• Young Indians are driving the OTT Video Content market, with 89% of the users within the 16-35 years age group. Male users account for over 79% of the total market.

Young Indians, under 35 years of age, accounted for 89% of the total Indian OTT video content platform users,according to Counterpoint Research’s India OTT Video Content Market Consumer Survey. Among young users, the age groups of 16-24 and 25-35 contributed equally to the overall market. Male users account for 79% of the total users.

Overall, Top 5 metro cities account for 55% of the total OTT video platform users, while Tier I cities account for another 36% of the users. As per the survey, Hotstar leads the Indian OTT video content market, followed by Amazon’s Prime Video, SonyLIV, Netflix, Voot, Zee5, ALTBalaji, and ErosNow in terms of the percentage of respondents subscribed to each platform. Production house-backed local OTT players, such as SonyLIV, Voot, Zee5, ErosNow, and ALTBalaji, are also competing with foreign players such as Amazon’s Prime Video and Netflix. The market remains highly focused on the ad-based model (AVOD), where advertisements drive revenues. However, subscription-based market (SVOD) continues to grow significantly.

In terms of engagement, Counterpoint Research survey found ErosNow users were the most engaged users, with 68% of its users indicating that they watch content on the platform daily. The platform continues to thrive through partnerships. In India, it partnered with Xiaomi for pre-installation on smart TVs. ErosNow has the highest percentage of its users consuming content on Smart TVs.

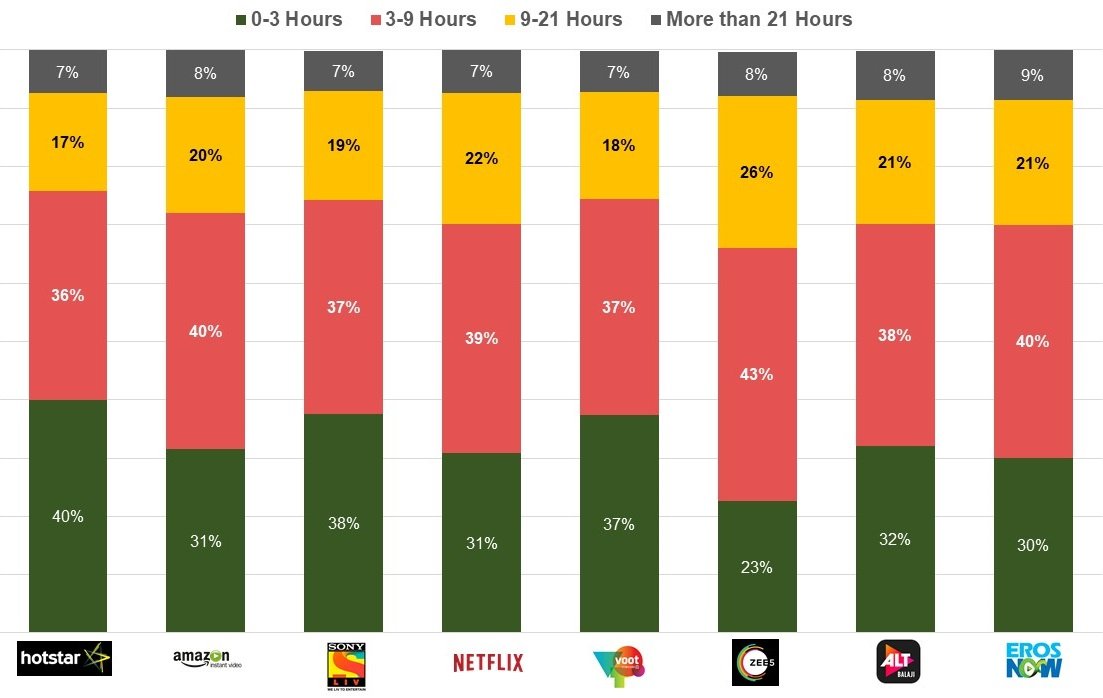

A total of 27% of ErosNow users watch content on Smart TVs. ErosNow also remains the only major Indian OTT platform to partner with Apple for its’ new Apple TV+ service which will launch across the globe later this year. Further, our survey revealed that 9% of ErosNow’s users see content on the platform for more than 21 hours a week. This is the highest among all other OTT platforms in India.

Exhibit 1 : Engagement Levels of OTT Users

Source : India OTT Video Content Market Survey

Commenting on the findings, Senior Analyst, Hanish Bhatia said, “India is a young country and OTT video market is a very competitive space in India at present. Platforms are focusing on price innovation, content creation an acquisition, and partnerships as the engine for growth. The low cost of mobile data and affordable smartphones have revolutionized overall video content consumption in India. However, OTT platforms have struggled to register profits, creating an environment ripe for acquisitions or exits. Having said that, new players continue to enter the market as it is expected to record double-digit growth from subscription revenues during the next five years.”

Key Insights :

Overall Market Demographics :

- Salaried employees are the largest consumer group of OTT users, followed by students, business owners, housewives, and others.

- More than one-third of the respondents indicated that they’re inclined to use free services only, while another one-third indicated that they’re paying for the subscription. Remaining respondents were either on a trial period or indicated that their friend or family pays for the subscription cost.

- The smartphone is the most popular device for OTT video content consumption. Xiaomi is the most popular smartphone brand among OTT users.

- Jio is the most popular network among OTT users in India, followed by Airtel and Vodafone-Idea.

- The most preferred language for video content is Hindi and English. Among regional languages, Telegu was found to be most popular, followed by Punjabi, Bengali, Marathi, Tamil, and others.

- Action and Comedy are the most preferred genres. While preference for Action was highest among male users, Drama and Romantic genre content was found to be most popular among female users.

OTT Video Content Platform Analysis :

- Local player Hotstar leads the market at present, with a sharp focus on cricket and content partnerships. According to our survey, 56% of Hotstar’s users hail from metro cities. The platform also has the highest penetration of non-paying users.

- Netflix and Amazon’s Prime Video were found to be highly popular in metros. Top 5 metros account for more than 65% users of these platforms. This was highest as compared to all other major platforms. These two platforms also have the highest penetration of salaried employees.

- However, SonyLIV scores highest among Tier-I cities. More than 40% of SonyLIV users are from Tier I cities.

- Voot has the highest penetration of female users. It also has the highest penetration of young users aged between 16-24 years.

- ALTBalaji scored highest among 25-35 age group users, which account for 59% of its users. Also, the platform is highly popular in Kolkata, with more than one-third of its users from Kolkata alone. This was the highest among all major platforms.

- ErosNow has the largest share (59%) of its users in the 25-39 age bracket in Tier II/III cities, highest among all major OTT platforms.