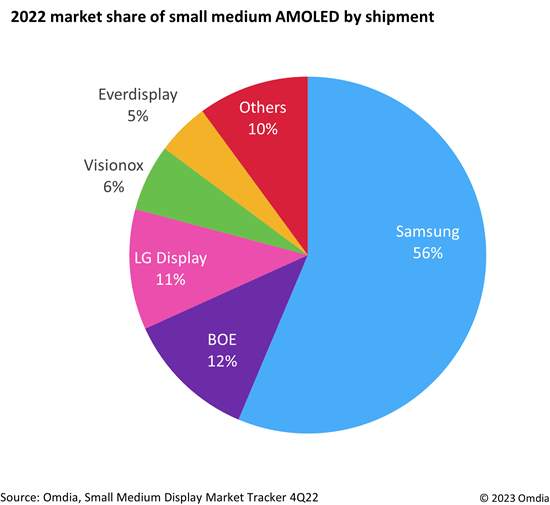

New research from Omdia’s latest Small medium display market tracker indicates that, in 2022, Samsung maintained its top position with 56% of the total market in terms of small medium size AMOLED market share, with BOE gradually approaching Samsung at 12%.

Overall shipments of small medium size (9.0-inch and smaller) AMOLED in 2022 were 762 million, down 6% by Year-on-Year (YoY) due to cooling smartphone demand following global inflation.

Samsung, the leading maker in the AMOLED market, maintained the lead with 429 million shipments in 2022, but its market share reduced from 61% in 2021 to 56% in 2022. LG Display, remained in second place from 10% share in 2021, to 11% in 2022.

However, BOE, further increased shipments with a 12% share overtaking LG Display in 2022 to reach second place. Emerging AMOLED manufacturers Visionox and Everdisplay, are the 4th and 5th largest AMOLED makers in China and are steadily increasing shipments closing the gap with their leading Korean counterparts.

According to Hiroshi Hayase, Research Manager in Omdia’s Display research practice, “Even though the difference in AMOLED shipment share is still large compared to Samsung, BOE has succeeded with orders of flexible LTPS-AMOLED from Apple for the iPhone 12, and improved its technical capabilities significantly. BOE is expected to gradually close the gap of shipment number with Samsung in small medium AMOLED market in next couple of years.”

The AMOLED market is looking to LTPO technology for its low power consumption. Samsung has increased its LTPO-AMOLED mass production capacity to secure orders for premium-class smartphones. Conversely, BOE and other Chinese display makers that have mastered the conventional LTPS technology have begun to increase shipments of LTPS-AMOLED for mid-range smartphones produced by China smartphone brands located in the same region.

“Korean AMOLED makers will maintain the technological advantage, and Chinese AMOLED makers will reduce the price of AMOLED but increase AMOLED shipments to mid-range smartphones produced by China smartphone brands by replacing the demand for TFT LCDs. However, there is still room for Chinese AMOLED manufacturers to increase their shipments in the future,” concludes Hayase.