Ministry of Agriculture &

Farmers Welfare

Strengthening Agricultural Finance and Welfare

CGS-NPF to enhance post-harvest financing and agricultural support

Posted On: 19 DEC 2024 6:27PM by PIB Delhi

Introduction

The Government of India launched the Credit Guarantee Scheme for e-NWR Based Pledge Financing (CGS-NPF) on 16 December 2024, providing a ₹1,000-crore corpus to support post-harvest financing for farmers. Under this scheme, farmers can access credit by pledging their produce stored in Warehousing Development and Regulatory Authority (WDRA) accredited warehouses, backed by electronic negotiable warehouse receipts (e-NWRs). Aimed at reducing distress sales, the initiative addresses a critical gap in agricultural finance while also encouraging warehouse registration and development closer to farmland. Union Minister of Consumer Affairs, Food and Public Distribution Shri Pralhad Joshi has also called upon the WDRA to expand its reach and ensure more warehouses are accredited.

This initiative supports the government’s broader efforts to bolster Indian agriculture, which contributes 17.7% to the overall Gross Value Added (GVA) at current prices in FY 24. The sector remains the backbone of the economy, employing nearly half the population and benefiting from one of the world’s largest tracts of agricultural land. Recognising its importance, the government continues to prioritise farmer welfare through initiatives that enhance productivity, provide financial support, and promote self-reliance. The CGS-NPF scheme represents a significant step towards empowering farmers and strengthening the foundation of Aatmanirbhar Bharat.

This initiative supports the government’s broader efforts to bolster Indian agriculture, which contributes 17.7% to the overall Gross Value Added (GVA) at current prices in FY 24. The sector remains the backbone of the economy, employing nearly half the population and benefiting from one of the world’s largest tracts of agricultural land. Recognising its importance, the government continues to prioritise farmer welfare through initiatives that enhance productivity, provide financial support, and promote self-reliance. The CGS-NPF scheme represents a significant step towards empowering farmers and strengthening the foundation of Aatmanirbhar Bharat.

Overview of the CGS-NPF Scheme

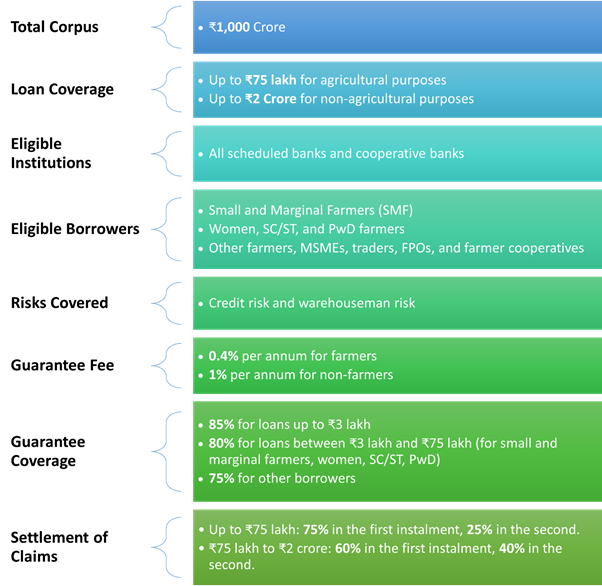

The Credit Guarantee Scheme for e-NWR Based Pledge Financing has garnered significant demand from various stakeholders, particularly in the banking sector. By increasing post-harvest lending against e-NWRs, the scheme aims to improve farmers’ income and enhance their access to institutional credit.

Focused on inclusivity, the scheme primarily benefits small and marginal farmers, women, Scheduled Castes (SC), Scheduled Tribes (ST), and Divyangjan (PwD) farmers with a minimal guarantee fee. It also extends its advantages to small traders (MSMEs), Farmer Producer Organisations (FPOs), and farmer cooperatives. The scheme ensures higher guarantee coverage for smaller loans, supporting equitable financial access.

Salient Features of CGS-NPF Scheme:

Other Key Agricultural Credit and Financial Support Schemes

Kisan Credit Card (KCC)

Introduced in 1998, the Kisan Credit Card (KCC) scheme provides farmers with easy access to agricultural inputs and cash for their production needs. In February 2019, RBI extended the KCC facility to Animal Husbandry and Fisheries for their working capital requirements. As of 31st March 2024, there are 7.75 crore operative KCC accounts.

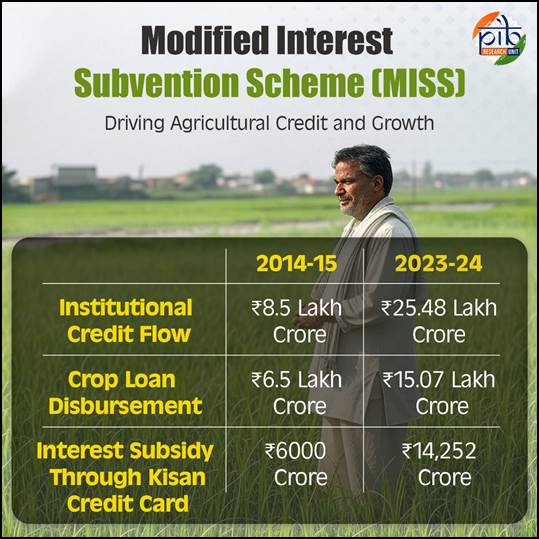

Modified Interest Subvention Scheme (MISS)

The Modified Interest Subvention Scheme (MISS) offers concessional short-term agri-loans to farmers for crop and allied activities, providing a 7% interest rate on loans up to ₹3.00 lakh, with an additional 3% subvention for timely repayment, reducing the effective rate to 4%. MISS also includes post-harvest loans against NWRs for small farmers with KCCs. Since 2014-15, institutional credit flow to agriculture has nearly tripled from ₹8.5 lakh crore to ₹25.48 lakh crore by 2023-24, while disbursement of easy and concessional crop loans has more than doubled from ₹6.5 lakh crore to ₹15.07 lakh crore. The interest subsidy through KCC has increased 2.4 times, from ₹6,000 crore to ₹14,252 crore in 2023-24.

Conclusion

The launch of the Credit Guarantee Scheme for e-NWR Based Pledge Financing (CGS-NPF) is a pivotal initiative aimed at enhancing post-harvest financing and reducing distress sales for farmers. With a ₹1,000-crore corpus, this scheme addresses a critical gap in agricultural finance by providing greater access to credit for small and marginal farmers, women, and Scheduled Castes and Tribes. The CGS-NPF scheme complements the government’s broader agricultural support framework, which includes other key initiatives like the Kisan Credit Card (KCC) and the Modified Interest Subvention Scheme (MISS). These schemes collectively empower farmers, boost agricultural productivity, and promote self-reliance, strengthening the foundation of Aatmanirbhar Bharat. As more farmers benefit from these schemes, the vision of a resilient, self-sustaining agricultural sector in India becomes increasingly achievable.

References:

Santosh Kumar/ Sarla Meena/ Saurabh Kalia

(Release ID: 2086154) Visitor Counter : 156