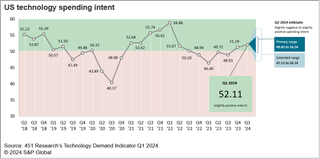

A new survey indicates that U.S. businesses and consumers had an overall positive attitude towards their technology spending plans in the first quarter of 2024, the second consecutive quarter of positive intent after more than a year of negative results.

The new data is from 451 Research’s U.S. Technology Demand Indicator, a survey-backed composite of U.S. intent to spend on technology. 451 Research is part of S&P Global Market Intelligence.

The report also found that the positivity will continue, although a flattening of the recent upward trajectory is likely, according to Liam Eagle, research director at S&P Global Market Intelligence.

An increase in the intent to spend on technology measured during Q1 continues an overall directional trend of gradually improving sentiment that stretches back to the beginning of 2023, despite some continued wariness about economic pressures, the researchers noted.

Artificial intelligence is an obvious target of intense interest during the last two years but is still in the early stages of focused spending by businesses. Even so, AI continues to present a potential spike in spending that will bring necessary IT functions like cloud systems and information security along with it.

The Technology Demand Indicator is based on surveys of IT decision-makers at nearly 1,400 US companies with a combined annual revenue of more than $3 trillion and more than 1,500 consumers in a population representative survey.

Key highlights from the analysis include:

- The Q1 Tech Demand Indicator score was 52.11, representing an overall positive sentiment (a score greater than 50) and a slight increase from a Q4 score of 51.42. The Q1 results continue an overall positive trajectory expressed since a low point of 46.60 in Q1 2023. The early results and projections suggest the potential for an average 2024 score in the positive range.

- Detailed signals of spending intent suggest key areas of technology — such as security, cloud and AI — play a significant role in driving enterprise technology spending via growing operational requirements, as well as new initiatives around data and AI.

- The continued positive trajectory for US technology spending intent measured by Tech Demand Indicator scores is reflected in directional trends in technology market performance, as measured by revenue growth rates in the information technology and communications services segments, which, combined, saw a slight increase from Q3 to Q4 (despite a slight decline in the information technology segment).

451 Research’s US Technology Demand Indicator is a representation of intention to spend money on technology among US businesses and consumers in the current and coming quarters. It is based on a composite of responses to survey questions about anticipated changes in spending from individuals making those decisions in both business and consumer categories.