According to new analysis from Omdia, 365 million subscription video on demand (SVOD) subscriptions will be distributed through operator TV, broadband and mobile bundles, representing 20% of the global streaming market. By 2029, bundling is expected to generate 540 million online video streaming subscriptions, or 25% of the global market.

Omdia has completed a significant extension of its global TV & video market data and forecasts, quantifying the size of telco bundling for popular streaming services from 2024 to 2029. This latest analysis is based on 2,000 live telco and online video distribution partnerships worldwide, at the end of 2024.

In mature markets, growth for direct-to-consumer (D2C) subscriptions is expected to decelerate and eventually decline as more customers shift towards operator bundles for TV and video. In key streaming markets such as the US and UK, the rise of bundling will negatively impact the D2C segment, leading to a year-on-year decline. As a result, bundling will be a key driver of future growth for SVOD.

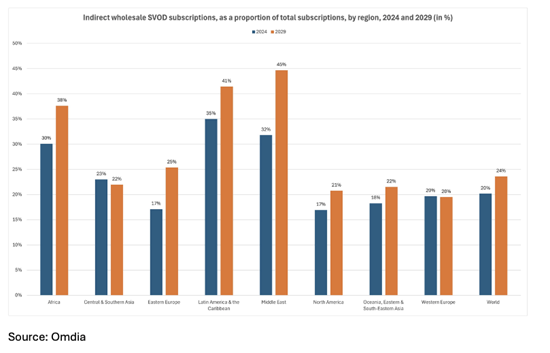

In developing markets, SVOD bundles will be crucial for driving the uptake of premium online video services. Omdia’s new 2029 forecast indicates that more than half of all SVOD subscriptions will be bundled in markets such as Brazil, Mexico, and South Africa. During the forecast period, some regions, such as the Middle East, will experience online video growth solely from telco wholesale arrangements, leading to D2C subscriptions declining at the regional level.

Bundles will add an average of 40 million new subscriptions annually up to 2029, according to Omdia’s latest analysis. However, in the context of a global SVOD subscriptions market exceeding 2 billion by that year, telco bundling will remain a complementary distribution channel for streaming. It is unlikely to ever replace or overtake D2C as the primary method of acquiring new customers for streaming services. This is due telco bundling only partially meeting the public’s demand for a fully integrated streaming platform.

Tony Gunnarsson, Principal Analyst in Omdia’s TV & Video team, said: “Consumer research reveals worrying levels of frustration with modern streaming services. There are too many options, yet customers struggle to find the right content. The global TV and video industry has collectively failed to create a common platform that allows customers to access multiple streaming services in one bundle with a single monthly bill. Historically, this is the role that pay-TV served. However, with the rise of Netflix and Amazon along with other popular streaming services such as Disney+, Max or Paramount+, customers face a hopelessly fragmented entertainment marketplace.”

In the current landscape, Omdia’s research indicates that the primary driver for SVOD through to 2029, will be the introduction, expansion, and refinement of hybrid ad-supported tiers on major global streaming services. While telco bundling of third-party SVOD services has become a common feature for customers worldwide, Omdia’s new analysis shows that D2C models are set to retain the lion’s share of streaming subscriptions for the foreseeable future.

Gunnarsson added:” Telcos are alleviating some customer frustration by aggregating streaming services through existing TV, broadband and mobile offerings. However, our latest analysis suggests is that operator bundling of SVOD won’t address the fundamental challenges facing D2C. The TV and video industry must unite to tackle the issues of bundling and aggregation of streaming for customers; otherwise, we risk losing them to free alternatives, or worse, experiencing a resurgence of widespread piracy.”