One in three respondents to our survey is intending to cut spending by 20% when making their next smartphone purchase, according to our latest Consumer Lens study. The economic activities of all major countries have been severely impacted by the COVID-19 crisis. With coronavirus cases surpassing 8 million globally in June 2020 and the new confirmed cases continuing to rise, all major markets saw a significant reduction in consumer spending. This will likely lead to negative smartphone sales growth globally in 2020.

To better understand consumer intentions in the smartphone market, we conducted a Global Consumer Lens study across seven major smartphone markets (USA, UK, India, France, Germany, Spain, Italy). According to the results, almost half of the respondents are expecting to delay their next purchase. Respondents planning to wait before buying are the highest in India (61%). We found a similar intention in Spain and Italy where 58% and 56% of respondents, respectively, planned to wait longer before replacing their smartphones. In the USA, the number intending to delay buying was 41%. Germany had the fewest respondents planning to delay purchasing (34%).

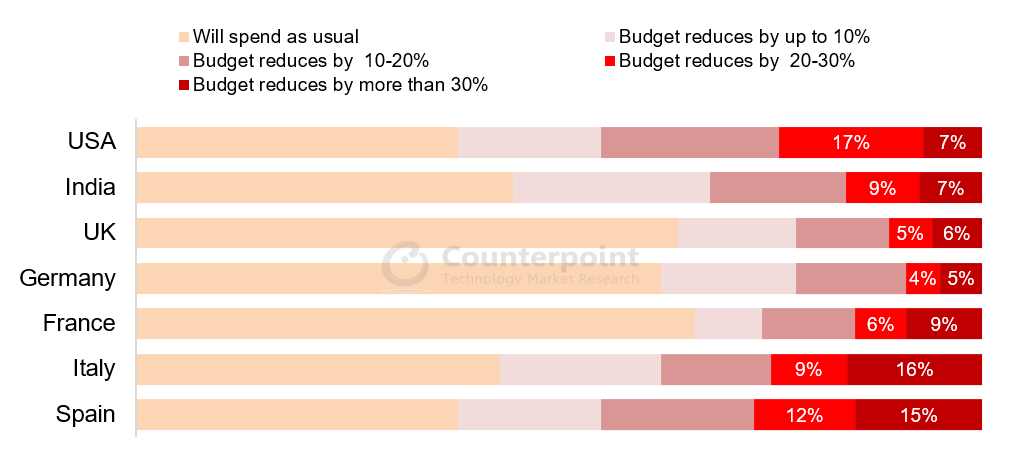

Commenting on consumer purchase intentions, Senior Analyst, Pavel Naiya, said, “The coronavirus outbreak and future income uncertainty has affected consumer behavior with many strictly limiting purchasing to only the essentials. Smartphone consumers from Spain and Italy are the most affected. Consumers intending to cut their future smartphone purchase budget by 20% or more are highest in Spain (27%) and Italy (25%), followed by the USA (24%). Looking at the current circumstances, we expect this trend will continue until mid-2021.”

Exhibit I: Future Spending Intention on Purchasing of Smartphone

To maintain social distancing, two-thirds of the respondents in India and more than half the respondents in Italy and the USA are looking for a ‘low touch’ sales channels. This will likely lead to more online ordering with home delivery and online ordering but collecting in-store also known as online-to-offline (O2O), or click-and-collect.

Commenting on the various approaches being taken by manufacturers, Research Associate, Arushi Chawla said, “We have seen many initiatives taking place in developing countries like India in the early phase of the lockdown period. Xiaomi started the Mi Commerce web app to connect consumers with the nearest retail store. Samsung has strategically partnered with Benow to help retailers register their inventory on its platform. Vivo’s Smart Retail, where customers can send their product related queries to retailers through SMS and reach out to the e-store (shop.vivo.com) or official Facebook page for order placing. Oppo customers can order deliveries or raise service requests on WhatsApp or via SMS.”

Ms. Chawla further added, “All O2O operations come with an overhead cost and additional expenses involved in the awareness-building campaign. It is hard on the bottom-line especially when most of these smartphone manufacturers are already operating on thin margins. Nonetheless, the coronavirus is here to stay, and top brands will look forward to creating long term strategic investments in making their distribution more agile.”

As the Wuhan region of China was the starting point of the COVID-19 pandemic, we explored consumer sentiment about smartphones manufactured in China. The anti-china sentiment is highest among Indian consumers. More than half of the respondents from India have a negative attitude towards Made-in-China products or Chinese smartphone brands. Around four in ten respondents said that they will not buy Made-in-China products or smartphones from Chinese brands. We believe the recent conflict on the India-China Line of Actual Control (LAC) will play a profound role in shaping this behavior. (Note: this survey was conducted before the India-China faceoff at LAC in Galwan Valley). However, to counter this sentiment, many brands have recently initiated “Made in India” and nationalistic campaigns.

Similarly, about one-fifth of respondents from the USA preferred not to buy Made-in-China products. In the era of globalization, it is difficult to label a product as “Chinese” as its components are sourced across different regions.

Many tech giants including Apple are reported to diversify their manufacturing to other countries, for example, Vietnam, Thailand, India, etc. Though we believe, these manufacturing strategies are more about avoiding an over-dependence on the Chinese ecosystem than anti-China sentiment. Nevertheless, it will be an uphill task to set up similar ecosystems in other countries. It may be easy to diversify the assembling of parts but choosing the right supplier located in a geographical cluster with skilled labour requires long term strategic partnerships and investments.

Country-level Consumer Insights:

USA:

- Online is the fastest-growing channel in the USA. It is more popular among respondents who are not working and who are looking to buy LG, Sony, and is least popular among prospective Apple buyers.

- As a mature market, most users are already divided between iOS and Android. Brand loyalty for Samsung and Apple users are similar. Apple users are most satisfied with the iPhone camera while Samsung users are most satisfied with the Galaxy display.

- The importance of selfie camera increases in the last two years, most likely because of new social media AR (Augmented Reality) features that use a selfie camera to create interactive content. More recently, video calls being a major part of daily routines have further accentuated the importance of good front-facing cameras.

UK:

- Two-thirds of UK consumers are considering buying a smartphone according to their usual plan. Only 11% are planning to cut their budget by 20% or more.

- 43% of the survey respondents are considering replacing their device in the next year. Operator stores continue to be the preferred channel of purchase, followed by mass merchandise electronic stores.

- Close to 90% of respondents have no hesitation in buying Made-in-China products.

India:

- Half the respondents are intending to spend between USD135 – USD250 (INR10,000 – INR 20,000)

- More than half of the respondents intend to replace their devices in the next year.

- As a big proportion of users will wait for a longer period to replace their smartphone, it will push the average replacement cycle from the current 22 months to around 26 months.

- Online review articles are the top source of information followed by friends and family and technology-related YouTubers.

- About seven in ten respondents are interested in buying a separate smartphone for kids to help with their learning.