Uber reported fourth-quarter earnings after the bell on Wednesday. The company beat analyst estimates on revenue for the quarter and said it’s starting to bounce back from headwinds caused by the omicron coronavirus surge.

The company’s stock was up more than 6% in after-hours trading.

Here are the key numbers:

- Earnings per share: 44 cents

- Revenue: $5.78 billion vs. $5.34 billion, according to a Refinitiv survey of analysts.

The company reported a net income of $892 million, which includes a $1.4 billion net benefit, pretax, related to its equity investments. Uber’s EPS of 44 cents includes that big investment gain. Excluding it, Uber posted a loss of 26 cents per share, adjusted, according to Refinitiv, beating Wall Street expectations of a 35 cent loss per share.

Its adjusted EBITDA, or earnings before interest, taxes, depreciation and amortization, was $86 million. That’s up $540 million from the same quarter a year ago.

Here’s how Uber’s largest business segments performed in the fourth quarter of 2021:

- Mobility (gross bookings): $11.3 billion, up 67% year-over-year

- Delivery (gross bookings): $13.4 billion, up 34% year-over-year

The company’s delivery segment, which includes its Uber Eats business, has continued to hold up as food delivery becomes a part of regular life. In an update to shareholders, the company said that its number of delivery merchants grew to more than 825,000. Delivery revenue of $2.42 billion outperformed the $2.28 billion generated by its core ride-hailing business. Freight revenue was up 245% year-over-year to $1.08 billion.

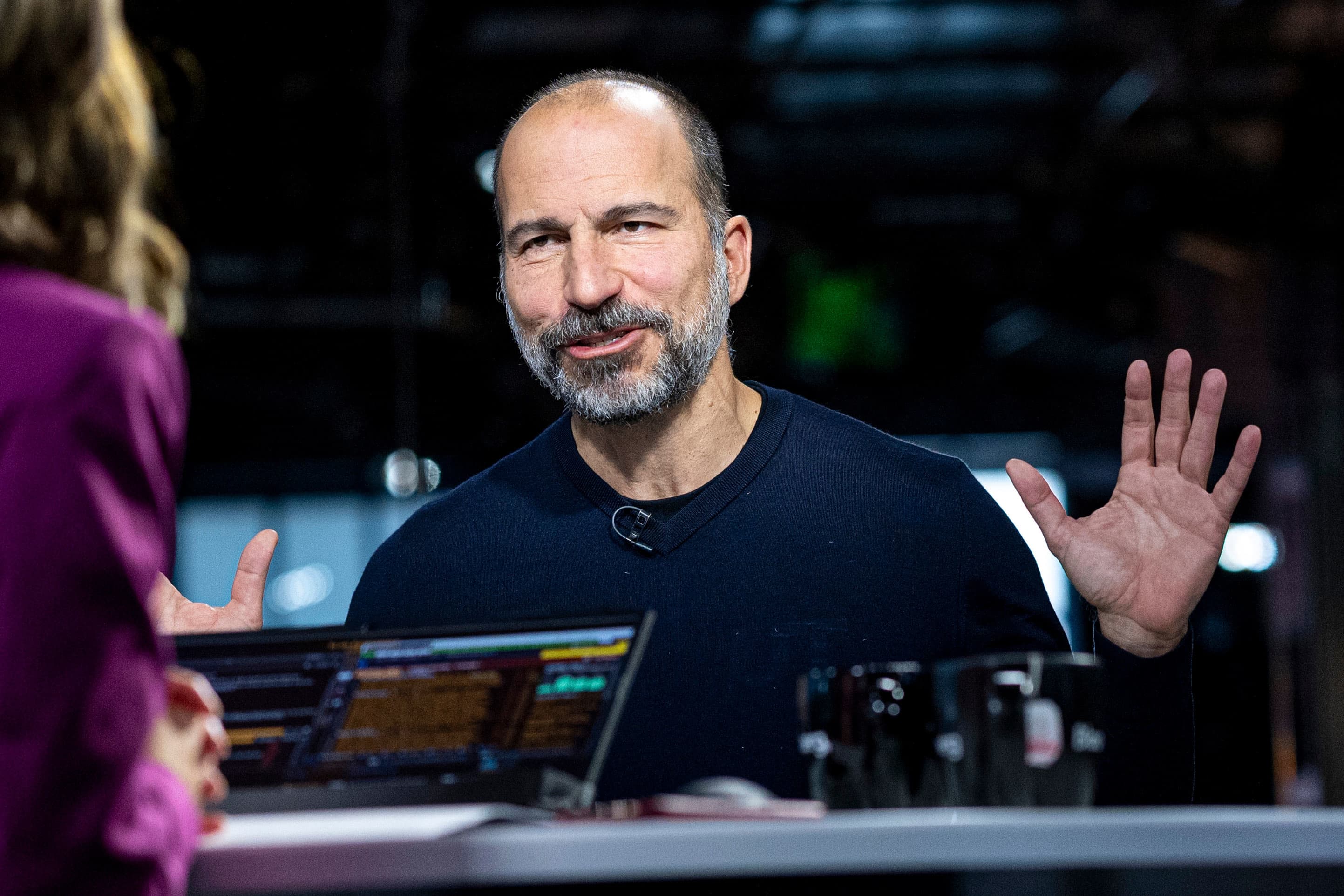

In a statement, Uber CEO Dara Khosrowshahi said the omicron coronavirus variant weighed on its business, but numbers are quickly recovering.

“While the Omicron variant began to impact our business in late December, Mobility is already starting to bounce back, with Gross Bookings up 25% month-on-month in the most recent week,” Khosrowshahi said.

During the company’s earnings call, Khosrowshahi added the company has maintained a strong driver supply even with the pandemic surge, which has led to shorter wait times and fewer surge pricing instances.

Uber reported 1.77 billion trips on the platform during the quarter, up 8% from the prior quarter and 23% from 2020. Monthly active platform consumers reached 118 million, also up 8% in the quarter. Drivers and couriers earned an aggregate $9.5 billion in the quarter.

Khosrowshahi said the company is working to add more workers who drive across its whole platform, instead of solely Eats or rides.

Another marker of pandemic recovery, airport gross bookings represented 13% of Uber’s mobility gross bookings. That marks a 24% increase over the third quarter and nearly 200% from the same period a year ago.

For its first quarter of 2022, Uber said it is projecting gross bookings of $25 billion to $26 billion. It anticipates adjusted EBITDA of $100 million to $130 million.

Executives briefly touched on the growing area of ultrafast delivery during the company’s call. Venture capitalists have poured funding into companies promising customers their orders within extremely short time frames, like 10 to 15 minutes. Uber CFO Nelson Chai said the company is doing some testing but is mostly focusing on partnerships.

Uber’s largest American competitor, Lyft, reported its fourth-quarter financials Tuesday. The company beat estimates on adjusted earnings per share and revenue but said it had fewer active riders than in the prior quarter. It also warned that omicron was weighing on its first-quarter results.