Some types of financing — such as personal loans or mortgages — may also be out of reach for someone who doesn’t have a good credit history,

Money, loans, and credit aren’t always comfortable or interesting topics to discuss, but understanding how credit scores and reports work can be critical to your personal financial success.

Most of our education systems don’t emphasize financial literacy. We may learn the Pythagorean Theorem as teenagers, but not the basics of managing money, much less how a credit card works or what a credit score is. For many young people starting their professional life, knowing how to manage money is far more important than knowing how to determine the angle and sides of a triangle.

When it came to credit cards, what was drilled into my head was: “If you can’t afford it, you don’t buy it.” Furthermore, as a golden rule, I was taught never to use this payment method, as credit was viewed simply as a gateway to debt.

For affordability, that’s sound advice. Still, as I found to my detriment when I tried to sign up for my first mobile phone contract (and was rejected as I had no “proof” that I was “creditworthy”), it’s far more beneficial to manage affordability and at the same time build a strong credit history and score.

And, the earlier you can start, the better.

A credit score is more than just a three-digit number. It has far more meaning than you may realize as life-changing events, such as buying a house or a car, are made possible (or can be denied) based on how credit agencies interpret your score and, therefore, how lenders view you as a credit risk.

Here’s what you need to know about credit scores, credit files, and how to either build or repair your existing credit score.

What is a credit score?

A credit score is a three-digit number, between 300 and 850 in the US, (or between 0 and 999 in some countries), intended to represent your “creditworthiness.” This term is used to describe how likely you are to stick to financial agreements.

Your credit score predicts your financial responsibility and the likelihood of you paying back a loan, and on time.

Credit scores are used to help companies decide whether to offer you mortgages, vehicle financing, credit cards, personal loans, Buy Now Pay Later (BNPL) services, and other forms of finance.

Who gives you a credit score? How are they assessed?

Credit bureaus and lenders may vary in how they assign credit scores and what influences are used to come up with a number. Mathematical models, from such firms as FICO or VantageScore in the United States, determine your score.

As noted by Equifax, most bureaus use models and ratings similar to these:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very good

- 800-850: Excellent

In the UK, there is no universal credit score, so score ranges are different between the three credit reference agencies, TransUnion, Experian and Equifax:

- 0-710: TransUnion

- 0-999: Experian

- 0-1,000: Equifax

As a general rule, the higher your credit score, the better.

Credit scores are determined through your financial history, existing credit accounts, the number of credit lines you have open to you, and the overall amount of debt you have.

There are three main bureaus in the US and UK: TransUnion, Equifax and Experian. Not every lender, however, reports to these credit reference agencies and so you may find discrepancies between different credit report companies when you check your score.

As an example, FICO will determine your credit score based on the following factors (although other models may use different percentages):

- Payment history: 35%

- Amounts owed: 30%

- Length of credit history: 15%

- Credit mix: 10%

- New credit: 10%

In addition, some credit report companies may only pull data from one or two bureaus, or take a mix of all three. Therefore, looking up your credit score can only provide a rough guide to your “actual” credit score and creditworthiness, as it doesn’t really exist as a single figure.

Are credit reports and credit scores the same thing?

Confusing a credit report and a credit score is an easy mistake to make.

A credit score is a three-digit number representing your creditworthiness based on an evaluation of your credit report. A credit report offers a deep delve into someone’s financial history.

A credit report will list personal information and “influences” that impact your credit score, both positive and negative aspects. This includes:

- Personal information such as name, Social Security number (or UK National Insurance), date of birth

- Linked current and former addresses

- Credit applications

- The average credit account age of existing services (such as credit cards)

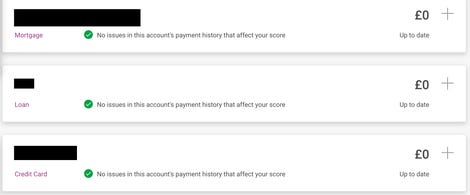

- Accounts, whether active, settled, or defaulted, and their balances

- Total borrowing levels

- Child support records

- Voter registration (in some countries, whether you are registered with an address to vote can have a positive impact, such as through the UK’s electoral roll)

In the past, your credit report would be provided to you in one lengthy document, but today you can access mobile and web portals which have a more user-friendly interface and that will show you any alerts or problems with current lending arrangements.

As lenders will often update credit agencies monthly, or whenever a significant change occurs, credit report updates can take a while to appear.

Some agencies will also provide “action plans” when a user views their report which offers advice on boosting credit scores over time.

A note about credit reports and fraud

Credit reports can be a real asset for personal security today.

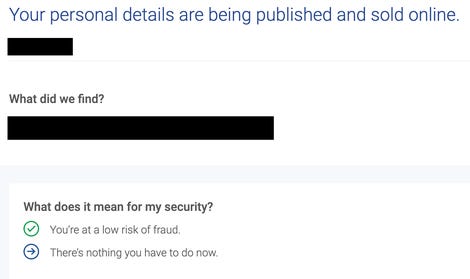

Unfortunately, it seems that every week we hear of a new data breach impacting an enterprise organization. When these incidents occur, consumer personally identifiable information, or PII, is often stolen, sold or leaked online.

This information may include names, physical addresses, email addresses, dates of birth, telephone numbers, Social Security or National Insurance numbers, scanned copies of ID cards, and payment card data.

These datasets can be used to perform social engineering, to potentially clone cards for making fraudulent purchases, or for ID theft, which can seriously impact your credit score.

A cybercriminal may take out loans or financing in your name that you are unaware of, for example, as long as they have the right information.

In the last few years, some credit agencies have begun linking credit reports to data leaks online and performing scans on their customer’s behalf, alerting them to any detections concerning the sale or leak of PII. When you become part of a company data breach, the victim firm will also often offer free credit monitoring as a way of apology to customers.

What are soft and hard checks?

When you apply for new credit, such as a credit card, a loan, or a BNPL service, the lender may check your credit history.

These checks are defined as soft and hard checks. Lenders, employers and other services require your permission to perform either check.

- Soft: A soft check (or soft pull) is common for credit pre-approval processes and BNPL. For example, you could run a pre-approval check before formally applying for a loan to get an idea of whether or not you are likely to be accepted. Still, as they aren’t usually part of the process for specific lending applications and don’t have anything to do with your potential risk as a borrower, they won’t impact your credit score.

Soft pulls will be visible on your credit report, though.

- Hard: A hard check (or hard pull) is usually linked to a specific credit application, whether for a car, a personal loan, a student loan, a mortgage or another form of financing.

Companies performing these inquiries ask for access to your credit report to determine your creditworthiness, to see if you’ve recently applied for other lines of credit, and whether or not you have defaulted on past loans.

Hard checks are associated with more significant forms of borrowing, where the risk to the lender may be higher if you default.

As an example, hard pulls are standard during the mortgage approval process. If lenders see a litany of missed loan payments on your credit file, for example, they may consider you too much of a financial risk to accept or impose higher interest rates.

Hard checks will typically impact your credit score and may lower it by a few points, but this is temporary and shouldn’t be of enormous concern. The caveat is that if you are applying for credit numerous times in a short period, the cumulative effect of hard checks could be more obvious.

Experian reports that a single hard check may impact your credit score by five points or less.

Hard checks may stay on your report for up to two years and become part of a timeline for when you have applied for credit — a factor that other lenders may consider when they perform their own checks in the future.

See also: The 5 best credit cards you can (and should) keep forever | How to build good credit during college

How can I check my credit score?

Requesting your credit score or report will not lower your score.

You shouldn’t be frightened at the prospect of checking your credit file — and by keeping a close eye on your report, you may be able to catch any signs of fraud or ID theft early, actually being of benefit to keeping your score in check.

Many credit reporting agencies offer consumers free and paid options to check their credit scores.

- You can request a copy of your credit report for free from the major bureaus — Equifax, Experian and TransUnion — via Annualcreditreport.com. At the time of writing, due to the COVID-19 pandemic, free reports are being offered weekly.

- You can also go directly to each agency and request either a free report or sign up for premium services which may include alerts, suggestions for credit score improvement, and other services.

- Capital One CreditWise: a free service (for customers and non-customers) to receive credit report alerts.

- UK consumers can visit Clearscore, Experian, MSE Credit Club or Checkmyfile.

What is the average credit score and does it matter?

The average FICO score in the US is 714, according to Experian, although this varies between states. In the UK, this number is 797.

They might seem high, so if your score is on the lower end, don’t worry. It takes time to build up a good credit history — for example, you couldn’t expect an 18-year-old to have the same score as someone who has been financially responsible for years and is in the 55+ age bracket.

What can a good credit score do for me?

If you have built up a reasonable credit score — generally speaking, “good” and above — this could mean that you are accepted for higher loan amounts and on more favorable repayment terms.

For example, two people could apply for vehicle finance. One has an “excellent” credit score, whereas the other has a “poor” rating. The candidate with an excellent score will be able to sign the deal with better credit terms, including a lower interest rate on the loan, and, therefore, will pay less throughout the agreement.

However, the candidate with a poor score may be considered more of a financial risk and so may have to agree to a higher annual percentage rate (APR) with less flexible payment terms — likely paying more in the long run.

Some types of financing may also be out of reach for someone who doesn’t have a good credit history, such as personal loans or mortgages.

What can harm my credit score?

In general, issues that can negatively impact your credit score are:

- Failing to pay bills on time: A poor financial history that includes missed payments can indicate financial risk to lenders.

- Defaulting: Defaulting on past loans and bills can be a serious red flag for lenders.

- Hard inquiries: While a few may have a negligible — and temporary — impact on your credit score, too many hard inquiries in a short space of time could lead a lender to believe you may have financial management issues.

- Young credit lines: The age of your existing financial ties — including credit cards — if they are all new can negatively impact a credit score. (On the other hand, if you’ve proven you can manage credit well over several years, this is a positive sign to lenders.)

- A lack of diversity: Having a mix of credit lines, including credit cards, a vehicle, a mortgage, a student loan, or service contracts, can indicate that you are responsibly managing various credit types and this could be a positive influence on credit scores. (However, it is more important that you pay what you have on time than spreading yourself thin by taking on credit lines you don’t need.)

- Relying on credit 24/7: If you’re finding yourself relying on credit month-to-month, and this is obvious in your credit report, this can signal to lenders that there may be deeper financial issues that need addressing. As a general rule, if you’re using a high percentage of your available credit, then this credit utilization may bring down your overall score.

What are CCJs, defaults and court judgments?

So-called “adverse events” can severely impact your credit score for a long time and may prevent you from being accepted for loans, new bank accounts, service contracts, and other types of financing.

“Adverse events” include financial or legal problems of note, such as county court judgments (CCJs) and/or civil case judgments, bankruptcies, individual voluntary arrangements (IVAs), serious loan defaults, foreclosures, and other problems in the public record.

Legal judgments, such as when someone sues you over an outstanding debt and wins, may stay on your report for six to seven years, depending on the country. Civil judgments now have to meet new legal criteria in some countries to be included in your report — for example, in the United States, due to the Fair Credit Reporting Act — and it may also be possible to appeal for civil records to be removed from your file if you believe they are wrong or unfair.

According to Lexington Law, some states require judgments to be removed from credit files once debts are paid.

Tax liens, which are legal claims on your assets, also used to be featured on credit reports. Bankruptcy filings, however, may still appear for up to a decade.

Even if you have severe marks against your credit, and will have them for a while, it doesn’t mean you can’t improve your credit score until they expire — although they may undermine just how far it can be improved.

How do linked addresses and people affect my credit?

An important but sometimes overlooked area of your overall chances of obtaining credit is the linked addresses and financial ties to other people contained in your credit file.

Individuals you have financial ties with — whether through joint bank accounts, business ventures, or legal judgments — may be connected to your credit report.

While simple connections may not officially impact your credit score, some organizations might consider your existing and past financial associations when they are making a lending decision.

It’s not that getting married, for example, means that you both now have a merged credit score. Rather, opening a bank account or jointly applying for credit means that lenders could look at both of you and your spouse and consider both of your credit histories.

You should, however, be cautious if, and when, you decide to tie yourself financially to someone. Say you have a housemate and you are both jointly responsible for paying a bill. If your housemate refuses to pay, this could appear on both of your credit files and, thereby, negatively impact your scores.

What about Buy Now, Pay Later (BNPL)?

While standard loans and financial agreements often impact your credit score, BNPL is a different breed of financial product.

BNPL providers, such as Klarna or Afterpay, will often only perform a soft check — if any at all — and will not generally report payments to credit bureaus. The caveat, however, is that late payments may negatively impact your credit score.

See also: Buy Now, Pay Later: Flexible payments for inflationary times, or a road to debt?

How can I repair, or build, my credit score?

- Find out your current credit score: The first thing you need to do is find out where you stand. Request your credit report from at least one credit monitoring agency, if not all of the three main providers, TransUnion, Equifax and Experian.

- Make sure your information is accurate and up to date: Inaccuracies or old information can have a detrimental impact on your score, especially if any inaccurate accounts or financial ties listed reflect badly on you. If you find anything suspicious or wrong on your report, contact the credit reference agency with an amendment request. In addition, if your credit report doesn’t include an up-to-date home address, you should address this too.

Author’s note: As a personal example, my credit score jumped up several hundred points overnight once my address was updated, and all it took was a five-minute online correction request.

- Deal with outstanding bills first: As such a high percentage of your credit score is based on payment history and amounts owed, you should focus first on tackling any outstanding or late bills and debts.

- Consider your credit utilization: If you have an available credit balance of $1,000, and you use $300, your credit utilization is 30%, in which you have credit available and what percentage you use. If possible, try to keep your percentage in the single digits. For more information, read: Why is credit utilization such a big deal?

- Snowballs or an avalanche: To reduce your debts and bring your credit utilization ratio down, there are two methods to consider. If you are paying multiple debts at the same time, the interest added on can become painful — and so it is worth considering either using a snowball or avalanche tactic. Both require you to pay a minimum amount on all of your debts except one.

- Avalanche: Any extra cash goes to the highest interest-rate debt first, and then the next highest interest-rate debt, and so on.

- Snowball: You tackle the smallest debts first to reduce the overall number of outstanding debts you have.

Either method has merit, and overall, can be used as debt-reduction strategies that could eventually mean you have more disposable income and less credit utilization. It might also be worth using balance transfer cards, which often offer a zero- or low-percent APR, to help you deal with high APR debts.

- Work with lenders and consider debt consolidation: If you’re struggling to stay current on your bills and financial agreements, you should consider contacting your lenders and see if they can offer you reduced payments to get back on track — and stop more late or missed payment notices appearing on your credit file.

- Credit counseling services can also help walk you through your credit problems and offer advice, or may potentially act on your behalf. The US Department of Justice has provided a list of approved agencies, accessible here, and UK consumers should contact Citizens Advice or StepChange.

- Consider the careful use of credit-building cards: You must be careful if you go down the credit-building card route, but if performed responsibly, you can improve your credit score relatively quickly. A note of caution: these credit cards generally have a very high interest rate and so to use them effectively, the best method is to make frequent, small purchases and pay them off immediately.

Author’s note: This is not financial advice, however, as an example, I used to have a credit score in the 300s as I had few financial agreements, an overdraft dispute hanging over my head, and little credit history. I applied for two high-interest credit building cards, from Luma and Barclays, and used each one, once a month, on shopping essentials. I paid each card off in full the next day without fail and repeated this process for roughly two years. They contributed to a massive improvement in my credit score.

- Should you leave a balance on your credit score? There is some speculation that leaving a balance on your credit cards builds your credit score. However, it can also be argued that paying off in full each month shows you can “settle” your accounts, and if you leave balances, this may not do your credit score any favors — and they might actually pile up.

- Secured cards: In the US, secured cards may come in handy to rebuild your credit. They can be used in the same way as typical credit cards but require a deposit, which reduces the risk to the issuer, and by making a small purchase and then paying it off in full, you can begin building a credit history.

- Don’t cut up those old cards: It might be tempting to clear your outstanding credit card balances and then cut up the cards. However, if you don’t consider overspending a challenge, leave those credit accounts open. Having older credit lines rather than opening and closing new ones frequently may improve your credit score.

- Utilities, telecoms contracts, and more: In some countries, such as the UK, mobile phone contracts and similar contracts often appear on credit scores and can be used — at least, marginally — to improve your score. However, this hasn’t really been the case in every country, including the US, although some credit agencies are capitalizing on this with services that allow you to boost your credit with payments made to these popular services. An example is Experian Boost, a free service that will include on-time payments made to services including Netflix, Disney+, AT&T and Verizon to bump up a credit score. (However, this only impacts Experian credit scores.)

Should I use a credit repair company?

You see the adverts online and on television, with companies promising a quick boost and fix of your credit score in return for a fee. As noted by the US Federal Trade Commission (FTC), there’s no quick fix for credit score repair and many of these organizations are likely trying to scam you.

There have even been investigations launched by the FTC into the deceptive practices of credit repair companies.

However, some legitimate firms and charities out there provide credit score coaching and mentorship, such as Operation Hope and the National Foundation for Credit Counseling (NFCC), rather than promising to remove negative influences on your credit report overnight. They may also take on disputes on your behalf, such as requests to remove debts or legal judgments that don’t belong to you.

“The fact is there’s no quick fix for creditworthiness,” the FTC says. “You can improve your credit report legitimately, but it takes time, a conscious effort, and sticking to a personal debt repayment plan.”