Online Insurance Market : End User Insurance Companies, Aggregators, Third Party Administrators and Brokers

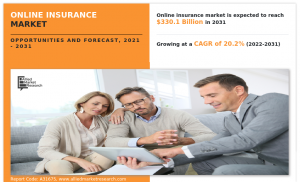

PORTLAND, UNITED STATES, UNITED STATES, July 12, 2023/EINPresswire.com/ — The global online insurance market was valued at $53.2 billion in 2021, and is projected to reach $330.1 billion by 2031, growing at a CAGR of 20.2% from 2022 to 2031.

Get a sample copy of this report : https://www.alliedmarketresearch.com/request-sample/32125

Segment review

The online insurance market is segmented on the basis of by, enterprise size, insurance type, end user, and region. On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. On the basis of insurance type, it is categorized into life insurance, motor insurance, health insurance, and others. By end user, it is classified into insurance companies, aggregators, and third-party administrators & brokers. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Top Impacting Factors

Increase in internet penetration

Increase in smart phone usage

End User Adoption:

The global online insurance market is expected to register growth as it helps companies to create, manage, monitor and control the online insurance ecosystem. Thus, the increase in the adoption of online insurance, owing to its technology platform is one of the most significant factors driving the growth of the market. With a surge in demand for online insurance, various companies have established alliances to increase their capabilities. For instance, in July 2022, Allianz Direct partnered with CHECK24 in Germany and Spain, in addition, consumers in both countries will be able to access Allianz Direct products on CHECK24’s comparison portals and also to improve growth, profitability, and the customer experience with this cooperation. For instance, in August 2021, Marsh partnered with Amazon to help its new digital insurance network to small business sellers to get affordable product liability coverage. For instance, in August 2022, Aviva partnered with Home Deposits Now – a provider of an alternative home deposit to help home buyers buy insurance online.

Inquire Before Buying : https://www.alliedmarketresearch.com/purchase-enquiry/32125

KEY BENEFITS FOR STAKEHOLDERS

The study provides an in-depth analysis of the online insurance market forecast along with current & future trends to explain the imminent investment pockets.

Information about key drivers, restraints, & opportunities and their impact analysis on global online insurance market trends is provided in the report.

The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

The online insurance market analysis from 2022 to 2031 is provided to determine the market potential.

Online Insurance Market Report Highlights

By Enterprise Size

Large Enterprises

SMEs

By Insurance type

Life Insurance

Motor Insurance

Health Insurance

Others

By End User

Insurance Companies

Aggregators

Third Party Administrators and Brokers

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Spain, Italy, Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Australia, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Key Market Players Esurance Insurance Services, Inc, AXA Group, ASSICURAZIONI GENERALI S.P.A., Zurich Insurance Group, Munich Re, Aviva, Swiss Re, Lemonade, Inc., RooT, Allianz SE

Request Customization : https://www.alliedmarketresearch.com/request-for-customization/32125

More Reports:

Smart Finance Hardware Market : https://www.alliedmarketresearch.com/smart-finance-hardware-market-A31798

Voice Banking Market : https://www.alliedmarketresearch.com/voice-banking-market-A31730

Insurance Aggregators Market : https://www.alliedmarketresearch.com/insurance-aggregators-market-A31712

Canada Extended Warranty Market : https://www.alliedmarketresearch.com/canada-extended-warranty-market-A24713

Payroll Outsourcing Market : https://www.alliedmarketresearch.com/payroll-outsourcing-market-A31433

Syndicated Loans Market : https://www.alliedmarketresearch.com/syndicated-loans-market-A31434

Allied Market Research

Allied Market Research

+ +1 800-792-5285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Online Insurance Market

![]()