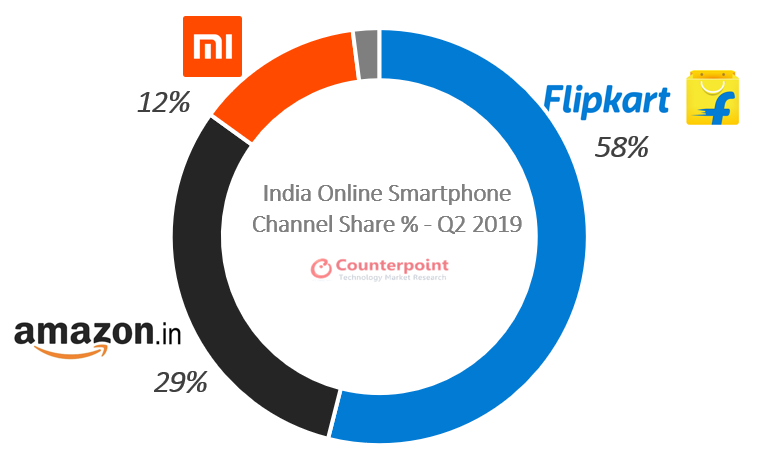

• Realme became the second-largest player in the online segment with 17% market share; Flipkart remains the leader in the online segment with a 58% share

• Amazon recorded highest ever shipments in the premium segment driven by OnePlus 7 series.

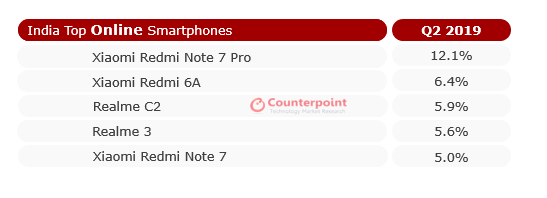

• Xiaomi Note 7 Pro was the best-selling device in the online segment in Q2 2019 ; Realme, Asus, Vivo, and OPPO were the fastest growing brands in the online segment

Smartphone shipments from the online channel in India grew 26% year-on-year (YoY) during Q2 2019, according to the latest research from Counterpoint’s Market Monitor service. New launches and multiple summer sale events drove the growth during the quarter.

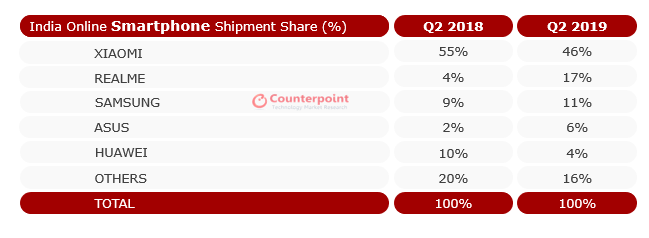

Commenting on the findings, Anshika Jain, Research Analyst stated, “The growth of Xiaomi and Realme and the focus of Samsung on online channels, with its Galaxy M-series, drove the shipments in the online segment. The success of these three brands also meant that the INR 15,000 to INR 20,000 (approx. US$210 – US$280) was the fastest-growing price band in the online segment. Xiaomi Note 7 Pro was the best performing model in this price band followed by the Realme 3 Pro.”

“The major e-commerce portals (Flipkart and Amazon) ran various summer sale campaigns and month-end discounts to promote their sales. Additionally, we saw that OEMs pushing their products towards their own online platforms (e.g., Mi.com, Realme) to divert some of the digital footfall to their own store. The upcoming quarter is crucial in terms of new launches, and lucrative offers as all the leading brands prefer to introduce their new products ahead of the festive season,” she added.

Commenting on the brand performance, Tarun Pathak, Associate Director, said, “The top five brands captured 84% share of the total online market. Brands and even channels are now diversifying their channel/platform strategy in a bid to increase their reach. For example, Amazon recently infused US$404 million in its India business and is also investing heavily in Future Retail group to strengthen its offline footprint in the Indian market.

Meanwhile, Xiaomi’s Mi.com has started to offer ‘Guaranteed Next-Day Delivery’ service in over 150 cities across India. Going forward, we estimate that the online market will get a strong push from all the major brands as they are gearing up for the upcoming festive season sale. Also, we expect online platforms to focus on targeting higher average selling price (ASP) models on their platforms rather than lower ASP devices to lure customers during the festive season sale.”

India Online Smartphone Market Share by Channel – Q2 2019

Source: Counterpoint Research Market Monitor Q2 2019

India Online Smartphone Top Brands Share – Q2 2019

Source: Counterpoint Research Market Monitor Q2 2019

India Online Smartphone Top Models– Q2 2019

Source: Counterpoint Research Market Monitor Q2 2019

- While the smartphone shipments in the offline segment declined by 4%, the online segment grew by 26% Mi Super Sale, HONOR Days, Flipkart Summer Carnival, Big Shopping Days, Amazon Summer sale, Amazon Fab Fest, Knock Out Offers, Realme 1ST anniversary sale, and Month End Mobile Fest were some of the most popular events during the quarter.

- Flipkart’s online channel share hit 58% while Amazon’s share reached 79% in the premium segment.

- Flipkart grew 45% YoY in Q2 2019, due to strong sales of Redmi Note 7 Pro, Realme C2 and Realme 3. These three models alone contribute to one-third of Flipkart’s overall sales. In May alone, Flipkart organized three sales events.

- Xiaomi, Realme, ASUS, and Samsung contributed the most for Flipkart and accounted for more than four-fifths of its total smartphone shipments.

- Amazon grew 9% YoY driven by with Xiaomi Redmi 6A, Samsung Galaxy M-series, Xiaomi Redmi 7, and the OnePlus7 Series.

- The top five brands captured 84% of the total online market.

- The top five smartphones shipped into online channels were from Xiaomi and

- Xiaomi alone captured around 46% of the total online market in Q2 2019. Its Redmi Note 7 Pro series, Redmi 6A, Redmi Note 6 Pro and Redmi Go drove volumes, contributing to more than two-thirds of Xiaomi’s total online sales. In June, Xiaomi introduced an ‘Express Delivery’ program to promote sales on Mi.com.

- Realme became the second-largest player in the online segment, driven by a strong online push and good performance of its affordable series – Realme C2, Realme 3, and Realme 3 Pro.

- Samsung was the third-largest player in the online segment. The M-series contributed to more than 50% of its online volume.

- Realme, Asus, Vivo, and OPPO were the fastest growing brands in the online segment.

- Amazon recorded its highest ever shipments in the premium segment, driven by the OnePlus 7-series.