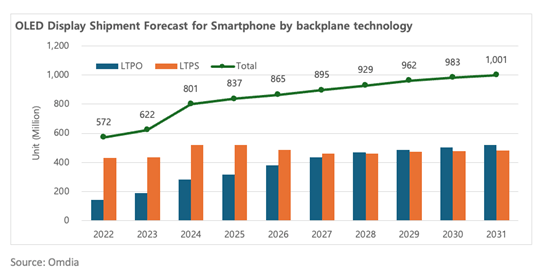

According to new market analysis by Omdia, the shipment volume of LTPO (Low-Temperature Polycrystalline Oxide) OLED displays for smartphones is projected to increase to 520 million units by 2031. During this period, the market share of LTPO OLED in smartphone OLED display shipments is expected to reach 52.0%, surpassing that of LTPS (Low-Temperature Polycrystalline Silicon) OLED.

The shipment volume of OLED displays for smartphones in 2024 is expected to grow by approximately 28.8% compared to 2023, surpassing 800 million units, and is projected to exceed 1 billion units annually by 2031. While the compound annual growth rate (CAGR) for LTPS OLED shipments is anticipated to be around -1.0%, LTPO OLED shipments are expected to grow at a CAGR of approximately 8.0%.

Jerry Kang, Research Manager at Omdia, responsible for OLED and emerging display market analysis, stated, “LTPO OLED has the advantage of lower leakage current compared to LTPS OLED, enabling low-power operation of displays at refresh rates below 30Hz. As a result, smartphone brands are increasingly adopting LTPO OLED as a method to reduce power consumption of their devices.”

Before 2020, almost all OLED displays used in smartphones applied LTPS driving circuits. However, after Samsung Electronics first applied LTPO driving circuits to the OLED display of the Galaxy Note 20 Ultra (2020), LTPO OLED has been adopted in various flagship smartphones such as the Apple iPhone 13 Pro/Pro Max (2021), Google Pixel 7 Pro (2022), Motorola Razr (2023), and Huawei Mate X5 (2024). Additionally, the application of LTPO OLED is expanding beyond smartphones to smartwatches and tablet PCs, leading panel manufacturers to develop various types of LTPO driving circuits tailored to the characteristics of different OLED products.

Jerry Kang noted, “As generative AI-related features are more frequently incorporated into smartphones, efficient power management of mobile devices is becoming crucial. Smartphone brands are expected to continuously seek enhancements in the brightness and resolution of OLED displays while also requiring that these improvements do not significantly raise power consumption.”

Omdia forecasts that panel manufacturers will adopt the LTPO driving method to the majority of the new investments in small and medium-sized OLED supply capacity (6th generation and below) and will also convert a significant portion of the existing LTPS OLED supply capacity to LTPO OLED. When investing in large OLED production capacities (7th generation and above) for products such as tablet PCs and laptop PCs, the advantages and disadvantages of LTPO and Oxide driving methods in terms of performance, productivity, and investment cost will be emphasized, leading to competition over the next three to four years.