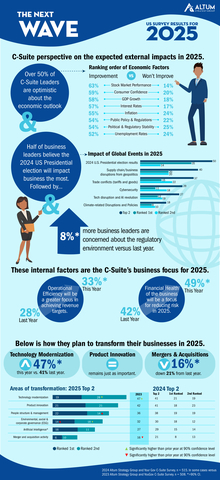

Altum Strategy Group’s and YouGov’s 2025 Next Wave Survey reveals key insights into the factors shaping business leaders’ strategies for the coming year, from global events to internal transformation priorities.

Next New Wave 2025 Survey Results Infographic from Altum Strategy Group. (Graphic: Business Wire)

“As we head into 2025, optimism and uncertainty are two sides of the same coin for the U.S. C-suite”

The survey found that half of U.S. business leaders anticipate that the results of the 2024 U.S. presidential election will significantly impact their businesses in 2025. Additionally, 40% of leaders are concerned about supply chain disruptions and business disruptions due to geopolitics, while 37% cite trade conflicts as key risks. These uncertainties underscore the need for adaptability and strategic planning in an evolving global context.

“As we head into 2025, optimism and uncertainty are two sides of the same coin for the U.S. C-suite,” said Matthew Gantner, CEO, Founder of Altum Strategy Group. “Navigating the challenges posed by global events and regulatory changes requires strategic foresight and a commitment to innovation. Additionally, business leaders are looking to balance resilience with transformation by focusing on financial health, operational efficiency, and technology modernization.”

Regulatory Challenges

Over half of business leaders remain optimistic about the economic outlook for 2025, particularly in larger companies. However, concerns over the regulatory environment are growing, with 34% identifying regulation as a top revenue challenge, up from 26% last year (>90%CI). Balancing economic optimism with regulatory preparedness will be a top priority.

Financial Health and Efficiency

The financial health of businesses emerges as the leading internal concern for 2025, with 49% of business leaders citing it as a critical risk, up from 42% in 2024 (weighted score; 90% CI). Operational efficiency is also gaining attention, with 33% (versus 28% in 2024; weighted score; 90% CI) identifying it as a top internal factor impacting revenue, emphasizing the importance of strengthening internal processes to mitigate risks and drive performance.

Tech Modernization

Technology modernization leads business transformation strategies for 2025, with 47% of leaders prioritizing it, up from 41% in 2024 (>90%CI). This shift is accompanied by a growing focus on AI transformation and product innovation, reflecting the need for businesses to remain competitive in a tech-driven marketplace.

Innovation over M&A for 2025 Growth

While mergers and acquisitions (M&A) as a transformation strategy have declined to 16% (down from 21% last year; > 90%CI), 42% of leaders are prioritizing product innovation to drive growth. This shift underscores a focus on developing new offerings and enhancing existing products to stay competitive in 2025.

The 2025 Next Wave Survey highlights the dual forces of optimism and uncertainty shaping the C-suite’s outlook. Business leaders are focusing on financial health, operational efficiency, and technological modernization while preparing for potential disruptions from global events and regulatory changes. This approach will ensure businesses are equipped to navigate risks and seize opportunities in the year ahead.