Nigeria based startup Autochek looks to bring the sales and servicing of cars in Africa online. The newly founded venture has closed a $3.4 million seed-round co-led by TLcom Capital and 4DX ventures toward that aim.

The raise comes fresh off of Autochek’s September acquisition of digital car sales marketplace Cheki in Nigeria and Ghana. It also follows the recent departure of Autochek CEO Etop Ikpe from Cars45 — the startup he co-founded in 2016, now owned by Amsterdam based OLX Group.

That’s a lot of news in a short-time for Ikpe. His new company will likely be in direct competition with his previous venture (also located in Nigeria). Still, the Nigerian entrepreneur — who built his early tech credentials at e-commerce startups DealDey and Konga — says Autochek is a new model.

“It’s different in the type of technology we’re building and that it’s asset light. I don’t have any inventory. I don’t buy cars. I don’t transact any [physical] cars. I don’t own any inspection locations. I don’t own any dealerships,” Ikpe told TechCrunch on a call from Lagos.

Autochek’s model, according to its CEO, is aimed at creating the digital infrastructure for a new system to better coordinate sales, servicing, and vehicle records of the car market in Nigeria and broader Africa.

Autochek CEO Etop Ikpe, Image Credit: Autochek

Ikpe characterizes that market as still largely informal and fragmented. “We’re basically focused on technology solutions to build the rails of [Africa’s] automotive sector to run on. We’re focusing on three foundations of the market: transactions and trading, maintenance, and financing,” he said.

Autochek’s platform — managed by a developer team in Lagos and Nairobi — is a network for consumers and businesses to buy cars, sell cars, service cars, and finance cars sales.

On the financing side, the startup launched with 10 bank partnerships in Nigeria and two in Ghana, according to Ikpe. Creating more financing options is both a big opportunity for the startup and consumers, he explained. “The used car market in Africa is a $45 billion a year market that has only a 5% financing penetration rate…so there’s huge upside for growth.”

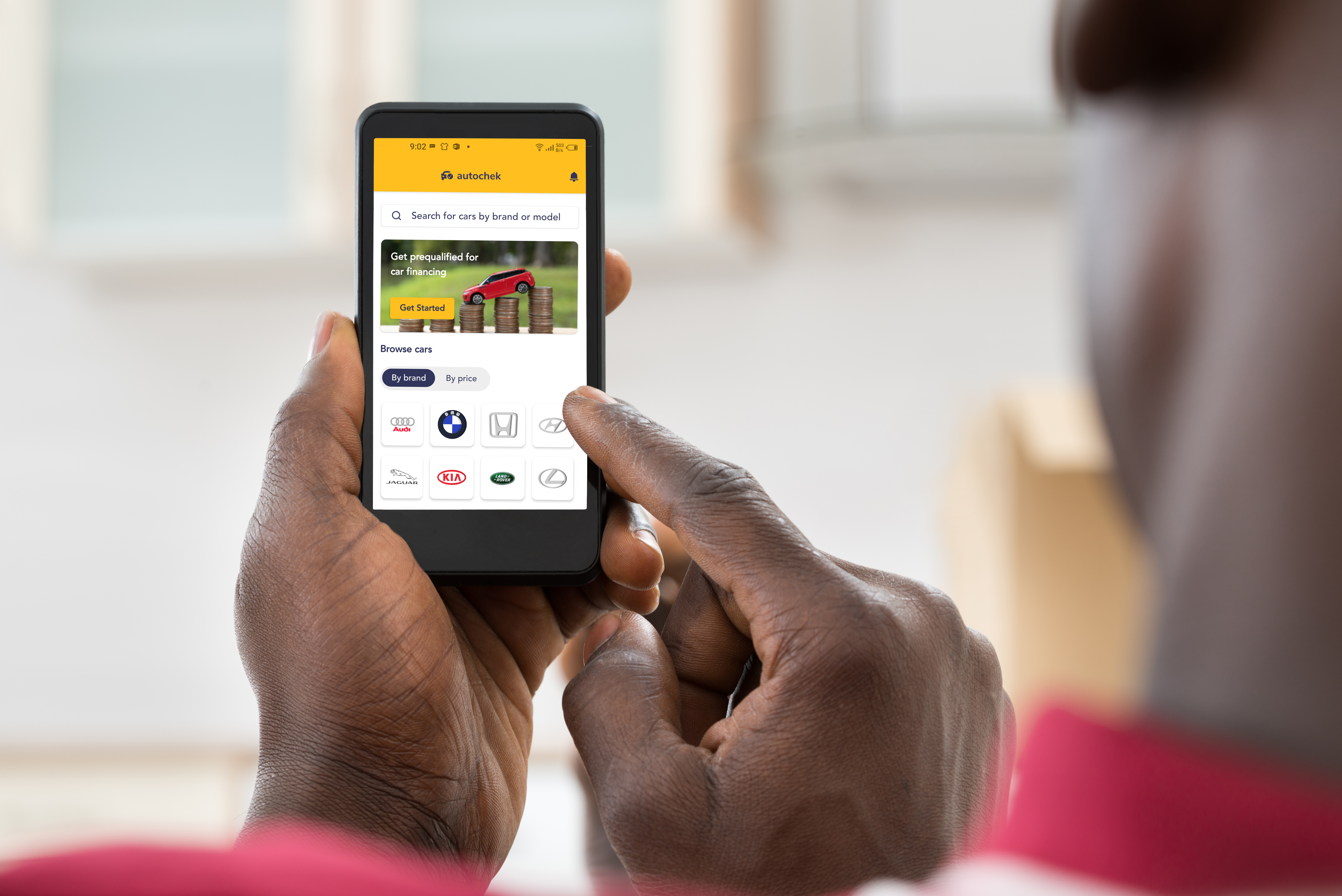

Image Credit: Autochek

Across its core product offerings, Autochek has created a network of partners and standards. The company generates revenues through fees charged on consumer transactions and commissions paid by dealers and service shops on the platform. Consumers can sign up and use the Autochek app for free.

On the sudden departure from his previous startup, Cars45, “I left because I wanted to build something else,” explained Ikpe. There’s been plenty of speculation in local tech press as to what happened, including reports of forced exits by investors. Ikpe declined to get into the details except to say, “I’ve resigned. I’ve moved on and I’m focused on doing what I’m doing right now.”

In addition to its operations in Nigeria — Africa’s most populous nation, largest economy and top VC destination — Autochek plans to use its seed-financing to expand services and geographic scope. The startup will add associated auto related services, such as insurance and blue book pricing products. Autochek is also eying possible entry in new countries such as Ivory Coast, Senegal, South Africa, Kenya, Egypt and Algeria. More M&A could also be in play. “Acquisitions are going to be a core part of our expansion strategy,” said Ikpe.

TLcom Capital Partner Andreata Muforo confirmed the fund’s co-lead on the $3.4 million seed round. Speaking to TechCrunch on a call from Nairobi, she named Autochek’s asset light model, Ikpe’s repeat founder status, and the fund’s view of auto sales and service as an underserved market in Africa as reasons for backing the venture. Golden Palm Investments, Lateral Capital, MSA Capital, and Kepple Africa Ventures also joined the investment round.

While fintech gains the majority of VC financing across Africa’s top tech hubs — such as Nigeria, Kenya and South Africa — mobility related startups operating on the continent have attracted notable support. Drone delivery venture Zipline and trucking logistics company Kobo360 have both received backing from Goldman Sachs. In 2019, FlexClub, a South African startup that matches investors and drivers to cars for ride-hailing services, used a $1.3 million round to expand to Mexico in partnership with Uber.