Plaid, the company building a universal banking API that lets you connect an app or service with a bank account, has updated Plaid Link. Plaid Link is the interface you see when you add your bank account to any app or service that uses Plaid, such as Venmo, Acorns or Chime.

Given that 3,000 apps have been using Plaid, chances are you’ve seen Plaid Link in the past. According to the company, one in four people in the U.S. have used Plaid to connect their accounts.

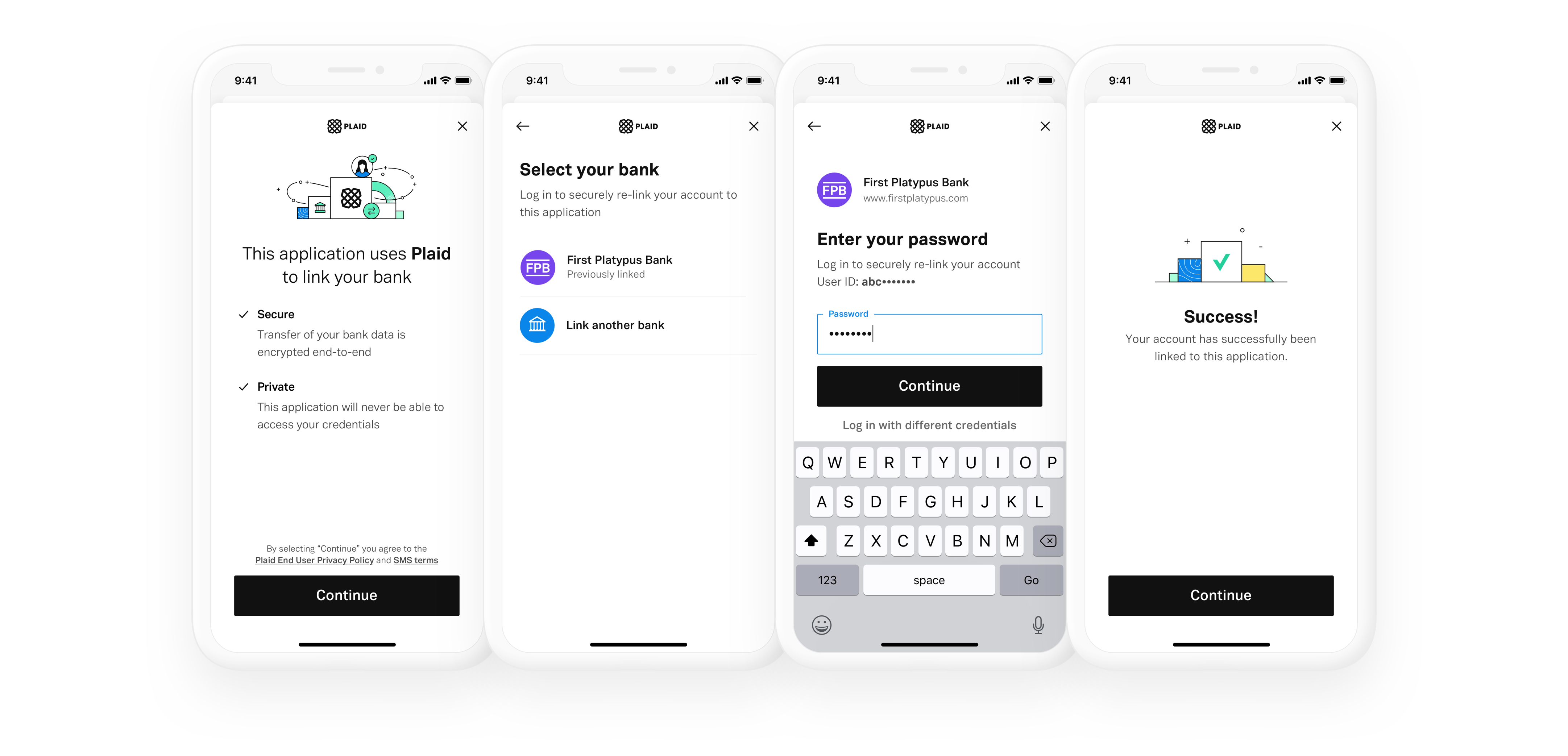

And today’s update is all about using Plaid with multiple apps. The first time you connect your bank account, you search for your bank, you enter your credentials and you log in.

The second time you need to add your bank account, Plaid shows you previously added bank accounts. You don’t have to scroll through a list of financial institutions and you don’t have to enter you user ID. Plaid might ask you for your password again or a one-time code.

Image Credits: Plaid

When you buy something on an e-commerce platform, you can save your card so that you don’t have to enter your card details again. With today’s update to Plaid Link, the company is doing the same thing with bank account information.

Payment cards thrived in part because it is much easier to pay with your card than connecting to your bank account to send money. Polishing Plaid Link reduces friction for fintech startups when it comes to connecting your accounts.

Plaid also says that Plaid Link is a bit faster. Each panel loads 30% faster. The list of banks now changes depending on your location. Local banks appear closer to the top of the list so you don’t have to scroll as much.