BOSTON, Dec. 3, 2020 /PRNewswire/ — Thermal management is a critical consideration for many technologies and markets, from electric vehicle battery packs to data centers and 5G devices. Several news stories, announcements, trends and acquisitions in 2020 have highlighted the need for effective thermal management in these emerging technology areas. A huge market is opening for component and material suppliers in the thermal management arena. In 2020, we have seen several industries and material suppliers continue this trend to emphasizing thermal considerations in product design and material selection.

Electric Vehicles

Electric vehicles (EVs) are the future of the automotive industry; unfortunately, 2020 appears to have been the year of the EV recall due to battery fires. In China, 10,579 battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) have been recalled due to fire hazards across 7 OEMs (January to October). General Motors has recalled 68,667 Chevrolet Bolts, telling owners not to park their cars near their house or in their garage for risk of fire. This has not just been limited to a few OEMs either. Contacts in the industry have revealed to IDTechEx that EVs will become safer than conventional vehicles, but currently, almost every OEM with an EV has had at least one serious fire-related incident. The causes of these fires have varied with contaminants in the cells being the cause in some cases and poor thermal design allowing batteries to overheat in others. Regardless of the root cause, the importance of preventing cell overheating and detection and containment of thermal runaway is a topic of growing importance.

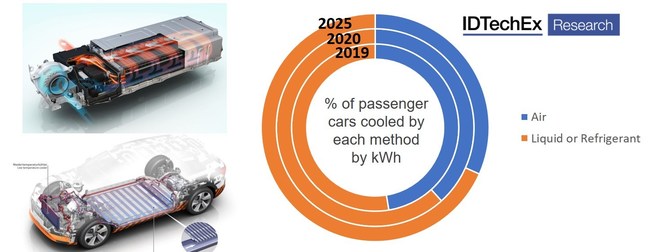

EVs have several areas that require effective thermal management; their high voltage batteries, traction motors and power electronics all require a specific temperature range for optimal operation. How this is incorporated with the vehicles cabin climate control is also a crucial area. In recent years we have seen manufacturers of EVs transition away from cooling their batteries passively or with forced air towards water-glycol systems. In 2019, liquid-cooled batteries became the most popular form of battery cooling in electric vehicles, a trend we see continuing for 2020. Nissan has historically been one of the main proponents of air cooling in their EVs with the Leaf, however, the newly announced Ariya will utilize liquid cooling. Honda’s first EV, the Honda e made first deliveries in 2020 with a liquid-cooled battery pack. 2020 was also Porsche’s first full delivery year for the Taycan, utilizing an 800 V battery pack with a sophisticated liquid cooling system.

Heating the cabin is one area that combustion vehicles have an advantage over EVs. The excess heat from a combustion engine can be used to warm the cabin, whereas, in an EV, many utilize a simple resistive heater, which drains the battery. More and more credence is being given to heat pumps, which can cool or warm a battery efficiently. When cooling the battery, the excess heat is sent to the cabin heater, heat from the ambient air can also be redirected to the cabin heater. Nissan was the first to utilize a heat pump back in 2013, in 2020 the vast majority of EV models released had heat pumps installed, including offerings from VW, Hyundai, Mini, Vauxhall and more. 2020 marked the first deliveries of the Tesla Model Y, Tesla’s first model using a heat pump. Since then, Tesla has announced that the Model 3 refresh for 2021 will also receive the heat pump.

With the rapidly growing market for EVs, fire events may become more common, meaning a much greater focus will be required towards fire safety from a regulation and material solution standpoint. The increasing utilization of liquid-cooled systems and heat pump technologies shows how manufacturers are considering the importance of thermal management and implementing solutions. For more information please see the “Thermal Management for Electric Vehicles 2020-2030” report from IDTechEx.

5G

5G promises incredible download rates and extremely low latency communication. The first 5G smartphones came to the market in 2019, but the market has expanded rapidly in 2020. Early 5G phones were commonly reported to overheat rapidly, especially in warmer climates when using mmWave, dropping to the use of 4G to keep temperatures down. Material utilization around the mmWave antenna also reveals challenges with signal propagation. This presents an opportunity for materials suppliers to address these challenges. The key markets will be for thermal interface materials (TIMs), heat spreaders and thermal insulation materials. Recent years have seen an increasing application of vapor chambers within smartphones to improve heat spreading. However, their future is far from set, with several high-end models still using graphite heat spreaders for their reduced complexity, cost and weight. For example in 2020, Samsung, who have previously hyped vapor chambers, have used a graphite heat spreader or a copper vapor chamber in the Note 20 interchangeably. Additionally for 2020, Apple’s first 5G phones, the iPhone 12 lineup, all use graphite heat spreaders and have not adopted vapor chambers.

Several new thermal materials for 5G applications were released in 2020. For TIMs, DOW introduced the DOWSIL TC-3065 Thermal Gel with a thermal conductivity of 6.5 W/mK and bondline thicknesses down to 150 microns, specifying applications in optical transceivers, solid-state disks and other network devices. Henkel also announced their portfolio of TIMs for 5G infrastructure, including the BERGQUIST LIQUI-FORM TLF 6000HG gel-type TIM with 6.0 W/mK thermal conductivity and their BERGQUIST GAP PAD TGP 10000ULM with a 10 W/mK thermal conductivity and plans for a 12 W/mK version. Another significant material release in 2020 was the announcement of W.L. Gore’s Thermal Insulation material for smartphones, this material has a thermal conductivity lower than air, helping reduce hot spots on the device surface, but is also compatible with the new mmWave 5G antenna that can struggle with signal propagation (see the IDTechEx article: Smartphone Thermal Management Materials: What’s New? What’s Next?).

The rapidly growing rollout of 5G and especially the increasing mmWave utilization will present further challenges and opportunities for various materials and components within the thermal management market for both smartphones and telecommunications infrastructure. IDTechEx has carried out an in-depth analysis of the technologies and markets for “Thermal Interface Materials 2020-2030: Forecasts, Technologies, Opportunities” and “Thermal Management for 5G“.

Notable Acquisitions and Partnerships

In October of 2020, Honeywell acquired Rocky Research, a Nevada-based leader in thermal, energy and power management solutions. This acquisition will allow Honeywell to significantly expand its thermal materials portfolio within the aerospace market. Rocky Research has previously secured several major contracts supporting the US Department of Defense and Homeland Security.

Rex Materials Group (RMG) were acquired by Unifrax in June 2020. Unifrax provides high-performance specialty materials for thermal management, emission control, batteries, specialty filtration and fire protection and are backed by Clearlake Capital Group, L.P. The incorporation of RMG into the group expands Unifrax’s portfolio of high temperature engineered thermal components.

Another acquisition in October 2020 was Latent Heat Solutions, LLC (LHS) being acquired by the CAVU Group. CAVU are a leader in thermal management and temperature monitoring solutions. LHS provides thermal management systems for commercial battery energy storage and temperature stabilization of thermally sensitive components. LHS’ technology includes the use of phase change materials (PCMs) and helps to prevent thermal runaway in battery cells. The merger is said to increase the innovative^ materials, engineering and production capabilities of CAVU.

KULR Technology Group, Inc. have announced a partnership with Airbus to provide their passive propagation resistant battery design solutions for Li-ion batteries in aerospace applications. KULR technologies include the prevention of thermal runaway and internal short circuits. KULR’s design involves a sleeve-like shield separating individual cells, carbon fiber cores and liquid coolant.

Summary

2020 has not only proven to continue the trends from manufacturers towards more effective thermal management, but various aspects have been highlighted in the public eye, with electric vehicle fires and recalls in addition to overheating smartphones. The continually growing market for thermal materials presents a variety of opportunities across several applications and will continue to grow rapidly in the coming years. 2021 and beyond will continue to see an increased pressure on thermal management, a challenge which will be solved by engineering and materials solutions across an increasingly wide range of applications.

IDTechEx has reports with extensive deep-dives into the technologies, players, trends and markets for several thermal management areas, with forecasts over the next 10 years. For more information, please contact [email protected] and see our portfolio of reports at IDTechEx.com/Research.

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact [email protected] or visit www.IDTechEx.com.

Image download: https://www.dropbox.com/sh/5u520hlep7rw9gb/AABBYb8LjGKyA1FZG_C0GYSua?dl=0

Media Contact:

Natalie Moreton

Digital Marketing Manager

[email protected]

+44(0)1223 812300

Social Media Links:

Twitter: https://www.twitter.com/IDTechEx

LinkedIn: https://www.linkedin.com/company/idtechex/

Facebook: https://www.facebook.com/IDTechExResearch

SOURCE IDTechEx