Varo Bank, which last year became the first U.S. neobank to be granted a national bank charter, announced this morning it’s raised another $63 million in new funding. The round was led by NBA star Russell Westbrook, who will also join the startup as an advisor focused on the direction of Varo Bank’s programs aimed at underserved communities, including communities of color.

Westbrook’s investment came through Russell Westbrook Enterprises, which previously backed social avatar startup Genies.

Existing Varo Bank investors also joined the round, including Warburg Pincus, The Rise Fund, Gallatin Point Capital, HarbourVest Partners, and funds managed by BlackRock. Varo Bank last year raised $241 million in Series D funding. With the additional funds, Varo Bank’s total raise to date is now $482.4 million.

Founded in 2017, Varo Bank competes with a growing number of all-digital banks operating in the U.S., including Chime, Current, N26, Level, Step, Moven, Empower Finance, Dave, GoBank, Aspiration, Stash, Zero, and others.

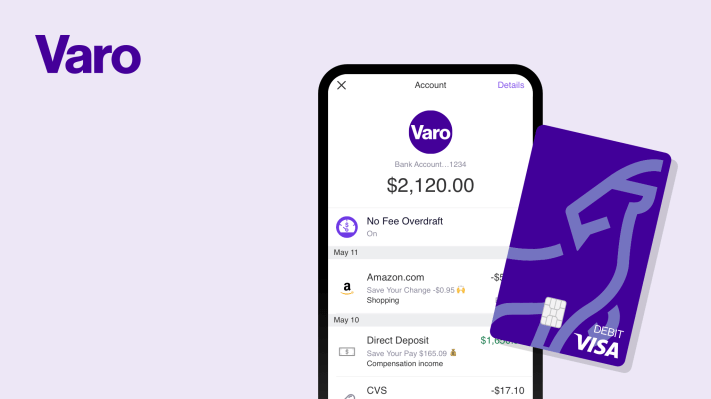

Like most neobanks, Varo Bank offers an easily accessible bank account with no monthly fees or minimum balance requirements, and a modern mobile app experience. It also includes high-interest savings and provides customers with access to a network of 55,000 fee-free Allpoint ATMs. But Varo Bank doesn’t have any physical bank branches.

Varo announced last year it had been granted a national bank charter from the Office of the Comptroller of the Currency (OCC) and secured regulatory approvals from the FDIC and Federal Reserve to open Varo Bank, N.A. — effectively becoming a “real” bank.

Today, Varo Bank has over 3 million bank accounts, and says it’s deposits are up by over 900% year-over-year. Spend on the Varo platform is also up by over 300%, year-over-year.

Westbrook’s interest in working with Varo Bank has to do with its focus on making an impact on financial inequality through its banking services. Specifically, the company is committed to bringing up to two-day early payroll deposits, savings accounts that pay higher rates than the national average, and a short-term cash advance line of credit, Varo Advance, that gives qualifying customers access to up to $100 as needed in the Varo Bank app. The credit line was launched in Dec. 2020, and remains fee-free through March 2021 due to the COVID-19 pandemic.

The new funds will be used to expand Varo Bank’s services, as well as work with Westbrook to co-create a community impact program that focuses on building financial literacy in underserved communities, the company told TechCrunch.

“The banking system has ignored or underserved a large portion of the American population – particularly communities of color. I’m passionate about making lasting social change and creating a stronger and more inclusive system,” said Mr. Westbrook, in a statement about his investment. “I am excited and ready to work with Varo to be a part of an economic revitalization for those who never had the access they deserved,” he added.

Russell Westbrook Enterprises, who was exclusively advised by Jefferies LLC in this transaction, the company noted.