It is only a question of time before the market is flooded with counterfeit semiconductors, say industry experts.

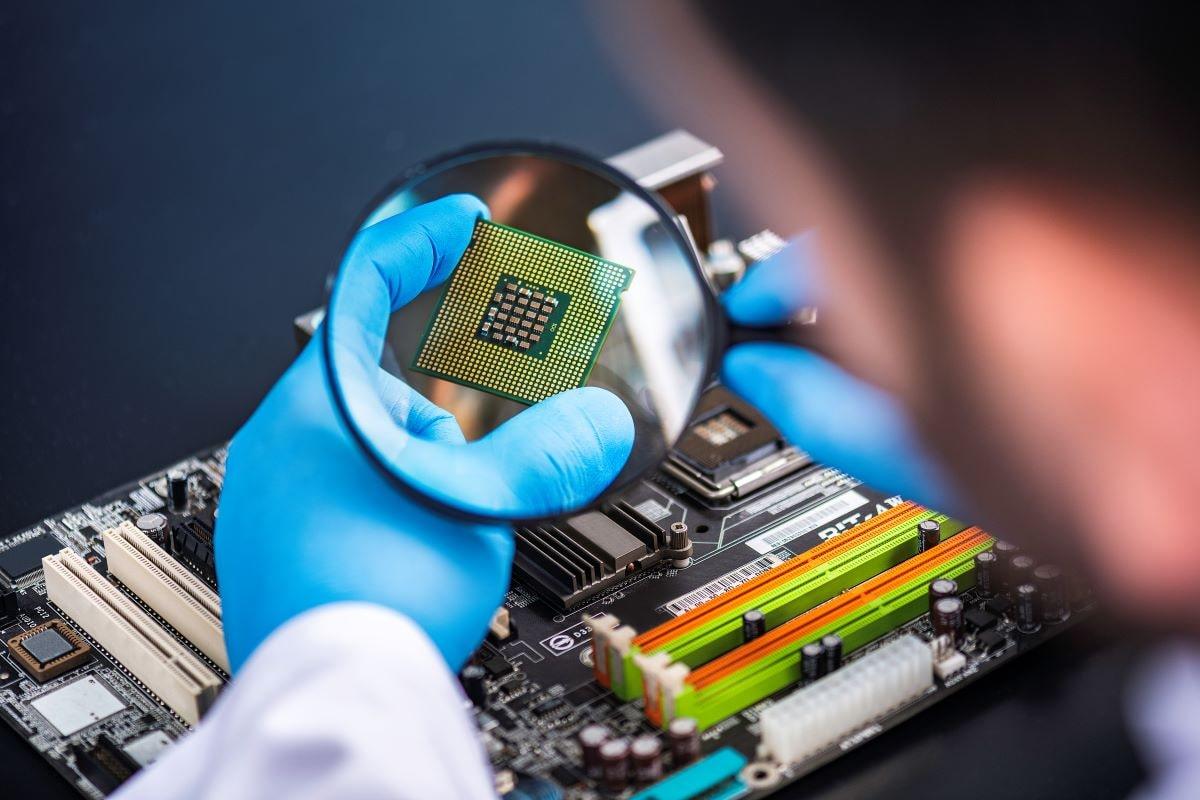

Image: Sefa Ozel / Getty ImagesFrom face masks to hand sanitizer and onto vaccine passports: almost all of the products that have been in high demand during the past few months have inevitably provided an opportunity for fraudsters looking to make easy money from counterfeits.

It is not surprising, therefore, that industry experts are looking at the growing global chip shortage with a degree of anxiety. There, too, demand is surpassing supply – and it is only a question of time before the market is flooded with semiconductors that just about pass for authentic, but in reality, are illegal products that could pose huge safety risks.

Since the start of the COVID-19 crisis, in effect, electronic device makers have come under the pressure of unprecedented demand from consumers. With companies and individuals alike rushing to purchase PCs, smartphones, tablets and gaming consoles, manufacturers have suddenly found themselves needing vast amounts of semiconductors – the tiny components that constitute the “brain” of most electronics, and which are produced in most cases by third-party companies called foundries.

SEE: Hiring Kit: Computer Hardware Engineer (TechRepublic Premium)

But foundries are currently unable to produce chips fast enough to cope with the surge in demand. This has led to global shortages that have now trickled down to most industries that depend on electronic components, ranging from basic home appliances like microwaves and refrigerators to the automotive sector.

With demand looking unlikely to calm down, analyst firm Gartner estimates that the semiconductor shortage will last well into 2022, and has warned equipment manufacturers that wafer orders could come with up to 12 months of lead time in the coming months.

For some companies, this will mean finding an alternative way of stocking up on chips or shutting down production lines. In other words, the current times are opening up a golden opportunity for electronic component counterfeiters and fraudsters to step in.

“If next week, you need to get 5,000 parts or your line will shut down, you will be in a situation of distress purchase and you will put your guard down,” Diganta Das, a researcher in counterfeit electronics at the Center for Advanced Life Cycle Engineering (CALCE), tells ZDNet. “You won’t keep to your rules of verifying the vendor or going through test processes. This is likely to become a big problem.”

As part of his research, Das regularly monitors counterfeit reporting databases like ERAI, and although it is too early to notice a surge, he is confident that the number of reports will start growing in the next six months as companies realize they have been sold illegal parts.

The problem, of course, is unlikely to affect tech giants whose reliance on semiconductors is such that they have implemented robust supply chains, and will typically only purchase components directly from chip manufacturers.

Those at risk rather include low-volume manufacturers whose supply chain for semiconductors is less established – but it could include companies in sectors that are as critical as defense, healthcare and even automotive.

Typically, those smaller companies will use the services of third-party distributors. These can be franchised distributors, which means that they have contracts in place to buy directly from the chip manufacturer; or they can be independent distributors, who buy and sell components from different places, including from equipment manufacturers who have surplus inventory.

Whether franchised or independent, distributors have become central to the semiconductor supply chain: according to analysis firm McKinsey, they now handle almost a quarter of the semiconductor industry’s revenues.

It remains true that, when purchasing parts from distributors, companies have to take particular care to make sure that they are buying legitimate components, especially when they are dealing with independent distributors, who buy and sell components on online open markets. This means that parts can change hands various times, and it can be difficult to trace back the origins and credentials of the original seller.

Most companies have understood that caution is necessary when buying from distributors, according to Das. Checking the records of the company that is selling components and carrying out thorough tests on the parts once they are received, for example, forms the basis of safe trading. But this means spending a week, sometimes two, just to perform due diligence – time that some businesses can’t afford to spend in the current context.

“If you are given the impression of a shortage, that you have to buy today or you won’t get the part, you won’t keep to your rules of verifying the vendor and going through test processes,” says Das. “That increases your chances of getting counterfeit parts.”

What’s more, on the supply side, says Das, counterfeiters excel at sniffing a good opportunity – and it doesn’t get much better than a global shortage of chips.

Steve Calabria, the founder of independent distributor PC Components, is part of an industry group known as the Independent Distributors of Electronics Association (IDEA), which seeks to create standards and certifications to ensure a level of quality for distributors who are not franchised.

Although only based on his own observations, Calabria is also convinced that this is only the start of a wave of counterfeit semiconductors creeping into the market. “I think we are on the cusp of a major problem here. The worldwide shortages have opened the door for criminals to exploit the electronic component marketplace, and I’m seeing early signs this has already started to happen,” Calabria tells ZDNet.

“We’re seeing companies that have never been rated by any other company in the industry showing significant quantities of parts that are in shortage. But what sounds too good to be true is too good to be true.”

An ongoing shortage of chips is a perfect terrain to lure in equipment manufacturers that are desperate to find alternative ways to get their hands on the components they need, says Calabria. And, in fact, it would not be the first time that disruptions to the electronic components supply chain triggered a wave of counterfeit products.

In 2011, for example, an earthquake and tsunami hit Japan, which is one of the key producers of electrolytic capacitors that are used to power some medical devices. Studies have shown since then that, as lead times extended for the component, manufacturers came under pressure to source parts quickly and started purchasing from third-party distributors. Before long, counterfeit products had made their way into the supply chain.

“We can be sure it will happen again, but this time it will be all components, not just chip capacitors,” says Calabria.

The risks of using counterfeit chips, even unknowingly, should not be underestimated. Typically, fraudsters use one of two methods to create fake products: they can clone them, building them entirely from scratch in a manner reminiscent of what has become common in the fashion industry, for example; or, they can recycle components from electronics waste, erase old markings, clean the part and package it to appear new to potential buyers.

In both cases, the final product might meet basic quality standards, but it will not have gone through any of the testing processes or reliability criteria that authentic chip manufacturers invest time and money into. The component is bound to fail after some time or under certain conditions – and it could mean big trouble for the companies that purchased it to manufacture their products.

In another example, an investigation carried out by the Senate Armed Services Committee in 2012 discovered more than one million counterfeit electronic parts that had been sourced from China were used in equipment designed for the Air Force, the Navy and for Special Operations.

Although nearly a decade later, the threats are the same today – except in an even larger number of sectors that are now relying on semiconductors for their products.

For Michael Pecht, professor of mechanical engineering at the University of Maryland and the founder of CALCE, there is no doubt that the next year will some businesses buying fraudulent parts as a result of the current shortage.

“I don’t think there is awareness in the industry at all,” Pecht tells ZDNet. “I think companies are thinking too much about meeting schedule demands, and not really about the issue of counterfeits. I’m particularly concerned with medical and military industries, and any safety-related business – even automotive, to an extent.”

For Pecht, businesses won’t be left with many options aside from consistently carrying out due diligence, no matter how long it might take. This could be as simple as doing an X-ray to check that the internal dimensions of the product are correct, or using specialized technologies to find out if the surface of the chip was scraped off and re-marked.

For businesses looking to purchase semiconductors in the next months, therefore, a heavy dose of auditing, cross-checking and investigating will be required to avoid buying into the most tempting offers. Lead times won’t be shortening any time soon – and as counterfeiters jump on the opportunity, vigilance will be key to avoid falling prey to malicious sellers.