, “Next week being a truncated week and the derivatives’ monthly expiry, we might see some volatility while Nifty is likely to consolidate at higher levels.”

Meanwhile, Vinod Nair, head of research at Geojit Financial Services, said that concerns persist regarding inflated valuations of the mid and small-cap stocks. However, large caps are expected to outperform in the medium term.

Amid the ongoing IPO frenzy, the public issues of two new-age tech companies will open next week for listing on NSE Emerge. While fintech SaaS company Trust Fintech Limited’s IPO will open on March 26, TAC Security’s IPO will open on March 27.

The stock market will remain closed on Monday (March 25) on the occasion of Holi.

Now, let’s take a look at the performance of some of the new-age tech stocks this week.

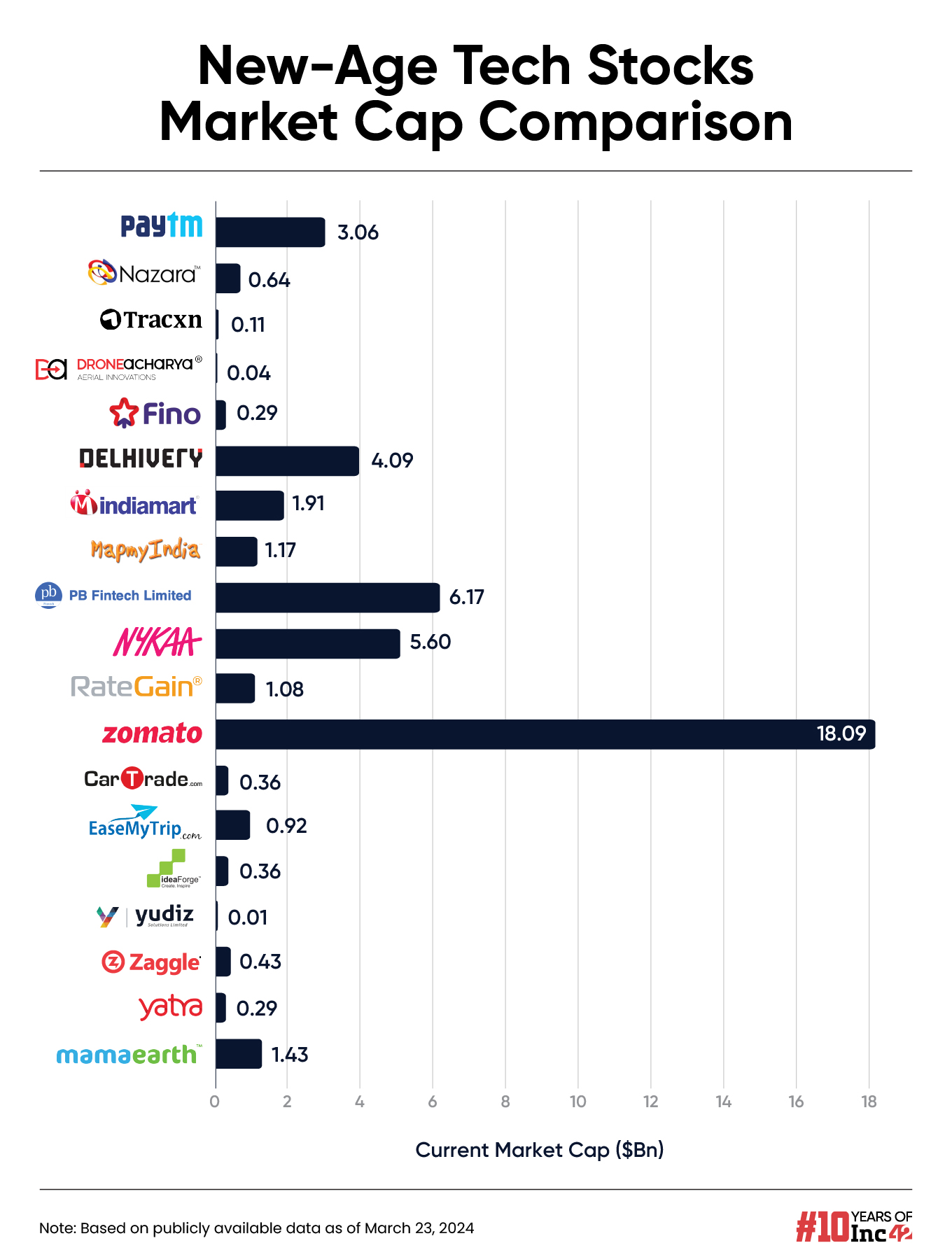

The total market capitalisation of the 19 new-age tech stocks under Inc42’s coverage stood at $46.05 Bn at the end of this week as against $43.74 Bn last week.

Zomato’s ‘Pure Veg Fleet’ Debate

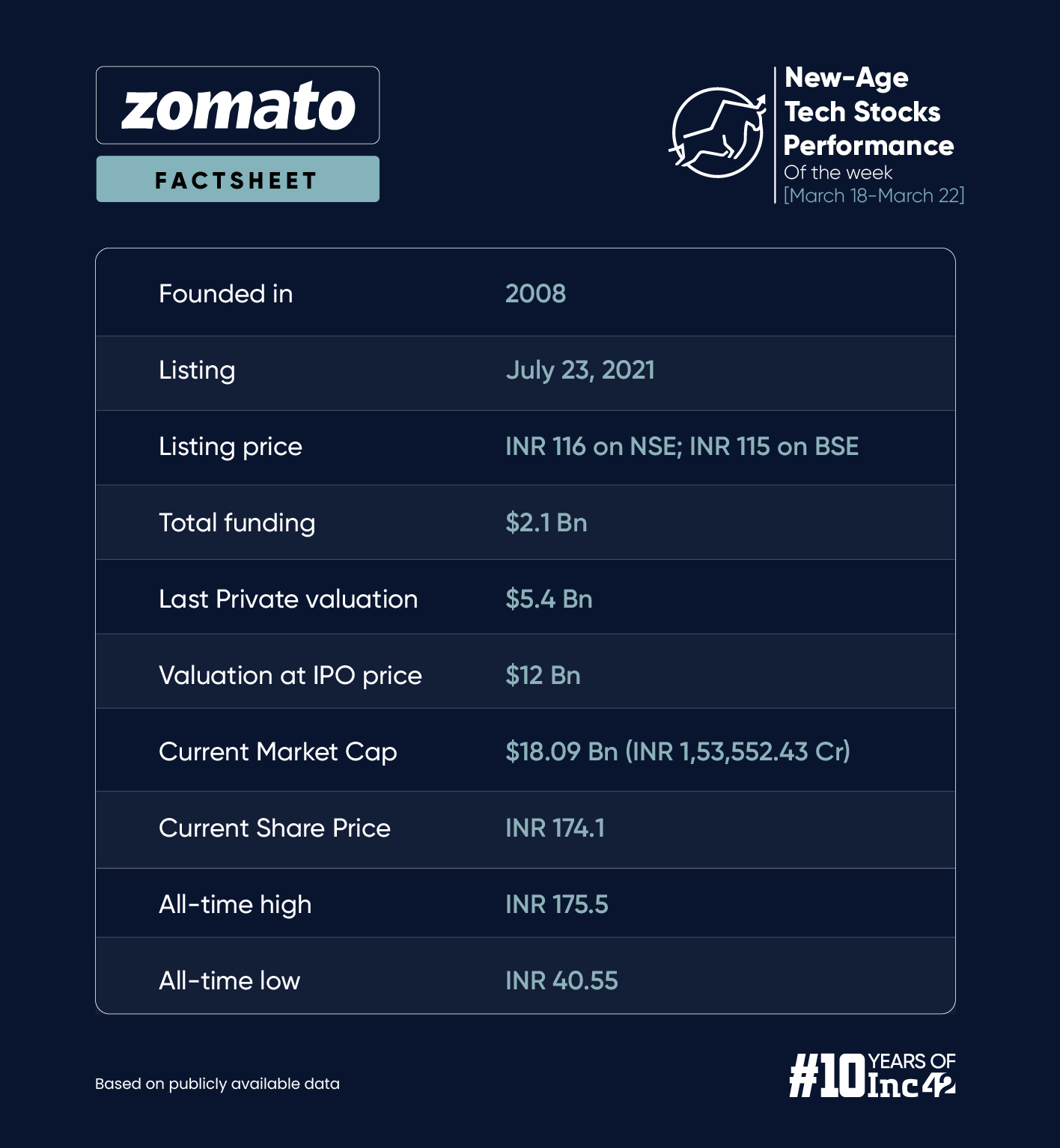

Share of food tech giant Zomato rallied 8.9% this week amid the launch of its ‘Pure Veg Fleet’ even as the company’s move faced backlash from some users.

In The News For

- Zomato founder and CEO Deepinder Goyal took to X on Tuesday (March 19) to announce the launch of a new delivery fleet called ‘Pure Veg Fleet’ and a new mode on its app called ‘Pure Veg Mode’ for customers with 100% vegetarian dietary preference.

- Following backlash, the company on the next day reversed its decision to introduce a green uniform for delivery partners designated for the new fleet.

Amid all these developments, shares of Zomato rallied over 10% in three consecutive trading sessions starting from Wednesday (March 20). Its shares ended the week at INR 174.1 on the BSE.

Meanwhile, it is also pertinent to note that earlier this week, brokerage Jefferies included Zomato in the list of its “top picks” for the next five years.

The brokerage sees a 2.5X upside in Zomato’s share price by March 2029, reaching the INR 400 mark.

“Low penetration levels in core segments offer a long runway to growth with both food delivery (19% GOV CAGR over FY24-30) and quick commerce (40% CAGR) expected to jump,” Jefferies said.

Zomato found its name alongside 10 other companies in the “top picks”, including Ambuja Cement, Axis Bank, JSW Energy, L&T, Max Healthcare, and SBI.

Shares of Zomato are currently trading almost 41% higher year to date.

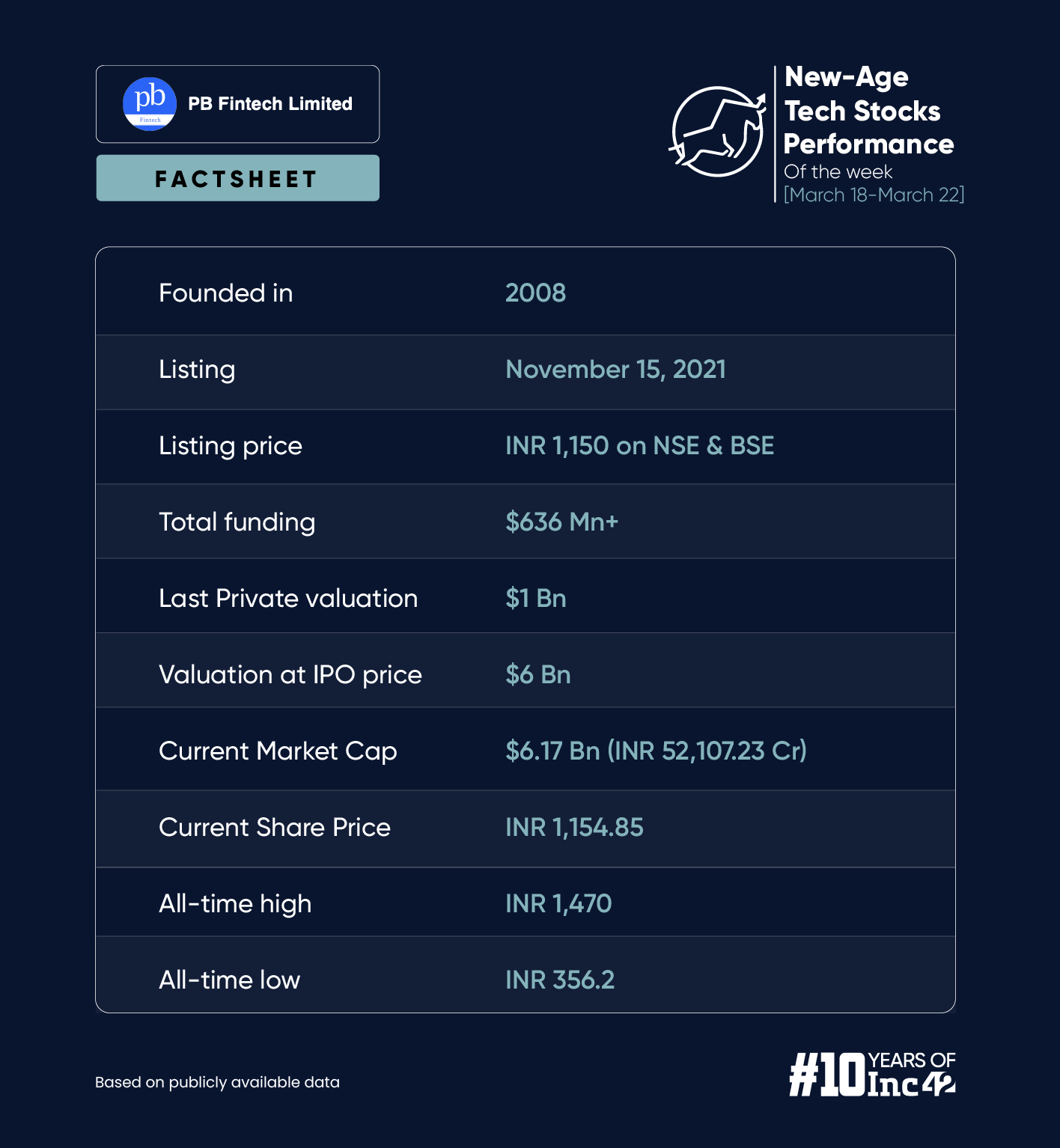

PB Fintech’s New Payment Aggregation Arm

Insurtech major Policybazaar’s parent entity PB Fintech announced this week its plans to incorporate a new wholly-owned subsidiary to enter the payment aggregation business.

The new subsidiary will have a proposed authorised share capital of INR 50 Cr and a proposed paid-up share capital of INR 27 Cr.

The announcement came weeks after PB Fintech said it was foraying into the reinsurance space.

Shares of PB Fintech rallied sharply following the announcement this week. Overall, the stock gained more than 5%, ending the week at INR 1,154.85 on the BSE.

Though the stock has seen some profit booking at higher levels this month, its growth trajectory remains steady. Overall, PB Fintech is trading over 45% higher year to date.

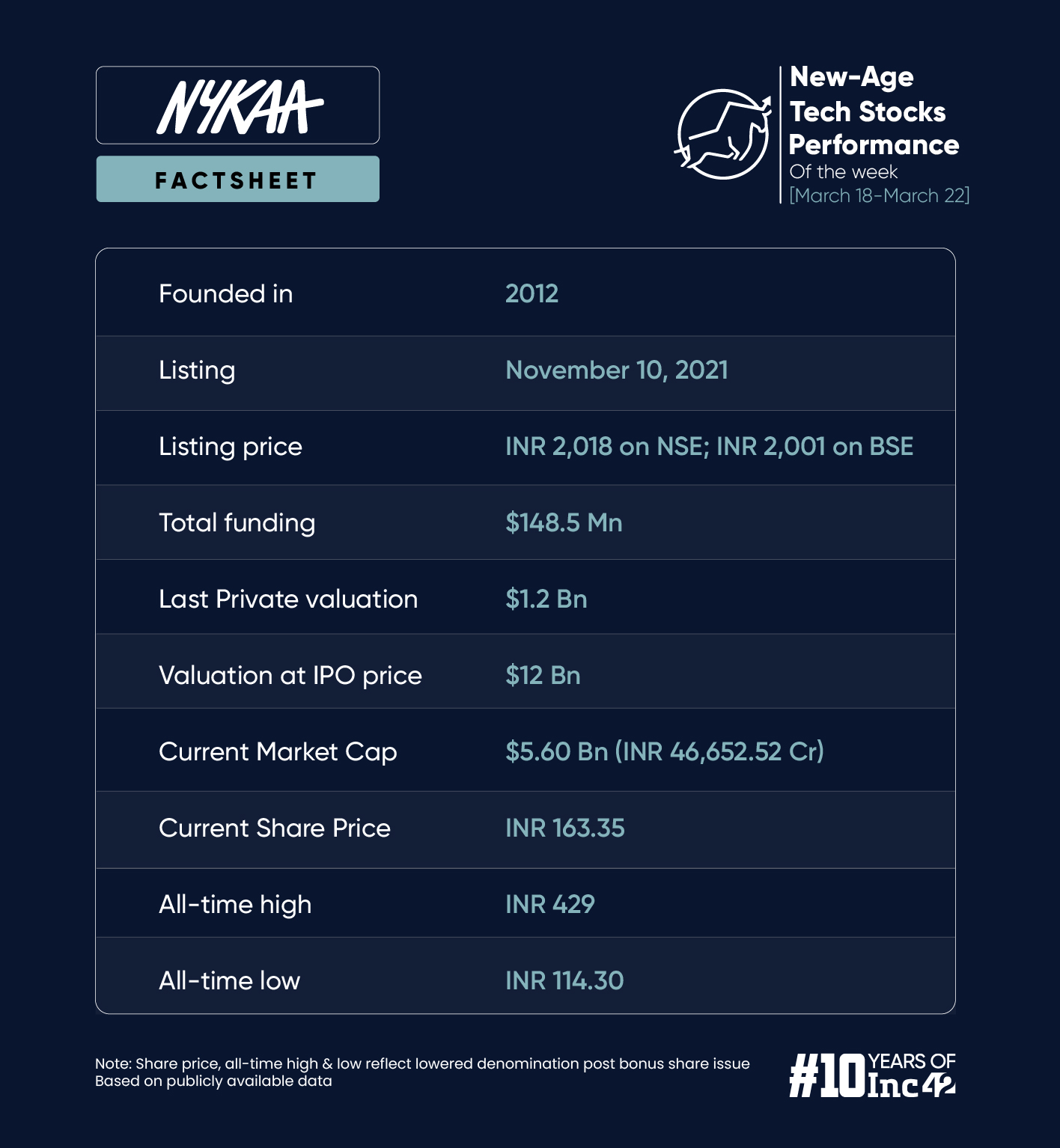

Nykaa Top Gainer

Reversing its recent trend of muted market performance, shares of Nykaa rallied almost 9% this week. The shares ended the last trading session at INR 163.35, a level last seen at the beginning of February.

Earlier this week, Nykaa founder and CEO Falguni Nayar addressed various topics, including rising competition in the beauty retail space, in an interview given to news agency PTI.

“I always say that let’s stay focused on the consumer and let’s give them far beyond the expectations so that consumers don’t have a reason to go to competition,” she said.

Meanwhile, HSBC reportedly said in a research note earlier this week that Nykaa shares are attractive post the 12% drop this year.

The company is among the top mid-cap picks of HSBC, along with seven others, including Prestige Estates, Phoenix Mills, Voltas, and Kalyan Jewellers.

“Post correction, Nykaa’s BPC business, which is structurally growing revenue at 20%-plus, trades at appealing valuations while the value in its fashion business is likely to be unlocked as it reaches EBITDA breakeven within the next two years,” HSBC reportedly said.

The brokerage retained its price target of INR 240 on the stock, which implies a 47% upside to its last close.