2021 is poised to mark a banner year for global fab equipment spending with 24 percent growth to a record US$67.7 billion, 10 percent higher than the previously forecast US$65.7 billion, and all product segments promising solid growth rates, according to the second-quarter 2020 update of the SEMI World Fab Forecast report.

Memory fabs will lead worldwide semiconductor segments with US$30 billion in equipment spending, while leading-edge logic and foundry is expected to rank second with US$29 billion in investments.

The 3D NAND memory subsegment will help power the spending spree with a 30 percent jump in investments this year before tacking on 17 percent growth in 2021. DRAM fab investments will surge 50 percent next year after declining 11 percent in 2020, and fab spending on logic and foundry, mainly leading edge, will trace a similar but more muted trajectory, rising 16 percent 2021 after an 11 percent drop this year.

Some segments will see lower fab equipment spending but impressive change rates nonetheless. Image sensors will notch an impressive 60 percent increase in 2020 and add a 36 percent surge in 2021. Analog and mixed-signal will grow by 40 percent in 2020 and 13 percent in 2021. And power-related devices are forecast to register 16 percent growth in 2020 with a healthy jump of 67 percent in 2021.

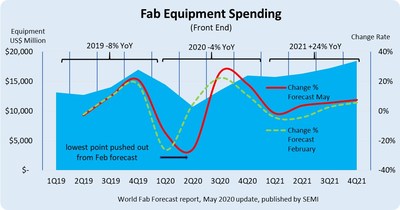

The SEMI World Fab Forecast report also shows the worldwide fab equipment spending trough in 2020 shifting from the first to the second quarter (see figure).

A review of quarter-over-quarter (QoQ) spending trends reveals the impact of the COVID-19 pandemic over the course of 2020. Global fab equipment spending QoQ declined 15 percent in the first quarter of 2020 – a performance that was stronger than the 26 percent decline forecast in February. In March, some companies appeared to build up safety stock as a countermeasure to the spreading virus as shelter-in-place orders emptied offices, malls and schools worldwide. As the contagion grew, demand for IT and electronic products such as notebooks, game consoles and healthcare applications surged. Some stockpiling is expected to stretch into the second quarter, fueled by fear of restrictions – scheduled to take effect in late June – on semiconductor equipment sold to China.