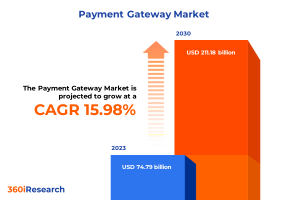

The Global Payment Gateway Market to grow from a size of $74.79 billion in 2023 to reach $211.18 billion by 2030, at a CAGR of 15.98% over the forecast period.

PUNE, MAHARASHTRA, INDIA, April 15, 2024 /EINPresswire.com/ — Payment Gateways Are Transforming Global E-commerce:

In today’s fast-paced digital landscape, payment gateways are crucial pillars, streamlining and securing online transactions across various eCommerce platforms, traditional businesses, and the burgeoning mobile commerce arena. As indispensable intermediaries, they ensure the swift and safe transfer of financial information between merchants and banks, driving the digital economy forward. Amidst an explosive growth in global eCommerce and a surge in international trade, the demand for sophisticated payment solutions is at an all-time high, catering to various currencies and regulations. Challenges include integration complexities and security vulnerabilities. The industry is making leaps in addressing these issues through advanced encryption and adopting AI and machine learning (ML) for fraud prevention. The global landscape witnesses diverse adoption rates and innovations, from the tech-forward Americas, where mobile payments reign supreme, to Europe’s unified market benefitting from regulatory advancements such as PSD2, and onto the cashless pursuits in the Middle East’s digital revamp. Dynamic and rapidly evolving payment systems in the APAC region are highlighted by China’s QR and blockchain innovations and India’s digital payment initiatives.

Download Sample Report @ https://www.360iresearch.com/library/intelligence/payment-gateway

The Rise of Mobile Payments With Embracing the Digital Wallet Revolution:

The surge in smartphone usage is revolutionizing the payment landscape. This digital wave has catalyzed the adoption of mobile payment solutions, such as PayPal, Google Pay, and Apple Pay, offering users seamless and secure transactions at their fingertips. Enhanced features such as biometric verification and contactless payments elevate mobile transactions’ security and convenience. Moreover, mobile wallets are gaining popularity for their ability to securely store payment information, facilitating instant cashless purchases. With encryption and biometric authorization, these wallets have become trusted companions for consumers, further incentivized by rewards and cash-back benefits. The integration of autopay for regular bills, alongside the capacity for varied transactions, from ticket purchases to grocery shopping, highlights the significant role of mobile payments in modern commerce, propelling the payment gateway industry forward.

The Rise of Hosted Payment Gateways By Simplifying E-commerce for Small and Medium-Sized Businesses:

Small and medium-sized enterprises (SMEs) increasingly turn to hosted payment gateways to modernize online transactions. This method, which redirects customers to a payment service provider’s platform for transaction completion before returning them to the merchant’s site, has become a favored solution for businesses seeking to bypass the complexities of high-level security measures and system integrations. While larger firms may lean toward integrated payment solutions for their seamless checkout experiences, keeping transactions on-site through direct API or secure HTTPS communications, hosted gateways offer SMEs an appealing mix of simplicity, security, and ease of implementation. Outsourcing the payment process allows these businesses to engage in eCommerce efficiently without the substantial investment in resources typically required for advanced payment systems. This trend highlights a broader move toward flexible, user-friendly solutions in the digital marketplace, empowering small businesses to compete more effectively online.

Request Analyst Support @ https://www.360iresearch.com/library/intelligence/payment-gateway

PayPal Holdings, Inc. at the Forefront of Payment Gateway Market with a Strong 33.66% Market Share:

The key players in the Payment Gateway Market include Ant Group Co., Ltd., Visa Inc., Amazon.Com, Inc., PayPal Holdings, Inc., Mastercard Incorporated, and others. These prominent players focus on strategies such as expansions, acquisitions, joint ventures, and developing new products to strengthen their market positions.

Introducing ThinkMi: Revolutionizing Market Intelligence with AI-Powered Insights for the Payment Gateway Market:

We proudly unveil ThinkMi, a cutting-edge AI product designed to transform how businesses interact with the Payment Gateway Market. ThinkMi stands out as your premier market intelligence partner, delivering unparalleled insights with the power of artificial intelligence. Whether deciphering market trends or offering actionable intelligence, ThinkMi is engineered to provide precise, relevant answers to your most critical business questions. This revolutionary tool is more than just an information source; it’s a strategic asset that empowers your decision-making with up-to-the-minute data, ensuring you stay ahead in the fiercely competitive Payment Gateway Market. Embrace the future of market analysis with ThinkMi, where informed decisions lead to remarkable growth.

Ask Question to ThinkMi @ https://app.360iresearch.com/library/intelligence/payment-gateway

Dive into the Payment Gateway Market Landscape: Explore 199 Pages of Insights, 216 Tables, and 20 Figures:

Preface

Research Methodology

Executive Summary

Market Overview

Market Insights

Payment Gateway Market, by Type

Payment Gateway Market, by Industry

Americas Payment Gateway Market

Asia-Pacific Payment Gateway Market

Europe, Middle East & Africa Payment Gateway Market

Competitive Landscape

Competitive Portfolio

Related Reports:

Online Payment Gateway Market – Global Forecast 2024-2030

Card Payments Market – Global Forecast 2024-2030

Outdoor Payment Terminal Market – Global Forecast 2024-2030

About 360iResearch

Founded in 2017, 360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset — our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

![]()