In the vast and often complicated universe of digital payments, peer-to-peer (P2P) payments platforms have emerged as popular, user-friendly services with rapidly growing user bases. From PayPal’s Venmo to Square’s Cash App, P2P payment apps offer consumers an easy way to send money to other people quickly and usually for free.

As the P2P space matures, the utility of these payment apps are expanding beyond split checks and farther into the business realm, as illustrated by PayPal’s Venmo for Business portfolio.

With 70 million users, Venmo is the darling of PayPal’s product portfolio and the undisputed leader in the P2P payments space. The social payments platform processed $47 billion of the company’s total payment volume in PayPal’s fourth quarter, representing a growth of 60% year over year.

PayPal has slowly introduced more business functions within Venmo, starting with the ability for users to pay select businesses with Venmo through the Braintree platform. In 2017, PayPal expanded this functionality and enabled Venmo payments at millions of US merchants, giving consumers the ability to choose either PayPal or Venmo as a payment option at checkout.

When a merchant enables Venmo as a checkout option, Venmo users can pay for goods or services using their app balance or linked cards and bank accounts anywhere PayPal is accepted in the US via the mobile web and desktop. More than two million merchants, including Lyft, Uber, StitchFix, and Pottery Barn, currently offer consumers the ability to pay with Venmo at checkout.

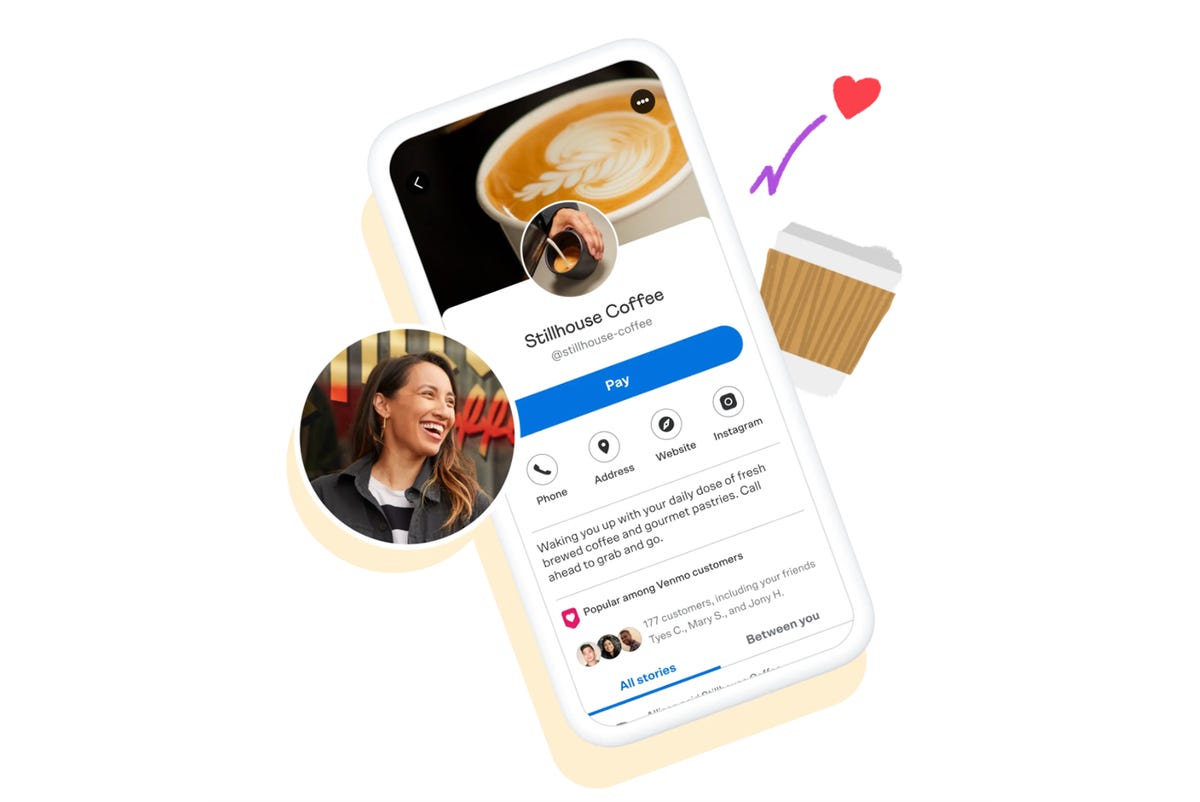

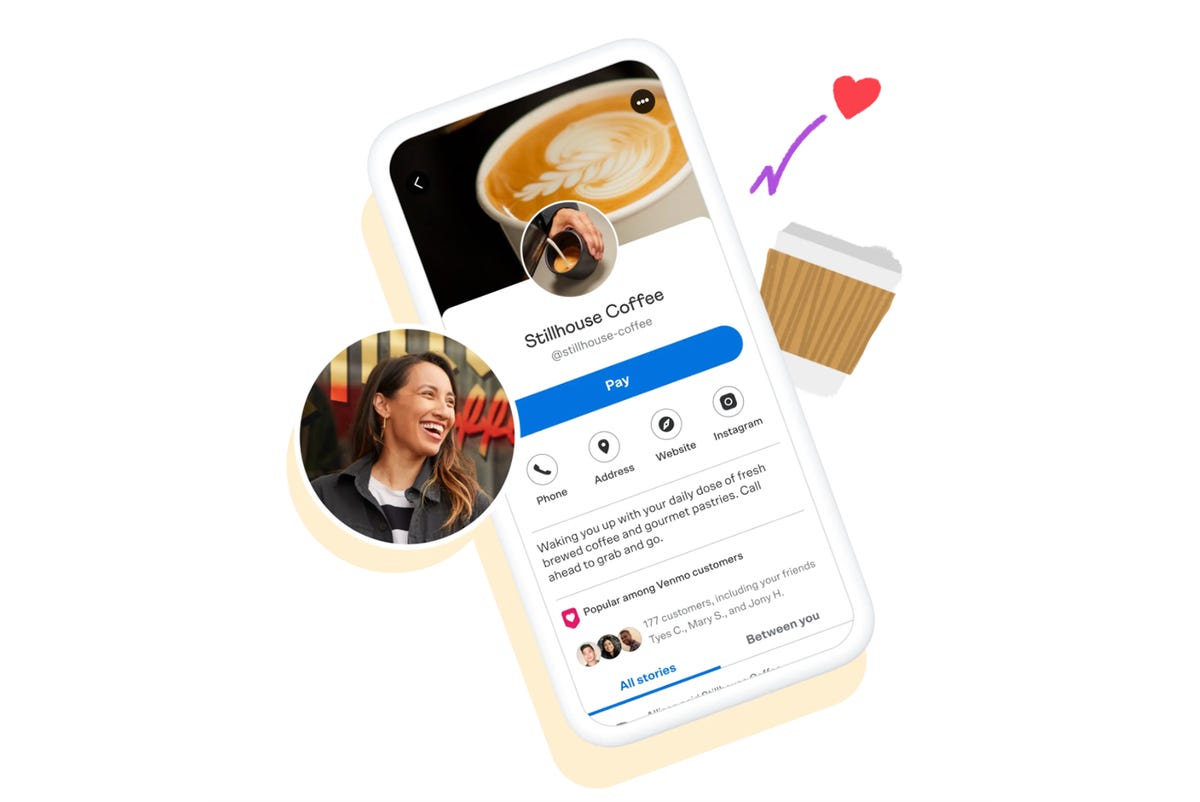

Last July, PayPal launched Business Profiles on Venmo as a pilot to give sole proprietors and casual sellers the ability to accept payments for goods and services via the Venmo app. In February, PayPal expanded the tool’s availability to all small businesses, and more than 150,000 businesses are signed up already.

There’s a lot to understand about Venmo for Business beyond the basics of P2P payments and payment acceptance. Here’s a breakdown of everything you need to know about Venmo for Business.

What is Venmo for Business?

The Venmo for Business portfolio includes both Business Profiles on the Venmo app — geared toward small businesses and casual sellers — and the ability to pay with Venmo, a feature aimed at small to large merchants.

With Business Profiles, Venmo is targeting small sellers or people with side hustles — such as dog walkers, landscapers, local artists, and crafters — who already use Venmo in a personal capacity to accept payments. The Business Profile lets these sellers separate their personal and business transactions for better bookkeeping and tracking, but also gives them a space to share details like the address, phone number, email, and website associated with their business.

Meanwhile, the Pay with Venmo experience is essentially a service for established merchants looking to offer Venmo as a payment option at checkout.

One of the key differences between Business Profiles and Pay with Venmo is that the latter is designed for payments made online or in-app. To accept Venmo online or in-app, merchants have to go through either PayPal or Braintree as their payment gateway. The Business Profile service is best suited for in-person Venmo acceptance and does not require the extra step of the payments gateway.

How does Venmo for Business work?

The Pay with Venmo option for merchants and sellers is tied to the PayPal Checkout service. PayPal has said that the addition of Venmo to a merchant’s website does not require additional integration work on the merchant’s part. Instead, the company said it relies on its existing platform architecture to enable Venmo as a payment method, mirroring the company’s approach to expanding One Touch.

The first step in getting PayPal Checkout is to sign up for a PayPal Business account. Then, you can work with one of the e-commerce platform providers that has PayPal Checkout integrated into its platform, or work with a developer to integrate PayPal Checkout into your website or app. Once enabled, cookied Venmo users will see Venmo as an option at checkout, and from there, they can just tap the Venmo button and complete the payment.

The process to set up a Business Profile is dramatically simplified. Existing Venmo account holders can search for the “Business Profile” option in the Venmo app’s main menu to begin the process. Venmo will ask for key business information, such as a unique name and Venmo username for the business, a description of the business, the business category, contact methods, and business address.

For registered businesses, Venmo will also ask for the legal business name and address, the Employer Identification Number (EIN), registration type, phone number, and business contact’s address. Once the business profile is published, you can add and edit a business photo and begin taking payments.

To accept payments, sellers are assigned a business-specific Venmo QR Code, which can be printed out and displayed at the point-of-sale for customers to scan with their phone, or sent directly via email, text, or AirDrop (iOS only) to provide a direct link to the Business Profile.

The fee structure is similar for both Pay with Venmo and Business Profiles. Pay with Venmo has the standard PayPal fee of 2.9% plus $.30 for each transaction. The Business Profiles fee is slightly less, with sellers charged 1.9% plus $0.10 of the payment.

Business features in Venmo for Business

One of PayPal’s biggest assets for the Venmo for Business portfolio is its own customer base of more than 377 million active users and 29 million merchants around the globe, as well as its existing infrastructure in over 200 markets. The pitch is that merchants can extend their reach globally by tapping into the convenience and ubiquity of PayPal’s payments infrastructure across the web.

Because Venmo is a social payments platform, sellers also have the opportunity to draw attention to their business through Venmo’s social feed and search. Once a payment is complete, it appears on an overall feed and a customer’s individual feed (depending on one’s privacy settings), increasing exposure of your brand or business amongst other Venmo users. PayPal said Venmo users tend to be highly engaged and on average check the app two to three times a week.

What’s more, the Business Profiles give smaller sellers a way to do business without establishing a formal web presence, like a full-blown website, Facebook Page, or Google Business listing. Venmo users can find a business profile by searching for a specific business name or username, but sellers can also share the profile on social media and other platforms outside Venmo for more visibility.

The takeaway

Whether it’s opting for the full PayPal Checkout experience or enabling Venmo acceptance with a Business Profile, the common benefit is really about offering customers as many options to pay as possible.

Business Profiles are a relatively simple way for casual sellers to accept payments without signing up for a formal payments processor or point-of-sale provider.

Similarly, offering Venmo at checkout gives merchants the ability to offer consumers more choice and reach a larger demographic, particularly millennials and Gen Z. According to data released by the Census Bureau last year, more than half of the nation’s total population are now members of the millennial generation or younger. When combined, the millennial and Gen Z populations total around 166 million consumers. The Venmo brand has seen the most traction among these younger populations.

PayPal also did a study of Venmo customers and found that nearly half (47%) of customers are interested in using Venmo as a payment method when checking out with merchants, and that 89% of customers prefer to pay with Venmo because they trust the brand, it’s easy to use and because it allows them to split transactions.