The COVID-19 pandemic has been a catalyst for the uptake of online shopping in the Middle East.

Image: d3sign/GettyHistorically, the MENA region has been one of the least likely to adopt e-commerce. The continued strength of traditional bricks and mortar retail, coupled with preferences for cash on delivery and in-person relationships with sellers, has meant that online shopping has not been as popular as in many other regions around the world.

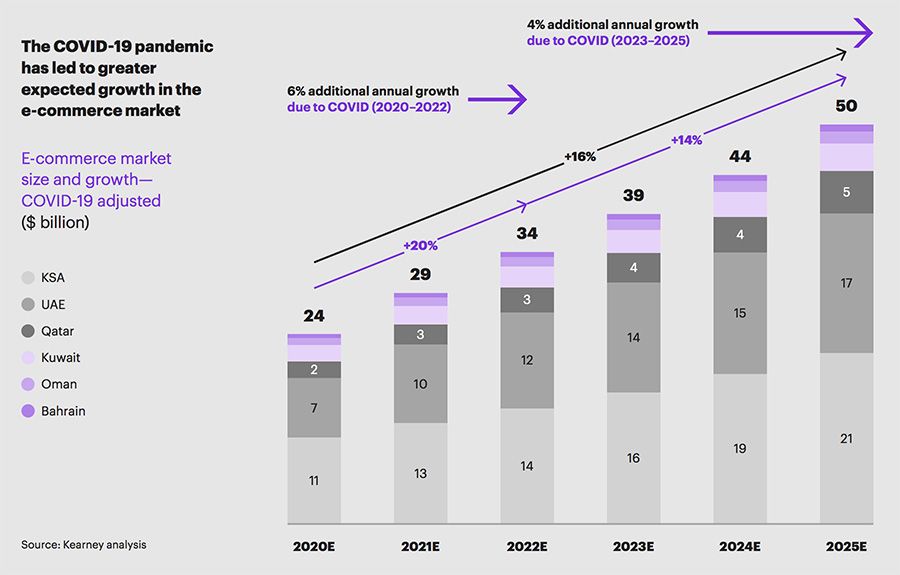

However, that picture had already begun to alter before the COVID-19 pandemic— which acted as a further catalyst for change. As a result, last year, the consultancy firm Kearney revised its predictions for the e-commerce market in the Gulf region (GCC) from $21bn in 2020 to $24 billion. By 2025, they estimate the market in this part of the Middle East will have doubled to $50 billion per year.

Kearney’s e-commerce projections in the Gulf region.

Image: Consultancy-me.comHow MENA turned the e-commerce corner

A number of factors can be ascribed to the adoption of online shopping in the Middle East and North Africa (MENA), including the presence of a large, digitally savvy youth population, as well as high mobile — and smartphone — penetration, especially in the Gulf.

See also: FinTech: Why these startups are banking on a payments revolution in the Middle East.

These factors have always offered a firm foundation for e-commerce, but for this potential to be fulfilled, there needed to be a step-change in both the supply and demand for online commerce.

The past 12-18 months has seen much of this come to fruition, driven by VC investment, government policies promoting innovation, and a greater willingness among consumers — many of them contending with lockdowns and quarantines — to shop online.

One key element has been the increased choice for consumers, enabling them to choose from a wider range of online possibilities. COVID-19 encouraged businesses large and small to explore new digital frontiers, ranging from the launch of a virtual Dubai Mall to the opening of Lulu Hypermarket’s online shopping service and e-commerce fulfilment centres.

Meanwhile, existing e-commerce properties have flourished. The recent acquisition of Mumzworld — the largest mother, baby and child e-commerce platform in the Middle East — by the Tamer Group in Saudi Arabia should facilitate further online expansion, as will continued cash injections from investors like Saudi Technology Ventures (STV) and Middle East Venture Partners (MEVP) into apps like the Saudi e-grocer Nana, which secured $18m in Series B funding late last year.

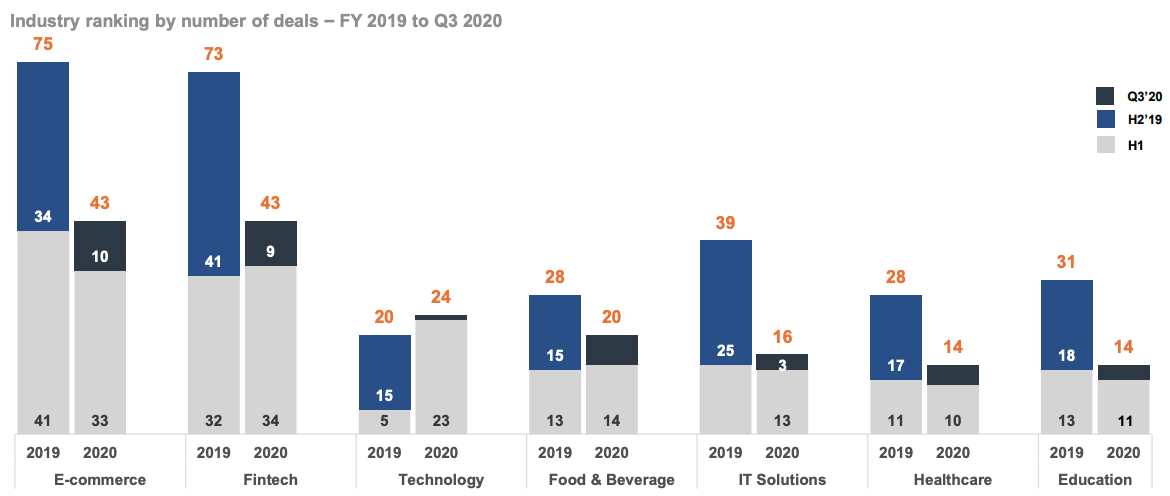

Although deal numbers dropped during the pandemic, data from MAGNiTT shows that the best-performing industries were e-commerce (43 deals) and Fintech (also 43). That momentum has continued into 2021, with companies like Opontia securing financing of $20 million to acquire and scale e-commerce brands across the region and the Egyptian last-mile delivery company Bosta closing a Series A investment of $6.7 million.

Top 7 industries by number of deals – FY 2019 vs Q3 2020.

Image: JETRO MENA Venture EcosystemSMEs have also responded to the COVID-19 challenge. An October 2020 study from Facebook, the World Bank and the Organization for Economic Co-operation and Development (OECD) found 61% of companies in Egypt, 56% in UAE and 38% in Saudi Arabia said their sales were down compared to the same period last year.

At the same time, 47% of these small companies in the UAE, 37% in Saudi Arabia and 38% in Egypt reported that more than a quarter of their sales in the previous month had been online. COVID has forced many of these SMEs to develop their digital presence — including introducing or developing online shopping capabilities — in some cases for the first time.

Online consumer behaviours have evolved, too. A report by WAMDA and the Legatum Center for Development and Entrepreneurship at MIT notes that “today, 80% of young Arabs shop online frequently, compared to 71% in 2019. In addition, 50% of those aged 18-24 in MENA are shopping more online after the pandemic.”

Data from the UAE-wide 2021 Stay Secure consumer survey released by Visa, Dubai Police and Dubai Economy (DED) found 98% of respondents said they had increased their use of digital payments (contactless cards and mobile wallets) for online payments during the pandemic, with 45% saying that they are likely to use contactless payments more.

Similarly, 40% of respondents indicated they are less likely to use cash on delivery, the previously predominant form of payment.

Growth in online grocery sales in Saudi Arabia and UAE.

Image: Consultancy-me.comHaving caught the e-commerce habit during COVID-19, the critical consensus is that there is no going back for consumers — as well as businesses.

Maintaining the momentum

All of this is good news for governments and investors across the region, who have taken a range of steps to encourage engagement from previously hesitant e-commerce consumers and, in some cases, businesses.

From improving inventory and delivery and onto legislation and regulatory frameworks to support the take-up of online payment and mobile wallets, e-commerce looks to be increasingly ingrained in the shopping and digital experiences of a growing number of people across the Middle East.

Nonetheless, for all the progress that has been made, challenges remain. Research suggests that the growth witnessed in the past year remains behind leaps seen in other regions.

Insights from a survey of UAE consumers show that shoppers are likely to be impatient if they encounter a poor online experience. More than a third of respondents said they would prefer to switch retailers (37%) or shop on another site (35%) if they encountered delays in completing an online purchase. Businesses need to address this concern.

Similarly, evidence from a forthcoming report by ESCWA (the United Nations Economic and Social Commission for Western Asia), previewed in a global review of COVID 19 and e-commerce published by the United Nations, observes that cultural barriers to adoption are cultural barriers of e-commerce in the Arab states remain.

See also: The CIO’s new challenge: Making a case for the next big thing.

Concerns about “legal barriers, lack of payment tools and limited engagement with e-commerce by merchants” were also expressed. By the same token, ESCWA research also suggests “that the lack of data in the region limited merchants’ understanding of potential markets and, thereby, [the] propensity to risk engaging in e-commerce.”

Despite this, we can say that COVID-19 has encouraged more businesses and consumers to check out the possibilities afforded by e-commerce. That’s especially true in areas like the Gulf region and across verticals like fashion and groceries.

At the same time, despite a greater willingness to check out online shopping, there’s still work to be done. Maintaining recent momentum, and facilitating the wider adoption of e-commerce products and services, will continue to require ongoing efforts from governments, retailers, banks, platforms and payment providers, as well as ensuring that pandemic-era consumer habits become the new normal.

Without this, a secure future for online shopping in MENA is not in the bag just yet.