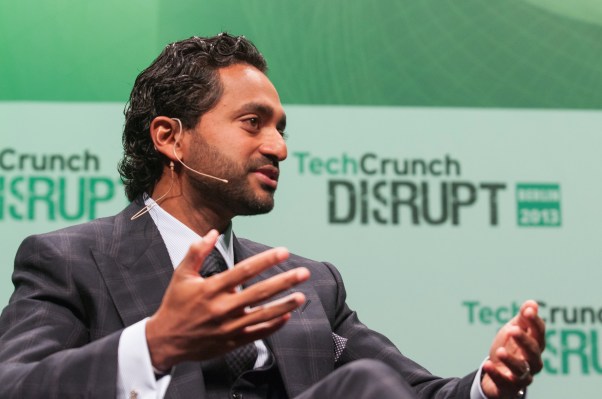

The man who arguably ushered in the current SPAC rush with the merger of Virgin Galactic with his Social Capital Hedosophia holding company has divested the remainder of his personal holdings in the space tourism company. Chamath Palihapitiya, who serves as the chairman of Virgin Galactic’s board, still holds 6.2% ownership in the company in partnership with investor Ian Osborne, but his solo holdings are now at zero.

Palihapitiya provided the following statement to TechCrunch via Virgin Galactic:

I sold 6M shares for $200M which I am planning to redirect into a large investment I am making towards fighting climate change. The details of this investment will be made public in the next few months. I remain as dedicated as ever to Virgin Galactic’s team, mission and prospects.

Palihapitiya sold 3.8 million shares in December 2020, noting that he was selling that equity “to help manage [his] liquidity” in order to provide funding for “several new projects starting in 2021.” At the time, Palihapitiya said he “remained committed and excited fore the future of SPCE [Virgin Galactic’s stock ticker on the NYSE].”

The sale this week comprised 6.2 million shares, netting Palihapitiya roughly $213 million in the process.

Virgin Galactic has had some setbacks in its testing program that pushed the projected date of its first paying commercial tourists flights out into 2022, from an earlier target of sometime this year. The company installed Disney Parks leader Michael Colglazier as its new CEO last July, replacing George Whitesides, who moved into a chief space officer role, before it was revealed Thursday that he’s departing the company. Whitesides’ decision is said to be due to a desire to pursue public service opportunities.

Space as a sector has been a hotbed of SPAC activity of late, with mergers from a number of companies including Astra, Spire, Rocket Lab, BlackSky and Momentus announced over the course of the past year. Virgin Galactic, as one of the earliest, will be closely watched by anyone looking for a yardstick by which to measure the tactic. The company’s share value is down just over 5% pre-market, and has been on a steady decline since reaching an all-time peak around mid-February.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.