Djamo, a financial super app for consumers in Francophone Africa, is the first startup from Ivory Coast to get backing from Y Combinator.

While there has been a huge profusion of financial services that have emerged in recent years in Africa, Djamo’s mission is to try to plug one specific and very underserved gap in Francophone Africa.

In the region, less than 25% of adults have bank accounts, as the focus for banks remains the top 10-20% wealthiest customers. The rest, which is a huge segment of the market of about 120 million people, is not perceived as profitable. But as banks slacked, mobile money from the region’s telcos filled in the gap. In the last 10 years, their wallets have reached more than 60% of the population — proof of how many millions of French-speaking natives were hungry for financial services. Today, this mobile money infrastructure and reach allows startups to build upon their existing payment infrastructure to democratize access through different applications.

Djamo is one such company taking advantage of this opportunity to bring affordable and seamless banking to the region.

In 2019, Hassan Bourgi, a second-time founder, returned to Ivory Coast after exiting his Latin American-based startup, Busportal, to Naspers-company redBus. There he met Régis Bamba who was still working at MTN, one of Africa’s largest telcos, leading several mobile money projects.

Frustrated by the unpleasant banking experiences they and many millennials faced in the country, Bourgi and Bamba launched Djamo last year to challenge the banking industry status quo.

“Banking services are really difficult to access here, and we saw that as a huge opportunity,” Djamo CEO Bourgi told TechCrunch. “Since day one, we wanted to design a mobile-first platform that could break into the masses and our combined experience building mass-market consumer products was very critical to launching Djamo.”

According to Bourgi, the country’s millennials are trying to create relations with technology companies and be served differently from the norm. So, Djamo is providing this audience with a better front-end experience and faster customer service.

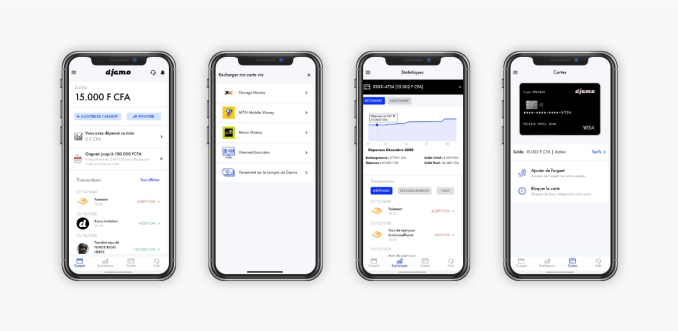

Image Credits: Djamo

Rather than offering a one-size-fits-all approach, they focused on accommodating multiple layers tailored to different user needs. Whether it’s affording Ivorians the luxury to pay for online services like Amazon, Alibaba or Netflix, or providing Visa debit cards in a timely fashion, these tailored approaches have made Djamo grow organically via word of mouth.

And why not? Before Djamo came along, the CEO says people would need to go to their bank branches and stay in long queues to get their cards or even load them with credit. Djamo relieves that stress and even allows customers to use their cards with zero fees in a wide range of services.

“For us, it was important to offer a zero-fee card with no recurring fee to a certain limit. After that, you pay as you go in transaction fees. There is a premium plan around $4 a month where users can transact to higher limits,” said Bourgi.

Today, Djamo claims to have around 90,000 registered users and processes over 50,000 transactions monthly. However, to get to this point, the company has ridden on sheer resourcefulness around its operations.

Unlike Nigeria, where there are established payment infrastructure players like Flutterwave and Paystack, Ivory Coast doesn’t have such household names.

“We have a couple of providers, but most are unreliable. But this doesn’t matter to the end-user, you have to make it work somehow,” said Bamba, the company’s CPO and CTO.

Lacking better options, Djamo switches from one provider to another to keep operations running. The year-old startup has also faced scepticism, common with most African fintech startups when they first launch. In Djamo’s case though, the founders had to go to lengths to prove to banks and customers that the platform was safe to use for onboarding, KYC and transactions.

Hassan Bourgi (CEO) and Régis Bamba (CTO & CPO). Image Credits: Djamo

Onboarding customers also came with its own set of problems: the delivery of Djamo Visa cards. Bourgi says unlike more developed countries on the continent, it is a Herculean task to access efficient delivery and logistics services in Ivory Coast. So, the startup built a delivery app with in-house delivery agents for this particular purpose. “The objective for our customers is that after registering with us, they get their cards the next day in a timely fashion,” Bourgi added.

But even before pushing out its MVP, Djamo had already received monetary validation for its product. In June 2019, it raised a pre-seed investment of $350,000 from private investors — arguably the largest round at this stage in the Francophone region. The ingenuity of the solution, at least to French-speaking Africa, and the founders’ track record, was crucial to Djamo closing the round, Hassan explained.

For a long time, Francophone Africa has been underrated by international investors, despite signs pointing to the emergence of a budding startup scene. Part of this has to do with language barriers and the region’s GDP and income per capita where English-speaking countries, excluding South Africa, contribute to 47% of sub-Saharan Africa’s average GDP, while French-speaking countries boast of only 19%.

However, with the World Bank stating that the region will have 62.5% of Africa’s fastest-growing economies by 2021, there’s bullishness around its growth in the coming years.

With so many untapped opportunities, underrepresented regions like Francophone Africa are ripe for disruption. Investors know this and though their checks are still skewed toward Anglophone Africa, million-dollar raises from Senegalese energy startup, Oolu and Cameroonian healthtech startup, Healthlane in 2020 show their keenness on the market.

Like Djamo, both startups are YC-backed and are the other Francophone startups to have made it into the accelerator. But with this Winter 2021 batch, Djamo becomes the first fintech startup from the region. Following Healthlane’s acceptance in 2020, it is also the first time French-speaking Africa has had representatives for consecutive years.

To the founders, YC’s backing validates Djamo’s premise that financial service distribution across the Francophone Africa region is fundamentally changing toward applications.

“In Ivory Coast, people always say that the banking industry is too complex and we can’t do anything about it. But we saw it as a huge opportunity and a great industry to take on. Everywhere you see frustration, customers in pain, there is an opportunity for a business to come and do it better,” said Bamba.

After participating in the three-month-long program, which culminates in a Demo Day on March 23rd, Djamo will also take part in Visa’s Fintech Fast Track Program, an avenue for the company to leverage the fintech giant’s network to introduce new payment experiences.